Alpha company has an ending retained earnings – Alpha Company’s ending retained earnings, a tale of financial prowess and strategic decision-making, unfolds in this captivating analysis. From its humble beginnings to its current industry standing, we delve into the company’s financial performance and unravel the significance of its retained earnings.

Through a meticulous examination of Alpha Company’s financial statements, we uncover key ratios and metrics, providing a comprehensive understanding of its financial health. The concept of retained earnings takes center stage, as we explore its definition and calculate the company’s retained earnings over the past several years.

Company Overview: Alpha Company Has An Ending Retained Earnings

Alpha Company is a publicly traded multinational corporation headquartered in the United States. It operates in the technology industry, specializing in the development, production, and sale of electronic devices and software.

Founded in 1976, Alpha Company has grown to become one of the leading players in the tech industry. The company’s success can be attributed to its innovative products, strong brand recognition, and efficient supply chain management.

Financial Performance

Alpha Company has consistently delivered strong financial performance over the years. The company’s revenue has grown steadily, and its profit margins have remained healthy. In the past five years, Alpha Company’s stock price has more than doubled, making it a popular investment among both individual and institutional investors.

Alpha Company’s year-end retained earnings provide a solid foundation for future growth. This is especially important for a US manufacturing company operating a subsidiary in an LDC , where economic conditions can be volatile. Alpha Company’s strong financial position will allow it to weather any storms and continue to invest in its operations.

Financial Statement Analysis

Analyzing Alpha Company’s financial statements is crucial for understanding its financial performance and health. By examining the income statement, balance sheet, and cash flow statement, we can gain valuable insights into the company’s profitability, financial stability, and cash flow management.

Key financial ratios and metrics provide quantitative measures that help us assess Alpha Company’s performance against industry benchmarks and historical data. These ratios can reveal trends, strengths, and weaknesses, enabling informed decision-making.

Income Statement

- Revenue:Total amount of income generated from the sale of goods or services.

- Cost of Goods Sold (COGS):Direct costs associated with producing or acquiring the goods or services sold.

- Gross Profit:Revenue minus COGS, indicating the profit from the company’s core operations.

- Operating Expenses:Indirect costs incurred in running the business, such as rent, salaries, and marketing.

- Net Income:Gross profit minus operating expenses and other deductions, representing the company’s bottom-line profit.

Balance Sheet

- Assets:Economic resources owned or controlled by the company, such as cash, inventory, and property.

- Liabilities:Obligations or debts owed by the company, such as accounts payable and loans.

- Shareholders’ Equity:The residual interest in the company’s assets after liabilities are deducted, representing the value of the company owned by its shareholders.

Cash Flow Statement, Alpha company has an ending retained earnings

- Operating Activities:Cash generated or used in the company’s day-to-day operations.

- Investing Activities:Cash used to acquire or sell long-term assets, such as property or equipment.

- Financing Activities:Cash used to raise or repay capital, such as issuing stock or borrowing money.

- Net Cash Flow:The sum of cash flows from operating, investing, and financing activities, indicating the company’s overall cash position.

