In the realm of employment, 1099 for an employee stands as a distinct category, offering a unique blend of flexibility and responsibility. Unlike traditional W-2 employees, 1099 workers operate as independent contractors, navigating a landscape of advantages and challenges that set them apart.

As we delve into the intricacies of 1099 employment, we’ll explore the benefits it offers, such as enhanced control over work schedules and the potential for increased earnings. However, we’ll also uncover the drawbacks, including the complexities of tax responsibilities and the lack of employer-provided benefits.

Definition of 1099 for an Employee

A 1099 employee is an independent contractor who provides services to a company or organization. They are not considered employees of the company and are not entitled to the same benefits as employees, such as health insurance, paid time off, or unemployment benefits.

1099 employees are responsible for paying their own taxes and self-employment taxes.

The main difference between 1099 employees and W-2 employees is that 1099 employees are not considered employees of the company. This means that they are not subject to the same payroll taxes and regulations as W-2 employees. 1099 employees are also not eligible for employee benefits, such as health insurance, paid time off, or unemployment benefits.

Advantages of 1099 Employment

- More flexibility and control over your work schedule.

- Higher earning potential than W-2 employees.

- Tax deductions for business expenses.

Disadvantages of 1099 Employment

- No employee benefits, such as health insurance, paid time off, or unemployment benefits.

- Responsible for paying your own taxes and self-employment taxes.

- Can be more difficult to find work than W-2 employees.

Advantages of 1099 Employment

1099 employment offers a range of benefits, attracting many individuals seeking flexibility, control, and financial autonomy.

One of the key advantages is the flexibility it provides. 1099 employees have the freedom to set their own hours, work from anywhere, and choose the projects they want to work on. This allows them to balance their work and personal lives more effectively and accommodate other commitments or responsibilities.

Control Over Work, 1099 for an employee

1099 employees also enjoy a greater degree of control over their work. They have the autonomy to decide how they approach tasks, set their own deadlines, and manage their workload. This level of control empowers them to work in a way that aligns with their strengths and preferences, leading to increased job satisfaction and productivity.

Disadvantages of 1099 Employment

1099 employment, while offering flexibility and autonomy, comes with several disadvantages. These include financial and insurance responsibilities, which can place a significant burden on individuals.

Financial Responsibilities

- Self-employment taxes:1099 workers are responsible for paying both the employee and employer portions of Social Security and Medicare taxes. This can amount to a significant financial burden, as the employer portion is typically around 7.65% of earnings.

- No guaranteed income:Unlike traditional employees, 1099 workers do not receive a regular paycheck. Their income can fluctuate depending on the availability of work and the terms of their contracts.

- Expense tracking:1099 workers are responsible for tracking all business expenses, such as equipment, supplies, and travel costs. This can be a time-consuming and complex task.

Insurance Responsibilities

- Health insurance:1099 workers are not eligible for employer-sponsored health insurance plans. They must purchase their own health insurance, which can be expensive, especially for those with pre-existing conditions.

- Disability insurance:1099 workers are not eligible for employer-sponsored disability insurance. They must purchase their own disability insurance, which can provide income protection in the event of an illness or injury.

- Workers’ compensation insurance:1099 workers are not covered by workers’ compensation insurance. This means that they are not eligible for benefits if they are injured on the job.

Tax Implications of 1099 Employment

As a 1099 employee, you’re responsible for managing your own taxes, unlike traditional W-2 employees who have taxes withheld from their paychecks. This means you need to set aside money to cover both federal and state income taxes, as well as self-employment taxes.

Self-employment taxes cover Social Security and Medicare contributions, which are typically split between employers and employees for W-2 workers. As a 1099 employee, you’re responsible for paying both the employer and employee portions of these taxes.

Estimated Tax Payments

To avoid owing a large tax bill at the end of the year, it’s important to make estimated tax payments throughout the year. These payments are based on your estimated tax liability and are due on April 15, June 15, September 15, and January 15 of the following year.

