1099 as an employee – Welcome to the world of 1099 employment, where flexibility and independence collide with unique challenges and responsibilities. Join us as we delve into the intricacies of this growing trend, exploring its benefits, pitfalls, and implications for the modern workforce.

Definition of 1099 Employee Status

A 1099 employee, also known as an independent contractor, is an individual who provides services to a company without being considered a traditional employee. Unlike W-2 employees who are subject to payroll taxes and receive benefits such as health insurance and paid time off, 1099 employees are responsible for managing their own taxes and benefits.

Common job roles that typically fall under 1099 status include freelancers, contractors, consultants, and gig workers. These individuals often have their own businesses and provide services to multiple clients on a project-by-project basis.

Benefits and Responsibilities of 1099 Employees

1099 employees enjoy several benefits, including greater flexibility and control over their work schedules. They can also often set their own rates and choose the projects they work on. However, 1099 employees are also responsible for their own taxes and benefits, which can be a significant expense.

They may also have to deal with the uncertainty of finding work, as they are not guaranteed a steady income.

Advantages of 1099 Employment

- Greater flexibility and control over work schedules

- Ability to set own rates and choose projects

- Potential for higher earnings

- Tax deductions for business expenses

Disadvantages of 1099 Employment

- Responsible for own taxes and benefits

- Uncertainty of finding work

- No guaranteed income

- May have to pay for own health insurance

Responsibilities of 1099 Employees

- File their own taxes

- Pay self-employment taxes (Social Security and Medicare)

- Obtain their own health insurance

- Keep track of business expenses

- Invoice clients for work

Tax Obligations of 1099 Employees

1099 employees are responsible for paying their own taxes, including income tax, self-employment tax, and any applicable state and local taxes. They must also file a tax return each year, reporting their income and expenses.

Self-employment tax is a combination of Social Security and Medicare taxes. The Social Security tax rate is 12.4% and the Medicare tax rate is 2.9%. 1099 employees must pay both the employer and employee portions of these taxes, which can amount to a significant expense.

1099 employees can deduct certain business expenses from their income when filing their taxes. These expenses can include things like office supplies, travel expenses, and health insurance premiums. However, 1099 employees are not eligible for certain deductions that are available to traditional employees, such as the employee portion of Social Security and Medicare taxes.

Determining Eligibility for 1099 Employee Status: 1099 As An Employee

Determining whether a worker qualifies as a 1099 employee involves assessing various factors to ensure proper classification. Misclassification can lead to legal and financial implications for both the employer and the worker.

Criteria for 1099 Employee Status

- Control:The employer exercises significant control over the worker’s work, including how, when, and where the work is performed.

- Financial Dependence:The worker relies heavily on the employer for income, and the employer has the ability to set the worker’s pay rate.

- Integration into the Business:The worker’s services are integral to the employer’s business, and the worker is not engaged in a separate trade or business of their own.

- Behavioral Factors:The worker follows the employer’s instructions, uses the employer’s equipment and supplies, and is subject to the employer’s policies and procedures.

Examples of Misclassification

- A delivery driver who is required to wear a company uniform, use a company vehicle, and follow specific delivery routes is likely misclassified as a 1099 employee.

- A software developer who works remotely but is closely supervised by the employer, receives regular performance evaluations, and is expected to work specific hours is also likely misclassified.

Tax Implications of 1099 Employee Status

1099 employees face distinct tax implications compared to their W-2 counterparts. They are responsible for managing and paying self-employment taxes, which encompass both the employee and employer portions of Social Security and Medicare taxes.

Calculating self-employment taxes involves multiplying net income by the self-employment tax rate, currently set at 15.3%. This amount is then divided into two parts: 12.4% for Social Security and 2.9% for Medicare. 1099 employees must pay both portions, unlike W-2 employees who have their employer cover half of these taxes.

Filing Taxes

1099 employees are required to file Schedule SE (Form 1040) along with their annual tax return. This schedule calculates self-employment taxes and reports the amounts due. Additionally, 1099 employees may be eligible for certain tax deductions and credits related to their self-employment activities.

Estimated Tax Payments

Due to the quarterly nature of self-employment taxes, 1099 employees are expected to make estimated tax payments throughout the year. These payments are based on their estimated annual income and tax liability. Failure to make timely estimated tax payments may result in penalties and interest charges.

Advantages of 1099 Employee Status

Despite the additional tax responsibilities, 1099 employee status offers certain advantages, such as:

- Greater control over work schedule and workload

- Flexibility to pursue multiple income streams

- Potential for higher earnings

Health Insurance Options for 1099 Employees

1099 employees face unique challenges in obtaining health insurance compared to traditional W-2 employees. As a result, they need to explore various options and consider the costs associated with different types of health insurance plans.

The Affordable Care Act (ACA) provides several options for 1099 employees to obtain health insurance. These include:

Individual Health Insurance Plans, 1099 as an employee

1099 employees can purchase individual health insurance plans through the Health Insurance Marketplace or directly from insurance companies. These plans typically have higher premiums than employer-sponsored plans, but they offer more flexibility and control over coverage.

- Pros:Flexible, portable, customizable coverage.