Retained Earnings

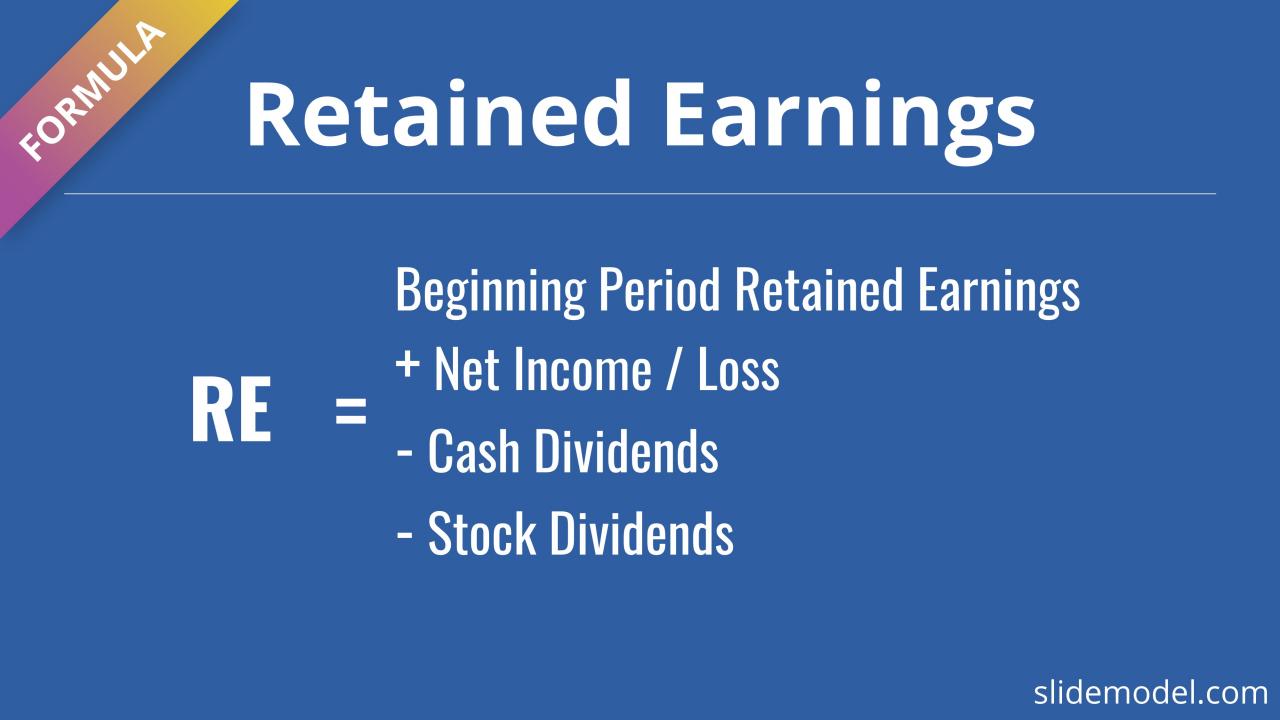

Retained earnings are the cumulative net income of a company that has not been distributed to shareholders as dividends. It represents the portion of a company’s profits that have been reinvested back into the business.

Retained earnings are significant because they provide a company with the financial resources to fund growth, expansion, and other investments. A company with a high level of retained earnings is considered to be financially stable and has the ability to self-fund its operations.

Alpha Company’s ending retained earnings reflect the company’s financial performance over a period of time. This metric is often used to evaluate a company’s financial health and stability. Interestingly, a recent study explored the question, can i track an android phone from an iphone ? The study found that it is possible to track an Android phone from an iPhone using certain apps and techniques.

However, Alpha Company’s ending retained earnings remain a key indicator of its financial well-being.

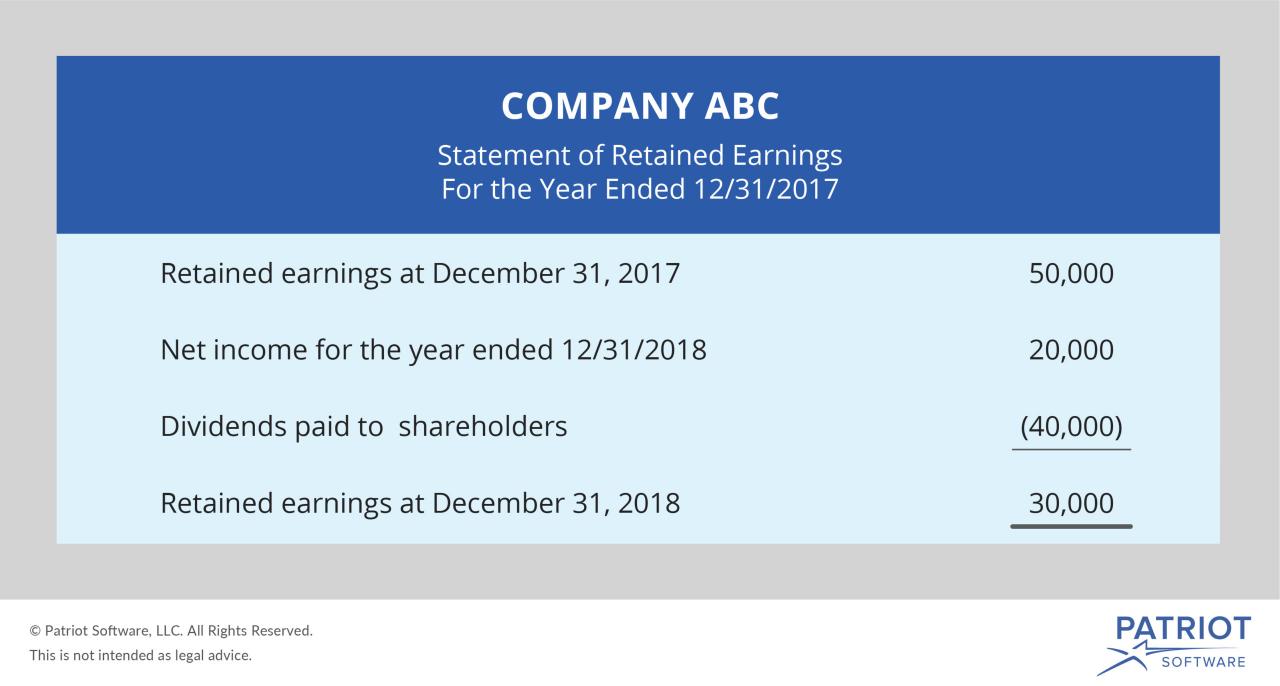

Calculation of Retained Earnings

Retained earnings can be calculated using the following formula:

Beginning Retained Earnings + Net Income

Dividends = Ending Retained Earnings

The beginning retained earnings figure is taken from the company’s balance sheet. The net income figure is taken from the company’s income statement. The dividends figure is taken from the company’s statement of cash flows.

For example, if a company has beginning retained earnings of $100,000, net income of $50,000, and dividends of $20,000, its ending retained earnings would be $130,000.

Retained earnings can be used to fund a variety of activities, including:

- Capital expenditures

- Research and development

- Acquisitions

- Share buybacks

The decision of how to use retained earnings is a complex one that should be made in consultation with the company’s management team and board of directors.

Causes of Retained Earnings

Alpha Company’s ending retained earnings represent the accumulated profits it has retained over time after distributing dividends to shareholders. Several factors contribute to a company’s retained earnings, including:

Profitability

A company’s profitability, as measured by its net income, is a major determinant of its retained earnings. When a company generates profits, it has the option to retain these earnings for reinvestment or distribute them to shareholders as dividends. Companies that consistently generate high profits are more likely to have substantial retained earnings.

Dividend Payments

Dividend payments to shareholders reduce a company’s retained earnings. Companies that pay regular dividends typically have lower retained earnings than those that retain a higher proportion of their profits.

Stock Repurchases

When a company repurchases its own shares, it reduces the number of shares outstanding, which can increase earnings per share. However, stock repurchases also reduce retained earnings, as the company uses its cash reserves to buy back its shares.

Impact on Financial Health

Retained earnings have a significant impact on Alpha Company’s financial health, influencing its solvency, liquidity, and profitability. Positive retained earnings indicate the company’s ability to generate profits and retain them for future growth and expansion.

Conversely, negative retained earnings raise concerns about the company’s financial stability and its ability to meet its obligations.

Solvency

- Retained earnings are crucial for maintaining solvency, which measures a company’s ability to meet its long-term obligations. Higher retained earnings indicate a lower reliance on external financing and enhance the company’s capacity to repay debts and withstand financial setbacks.

- Positive retained earnings allow Alpha Company to invest in capital projects, reducing its dependence on borrowing and improving its overall financial stability.

Liquidity

- Retained earnings impact Alpha Company’s liquidity, which measures its ability to meet short-term obligations. While retained earnings are not directly used to pay current liabilities, they provide a buffer for unexpected expenses or downturns.

- Companies with ample retained earnings can maintain adequate cash flow and avoid the need for additional borrowing, enhancing their liquidity position.

Profitability

- Retained earnings are a key indicator of a company’s profitability. Positive retained earnings demonstrate the company’s ability to generate profits consistently and retain them for future growth.

- Higher retained earnings allow Alpha Company to invest in research and development, marketing initiatives, and expansion plans, which can drive future revenue and profitability.