You can use Form 1040-ES to calculate and make your estimated tax payments. The IRS provides a helpful worksheet on their website to guide you through the process.

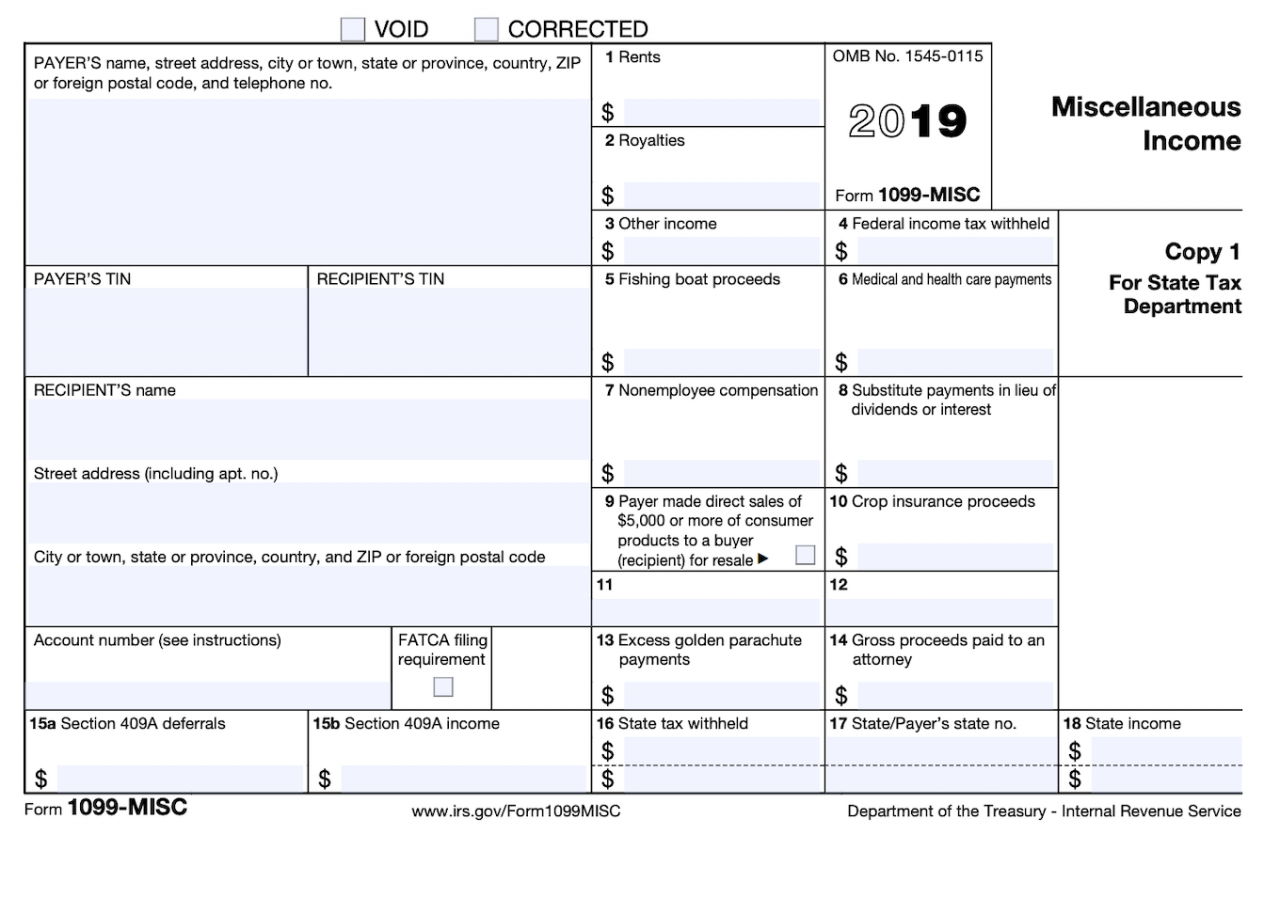

Filing 1099 Forms

Filing 1099 forms is crucial for reporting income earned by independent contractors and self-employed individuals. The Form 1099-NEC is specifically used to report nonemployee compensation.