- Cons:Higher premiums, limited coverage options.

Group Health Insurance Plans

Some professional organizations and associations offer group health insurance plans to their members. These plans can provide lower premiums and more comprehensive coverage than individual plans.

- Pros:Lower premiums, broader coverage.

- Cons:Limited availability, may require membership in a specific organization.

Short-Term Health Insurance Plans

Short-term health insurance plans are designed to provide temporary coverage for a specific period, such as between jobs or during a transition. These plans have lower premiums than traditional health insurance plans, but they offer limited coverage and may not meet all health care needs.

- Pros:Lower premiums, temporary coverage.

- Cons:Limited coverage, may not meet all health care needs.

Retirement Savings for 1099 Employees

Retirement planning is crucial for 1099 employees, as they are responsible for securing their financial future in the absence of employer-sponsored retirement plans. This article explores the significance of retirement savings and provides guidance on available options.

1099 employees face unique challenges in retirement planning due to the lack of traditional employer contributions and benefits. They must take a proactive approach to save for their future by exploring self-directed retirement accounts.

Contribution Limits

The contribution limits for self-directed retirement accounts vary depending on the type of account and the individual’s age and income. Here are the contribution limits for 2023:

- Traditional and Roth IRAs: $6,500 ($7,500 if age 50 or older)

- SIMPLE IRAs: $15,500 ($17,500 if age 50 or older)

- SEP IRAs: $66,000 ($73,500 if age 50 or older)

- 401(k) plans: $22,500 ($30,000 if age 50 or older)

Legal Considerations for 1099 Employees

1099 employees enjoy certain legal rights and protections, just like traditional W-2 employees. These rights include the right to:

- Be paid minimum wage and overtime

- Receive workers’ compensation benefits if injured on the job

- File a discrimination or harassment complaint

1099 employees may also face unique legal issues, such as:

Wage Disputes

1099 employees are not covered by the Fair Labor Standards Act (FLSA), which means they may not be entitled to overtime pay or minimum wage. However, some states have laws that protect 1099 employees from wage theft.

Misclassification

Misclassification occurs when an employer incorrectly classifies a worker as a 1099 employee when they should be classified as a W-2 employee. This can deprive workers of important benefits and protections.

Employer Responsibilities for 1099 Employees

When hiring 1099 employees, employers have certain obligations to fulfill. These responsibilities include:

