$3000 is deposited in an account that pays 5%. Embark on a financial journey where we unravel the intricacies of interest, time value, and their impact on your savings. From calculating interest earnings to understanding how inflation affects purchasing power, this guide empowers you to make informed decisions about your financial future.

Delving into the world of deposits, we’ll explore various account options, such as savings accounts, money market accounts, and certificates of deposit. Discover their unique features and benefits to find the perfect fit for your financial goals, whether it’s saving for a down payment on a home or securing a comfortable retirement.

Interest Calculation

The interest earned on a deposit is calculated using the following formula:

Interest = Principal x Interest Rate x Time

Where:

- Principal is the amount of the deposit.

- Interest Rate is the annual interest rate paid on the deposit.

- Time is the length of time the deposit is held.

For example, if you deposit $3,000 in an account that pays 5% interest, the interest earned after one year would be:

Interest = $3,000 x 0.05 x 1 = $150

Time Value of Money

The time value of money is the concept that money today is worth more than the same amount of money in the future.

This is because money today can be invested and earn interest, which increases its value over time.

The interest rate and the length of time the deposit is held both affect its future value.

For example, if you deposit $3,000 in an account that pays 5% interest, the future value of the deposit after one year would be:

Future Value = $3,000 x (1 + 0.05) = $3,150

After two years, the future value would be:

Future Value = $3,150 x (1 + 0.05) = $3,307.50

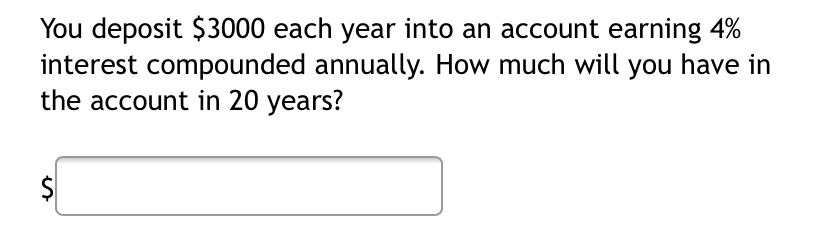

Compounding Interest

Compounding interest is interest that is earned on both the principal and the interest that has already been earned.

This means that the interest earned in each period is added to the principal, and then interest is earned on the new, larger principal in the next period.

Compounding interest can significantly increase the value of a deposit over time.

For example, if you deposit $3,000 in an account that pays 5% interest compounded annually, the future value of the deposit after one year would be:

Future Value = $3,000 x (1 + 0.05) = $3,150

After two years, the future value would be:

Future Value = $3,150 x (1 + 0.05) = $3,307.50

After three years, the future value would be:

Future Value = $3,307.50 x (1 + 0.05) = $3,472.88

Impact of Inflation

Inflation is the rate at which the prices of goods and services increase over time.

Inflation can erode the purchasing power of a deposit over time.

For example, if you deposit $3,000 in an account that pays 5% interest, the future value of the deposit after one year would be $3,150.

However, if inflation is 2% per year, the purchasing power of $3,150 will be less than $3,000 in one year.

Deposit Options: 00 Is Deposited In An Account That Pays 5

There are a variety of different types of deposit accounts available, including:

- Savings accounts

- Money market accounts

- Certificates of deposit

Each type of account has its own features and benefits.

Savings accounts are the most basic type of deposit account.

They offer a low interest rate, but they also allow you to access your money at any time.

Money market accounts offer a higher interest rate than savings accounts, but they require you to maintain a minimum balance.

Certificates of deposit (CDs) offer the highest interest rate, but they require you to lock your money in for a specific period of time.

Financial Planning

Deposits can play an important role in financial planning.

They can be used to achieve a variety of financial goals, such as:

- Saving for retirement

- Purchasing a home

- Funding a child’s education

By understanding the different types of deposit accounts available and how they can be used to achieve your financial goals, you can make the most of your money.

Epilogue

In the realm of financial planning, deposits serve as a cornerstone for achieving your dreams. Whether you’re saving for a rainy day, a major purchase, or the golden years of retirement, understanding the dynamics of interest, time value, and inflation will equip you with the knowledge to make your money work harder for you.

Embrace the power of deposits and watch your financial aspirations take flight.

Answers to Common Questions

What is the formula for calculating interest on a deposit?

Interest = Principal x Interest Rate x Time

How does compounding interest differ from simple interest?

Compound interest earns interest on both the principal and the accumulated interest, while simple interest only earns interest on the principal.

How can inflation affect the value of my deposit?

Inflation erodes the purchasing power of money over time, meaning your deposit may be worth less in the future due to rising prices.