Form 1099-NEC Filing

To file Form 1099-NEC, businesses must follow these steps:

- Gather the necessary information, including the contractor’s name, address, taxpayer identification number (TIN), and the amount of compensation paid.

- Access the IRS website or use a tax software program to obtain the Form 1099-NEC.

- Complete the form accurately and thoroughly, including all required fields.

- File the form with the IRS by the specified deadline. The deadline for filing Form 1099-NEC is January 31st following the tax year in which the compensation was paid.

- Provide a copy of Form 1099-NEC to the contractor by the same deadline.

Deadlines and Penalties

It’s essential to meet the deadlines for filing Form 1099-NEC to avoid penalties. Late filing can result in fines of up to $280 per form, with a maximum penalty of $570,000 per year.

Remember: Filing Form 1099-NEC on time ensures compliance with tax laws and avoids potential penalties.

Avoiding Misclassification as a 1099 Employee

The Internal Revenue Service (IRS) has strict criteria for determining whether a worker is an employee or an independent contractor. Misclassifying employees as independent contractors can have serious consequences for both the employer and the worker.

Determining Employee Status

The IRS uses a “20-factor test” to determine whether a worker is an employee or an independent contractor. The following are some of the most important factors:

- Behavioral Control:Does the employer control the worker’s day-to-day activities?

- Financial Control:Does the employer provide the worker with tools, equipment, and supplies?

- Relationship of the Parties:Does the worker have a written contract with the employer?

- Type of Work:Is the work performed by the worker an integral part of the employer’s business?

Consequences of Misclassification

Misclassification can have a number of negative consequences, including:

- Back taxes and penalties:The employer may be liable for back taxes and penalties if they misclassify an employee as an independent contractor.

- Loss of benefits:Employees who are misclassified as independent contractors may lose out on important benefits, such as health insurance, paid time off, and workers’ compensation.

- Legal liability:Employers may be held liable for injuries or damages caused by workers who are misclassified as independent contractors.

It is important for both employers and workers to understand the IRS criteria for determining employee status. Misclassification can have serious consequences, so it is important to get it right.

Converting from W-2 to 1099 Employment

Transitioning from the comfort and security of a W-2 employee to the flexibility and potential earnings of 1099 employment can be an exciting yet daunting step. This guide will provide a roadmap to help you navigate the transition smoothly, addressing factors to consider and potential legal implications.

Factors to Consider

- Income Stability:1099 employment often involves fluctuations in income, so it’s crucial to assess your financial stability and prepare for potential gaps.

- Benefits:As a W-2 employee, you typically receive benefits such as health insurance, paid time off, and retirement contributions. Consider the cost of replacing these benefits if transitioning to 1099 employment.

- Tax Implications:1099 contractors are responsible for paying self-employment taxes (Social Security and Medicare), which can increase your tax burden.

- Legal Considerations:Ensure that the reclassification from W-2 to 1099 employment is legitimate and complies with labor laws to avoid potential misclassification.

Legal Implications

Misclassifying employees as independent contractors can lead to legal consequences, including back taxes, penalties, and lawsuits. To avoid misclassification, it’s essential to:

- Understand the IRS’s “20-factor test” for determining employee status.

- Document the reasons for the reclassification and maintain clear distinctions between employees and contractors.

- Consult with legal counsel to ensure compliance with labor laws.

Resources for 1099 Employees

As a 1099 employee, it’s crucial to stay informed about your rights and responsibilities. Fortunately, there are many resources available to help you navigate the complexities of 1099 employment.Here are some helpful resources:

Government Websites

- IRS website: https://www.irs.gov/businesses/small-businesses-self-employed/independent-contractor-self-employed-or-employee

- Department of Labor website: https://www.dol.gov/agencies/whd/workers

Professional Organizations

- National Association for the Self-Employed (NASE): https://www.nase.org/

- Freelancers Union: https://www.freelancersunion.org/

Online Forums

- 1099 Forum: https://www.1099forum.com/

- Freelance Forum: https://www.freelanceforum.com/

Case Studies of 1099 Employment

1099 employment can be a viable option for individuals and businesses seeking flexibility and autonomy. Here are some real-life examples of successful 1099 employment arrangements:

Example 1: Freelance Writer

- Challenge:Finding consistent work and maintaining a stable income.