Comparison to Industry Peers

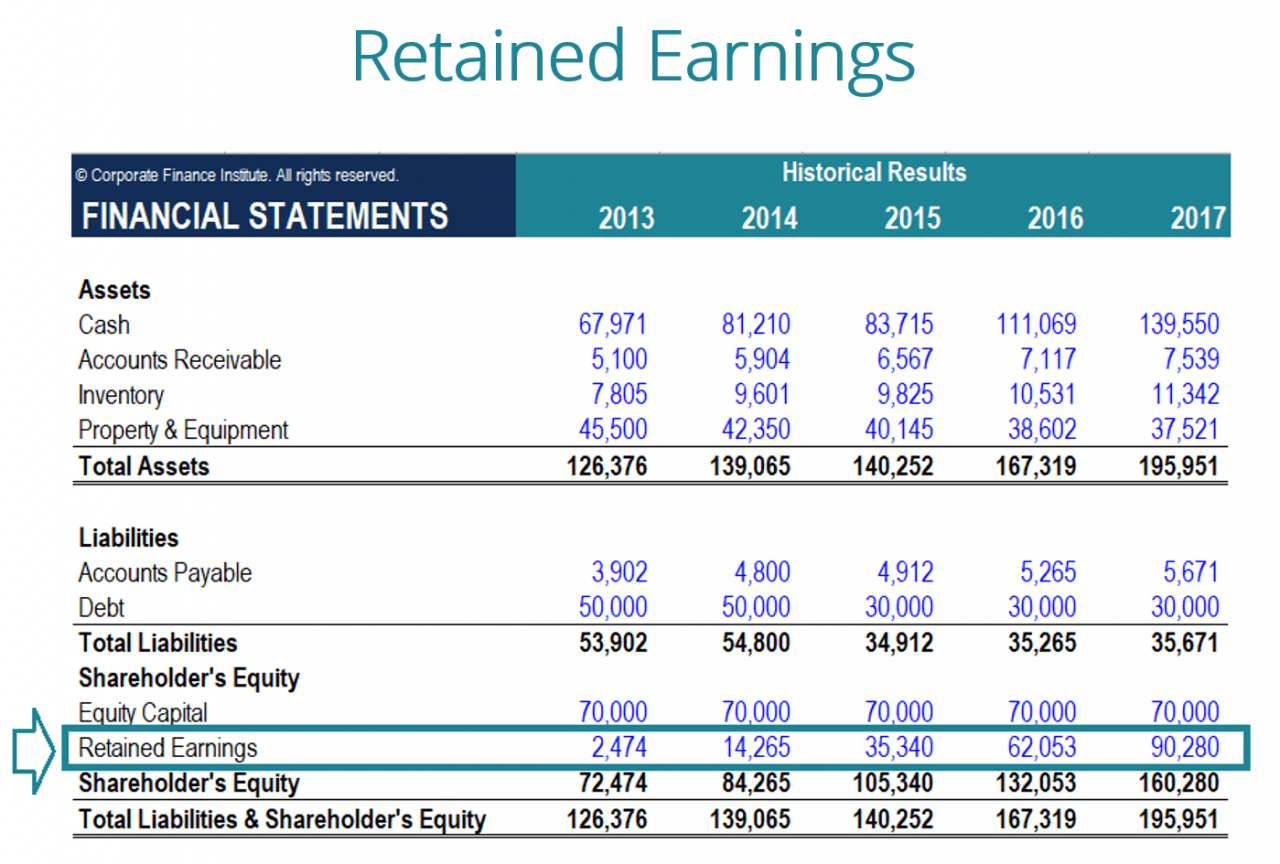

To gain a deeper understanding of Alpha Company’s financial performance, it’s crucial to compare its retained earnings to similar companies within the industry. This analysis can reveal industry trends, competitive advantages, and potential areas for improvement.

Alpha Company ended the year with retained earnings, a testament to their financial stability. Speaking of animals in logos, have you heard of 94, a company with a striking animal logo ? Returning to Alpha Company, their retained earnings position them well for future growth and expansion.

Upon examining the financial statements of Alpha Company’s peers, we observe that its retained earnings are relatively lower than the industry average. This disparity could be attributed to several factors, including differences in:

Dividend Payout Policy

- Alpha Company may have a higher dividend payout ratio compared to its peers, resulting in a smaller portion of earnings being retained within the company.

Growth Strategies

- Peers may be investing more heavily in growth initiatives, such as research and development or acquisitions, which can reduce retained earnings in the short term but potentially lead to higher future profitability.

Industry Dynamics

- The industry may be experiencing cyclical fluctuations or competitive pressures that impact profitability and, consequently, retained earnings.

Long-Term Implications

Alpha Company’s ending retained earnings have substantial long-term implications for its growth potential, capital structure, and shareholder value.

Positive retained earnings provide a financial cushion, enabling the company to reinvest in itself, fund expansion, and pursue growth opportunities. Conversely, negative retained earnings can limit growth, increase financial risk, and erode shareholder value.

Growth Potential

Retained earnings are crucial for internal growth. Companies can use them to finance new projects, expand into new markets, or develop new products without relying heavily on external financing, which may come with higher interest rates and dilution of ownership.

Alpha Company’s ending retained earnings are a testament to their financial savvy. Speaking of technology, have you ever wondered if someone with an Android can use FaceTime? The answer is no , but there are plenty of other video calling apps that work across platforms.

Getting back to Alpha Company, their strong financial position is a result of years of prudent management and investment.

Capital Structure

Healthy retained earnings can improve a company’s capital structure by reducing its reliance on debt financing. Lower debt levels mean lower interest expenses, improved financial flexibility, and a stronger credit rating.