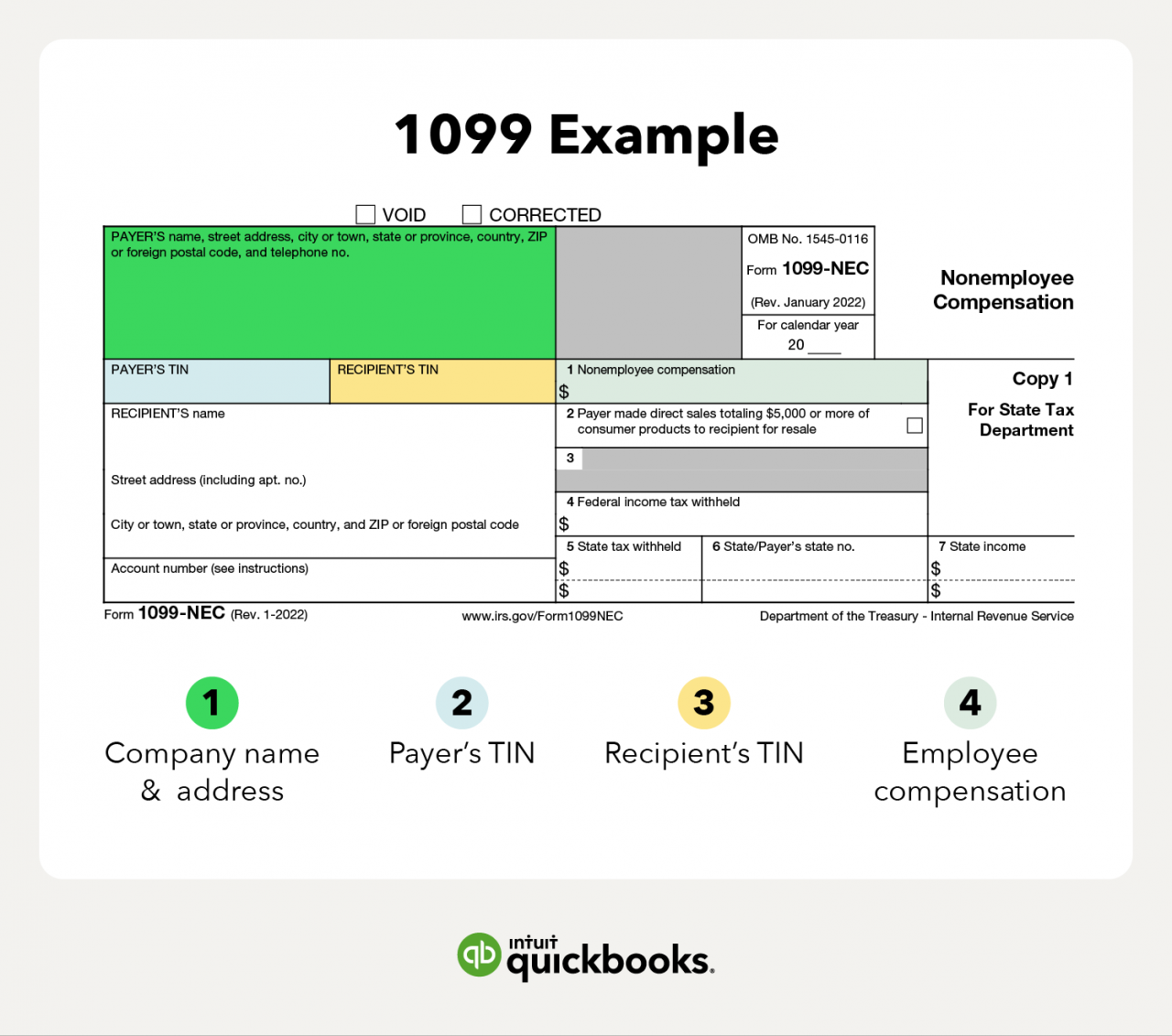

Issuing 1099 Forms and Complying with Tax Reporting Requirements

Employers are required to issue Form 1099-NEC to 1099 employees who have earned $600 or more during the tax year. This form reports the amount of income paid to the 1099 employee and is used for tax reporting purposes.

Employers must also comply with other tax reporting requirements, such as filing Form 1096 to the IRS, which summarizes all 1099-NEC forms issued during the year.

Failure to comply with these reporting requirements can result in penalties from the IRS.

Ethical Considerations for 1099 Employees

The misclassification of employees as 1099 contractors is an ethical issue with far-reaching consequences. By denying workers their rightful employee status, companies may be violating labor laws and depriving them of essential benefits and protections. This practice can lead to wage theft, lack of access to healthcare and retirement savings, and increased financial insecurity for workers.

Best Practices for Fair Treatment of Workers

To ensure fair and equitable treatment of all workers, businesses should adhere to the following best practices:*

-*Accurate Classification

Properly classify workers as employees or independent contractors based on the nature of their work and the level of control exercised by the company.

-

-*Clear Contracts

Establish clear and written contracts that Artikel the terms of employment, including job duties, compensation, and benefits.

-*Compliance with Labor Laws

Comply with all applicable labor laws and regulations, including minimum wage, overtime pay, and access to benefits.

-*Fair Compensation

Provide fair compensation that is commensurate with the work performed and industry standards.

-*Equal Opportunities

Ensure equal opportunities for advancement and promotion regardless of employment status.

-*Ethical Treatment

Treat all workers with respect and dignity, regardless of their classification.

Future Trends in 1099 Employment

The rise of the gig economy has led to a surge in 1099 employment, and this trend is expected to continue in the future. As more and more companies embrace remote work and flexible staffing models, the demand for 1099 workers is likely to increase.

This shift is having a significant impact on the workforce, and it is important to understand the potential changes that may occur in regulations and policies affecting 1099 employees.

One potential change is the implementation of new regulations that provide more protection for 1099 workers. Currently, 1099 workers are not covered by many of the same labor laws that protect traditional employees. This means that they may be more vulnerable to exploitation and abuse.

New regulations could help to level the playing field and ensure that 1099 workers are treated fairly.

Impact on Labor Market

The growing trend of 1099 employment is also likely to have a significant impact on the labor market. As more and more workers become 1099 contractors, the traditional employer-employee relationship may become less common. This could lead to a more fragmented workforce, with workers having less job security and fewer benefits.

However, the rise of 1099 employment could also create new opportunities for workers. For example, 1099 workers may have more flexibility and control over their work schedules. They may also be able to earn more money than traditional employees, as they are not subject to the same payroll taxes and benefits.

Changes in Regulations and Policies

The changing nature of work is likely to lead to changes in regulations and policies affecting 1099 employees. For example, the government may need to create new laws to protect 1099 workers from exploitation and abuse. Additionally, companies may need to develop new policies to manage their 1099 workforce.

It is important to note that the future of 1099 employment is uncertain. However, the trends that are currently underway suggest that this type of work is likely to become more common in the years to come. As a result, it is important for both workers and companies to understand the potential implications of this shift.

Final Thoughts

As the gig economy continues to evolve, 1099 employees will play an increasingly significant role. By understanding the nuances of this employment status, individuals can empower themselves to make informed decisions, protect their rights, and navigate the challenges and opportunities that lie ahead.

Question Bank

What are the key differences between 1099 employees and W-2 employees?

1099 employees are typically independent contractors who are not subject to the same tax withholdings and benefits as W-2 employees. They are responsible for paying their own self-employment taxes and managing their own health insurance and retirement savings.

What are the advantages of being a 1099 employee?

Flexibility, control over work hours, and the potential for higher earnings are some of the key advantages of 1099 employment.

What are the responsibilities of 1099 employees?

1099 employees are responsible for paying their own self-employment taxes, managing their own health insurance and retirement savings, and ensuring that they meet all applicable tax and regulatory requirements.