- Benefit:Flexibility to set their own hours, choose projects, and work from anywhere.

Example 2: IT Consultant

- Challenge:Staying up-to-date with rapidly changing technology.

- Benefit:Ability to work on multiple projects simultaneously and charge premium rates for specialized skills.

Example 3: Virtual Assistant

- Challenge:Balancing work with personal responsibilities.

- Benefit:Flexibility to work from home and set their own schedule.

Future Trends in 1099 Employment

1099 employment is projected to continue growing as technology and the gig economy expand. The flexibility and autonomy of 1099 work are appealing to many workers, and businesses are increasingly turning to 1099 contractors to meet their staffing needs.

One of the key drivers of the growth of 1099 employment is the rise of the gig economy. Platforms like Uber, Lyft, and TaskRabbit have made it easy for people to find flexible work that fits around their schedules. This type of work is particularly appealing to millennials and Gen Z workers who value flexibility and independence.

Another factor contributing to the growth of 1099 employment is the advancement of technology. Technology has made it easier for businesses to find and manage 1099 contractors. Online platforms and software tools make it possible to streamline the process of hiring, onboarding, and paying 1099 workers.

Impact on the Workforce

The growth of 1099 employment is having a significant impact on the workforce. More and more workers are choosing to freelance or work as independent contractors, rather than traditional employees. This trend is expected to continue in the years to come, as technology and the gig economy continue to grow.

The shift to 1099 employment has a number of implications for workers. One of the biggest challenges is the lack of benefits. 1099 workers are not eligible for employee benefits such as health insurance, paid time off, or retirement plans.

This can make it difficult for 1099 workers to plan for the future.

Another challenge for 1099 workers is the issue of misclassification. Misclassification occurs when a worker is classified as a 1099 contractor when they should be classified as an employee. This can have serious consequences for workers, as it can lead to them losing out on benefits and protections that they are entitled to.

Legal Considerations for 1099 Employees

1099 employees, also known as independent contractors, have unique legal rights and responsibilities compared to traditional W-2 employees. Understanding these legal considerations is crucial to protect their interests and avoid potential liabilities.

One key aspect is the contract between the 1099 employee and the hiring entity. This contract should clearly Artikel the scope of work, payment terms, and any other relevant details. It is essential to have a written contract in place to avoid misunderstandings and disputes.

Liability

As independent contractors, 1099 employees are generally responsible for their own liabilities, including insurance and taxes. They are not covered by the same workers’ compensation and unemployment benefits as W-2 employees. It is important for 1099 employees to carefully consider their liability exposure and obtain appropriate insurance coverage.

Dispute Resolution

Disputes between 1099 employees and hiring entities can arise for various reasons, such as payment issues or disagreements over the scope of work. In such cases, 1099 employees may have limited options for dispute resolution compared to W-2 employees. Arbitration or mediation may be options, but it is important to understand the terms and implications of any dispute resolution mechanisms.

Concluding Remarks: 1099 For An Employee

Ultimately, the decision of whether 1099 employment is the right path depends on individual circumstances and career goals. By weighing the advantages and disadvantages carefully, aspiring 1099 workers can make informed choices that align with their aspirations and financial objectives.

Answers to Common Questions

What are the key differences between 1099 and W-2 employees?

1099 employees are independent contractors, while W-2 employees are traditional employees. 1099 workers are responsible for their own taxes and benefits, while W-2 employees have these taken care of by their employer.

What are the benefits of being a 1099 employee?

Flexibility, control over work schedule, potential for increased earnings

What are the drawbacks of being a 1099 employee?

Complex tax responsibilities, lack of employer-provided benefits, financial uncertainty