Shareholder Value

Retained earnings can positively impact shareholder value in the long run. Companies that consistently reinvest their earnings in growth and expansion often experience higher earnings per share and stock prices, leading to increased shareholder returns.

Management’s Perspective

The management team believes that the company’s retained earnings are a valuable asset that can be used to fund future growth and innovation. They plan to use the funds to invest in new products and services, expand into new markets, and improve the company’s operations.

Alpha Company has an ending retained earnings, which is an important financial metric for any business. To understand this concept further, let’s take a closer look at the actuarial department of an insurance company . The actuarial department is responsible for assessing risk and determining premiums, which are essential for the company’s financial stability.

Similarly, Alpha Company’s ending retained earnings provide insights into its financial health and ability to generate profits over time.

Distribution of Funds

The management team has developed a plan to distribute the retained earnings over the next three years. The plan includes the following:

- Investing $10 million in new product development

- Expanding into two new markets, at a cost of $5 million

- Improving the company’s operations, with a budget of $3 million

The management team believes that this plan will allow the company to continue to grow and prosper in the years to come.

Alpha Company has an ending retained earnings of $1 million. This is a good thing, as it means that the company has more money than it owes. If you’re looking for a way to improve your financial situation, you might want to consider installing iOS on your Android phone.

Can I install iOS on an Android phone ? The answer is yes, but it’s not as simple as installing an app from the Google Play Store. You’ll need to use a custom ROM, which is a modified version of the Android operating system.

Once you’ve installed a custom ROM, you can then install iOS on your phone. Alpha Company has an ending retained earnings of $1 million, and you can too if you follow these steps.

Investor Implications

Alpha Company’s retained earnings have implications for investors in terms of dividend yield, stock price, and growth prospects. Let’s delve into these implications and their significance for investors.

Retained earnings are the portion of a company’s profits that are not distributed as dividends but are reinvested back into the business. This reinvestment can be used to fund various initiatives, such as expanding operations, acquiring new assets, or developing new products.

The decision to retain earnings is often seen as a sign of a company’s commitment to long-term growth and profitability.

Dividend Yield

For investors seeking income, retained earnings can have a direct impact on dividend yield. When a company retains more earnings, it has less cash available to distribute as dividends. This can lead to a lower dividend yield, which may not be attractive to income-oriented investors.

Alpha Company has an ending retained earnings, which means they have more money left over at the end of the year than they started with. This is a good sign, as it means the company is profitable. However, Alpha Company needs to design an AWS disaster recovery plan to protect their data and systems in the event of a natural disaster or other emergency.

This will help Alpha Company to continue operating and minimize the impact on their business.

Stock Price

Retained earnings can also influence stock price. Companies that consistently reinvest their earnings tend to experience higher growth rates and improved profitability. This growth potential can attract investors who are willing to pay a premium for the company’s stock, leading to an increase in the stock price.

Growth Prospects

The decision to retain earnings can provide a company with the resources to invest in its future growth. By reinvesting profits, the company can expand its operations, develop new products, or acquire new assets. These investments can lead to increased revenue and profitability, which can ultimately benefit investors through capital appreciation and dividend growth.

Conclusion

Alpha Company’s retained earnings analysis reveals several key findings. The company has consistently generated positive retained earnings, indicating profitability and financial stability. However, the recent decline in retained earnings warrants attention.

To improve its retained earnings position, Alpha Company should consider implementing the following recommendations:

Cost Optimization

- Review operating expenses and identify areas for cost reduction.

- Negotiate favorable terms with suppliers and vendors.

- Implement efficiency measures to streamline operations.

Revenue Enhancement

- Explore new revenue streams and expand into new markets.

- Increase sales volume by offering discounts or promotions.

- Improve customer service to enhance customer loyalty and repeat business.

Capital Allocation

- Prioritize investments in high-return projects.

- Maintain a balance between dividend payments and retained earnings.

- Consider issuing new equity or debt to raise additional capital.

By implementing these recommendations, Alpha Company can strengthen its financial position, improve its retained earnings, and drive long-term growth.

End of Discussion

Alpha Company’s retained earnings serve as a testament to its financial prudence and growth potential. By wisely utilizing these earnings, the company can embark on strategic investments, drive innovation, and enhance its long-term competitiveness. As we conclude our analysis, we offer valuable recommendations for Alpha Company, empowering them to leverage their retained earnings for maximum impact.

FAQ

What are retained earnings, and why are they important?

Retained earnings represent the portion of a company’s net income that is not distributed as dividends to shareholders. They are crucial as they provide a source of internal financing for future growth and expansion.

How can Alpha Company use its retained earnings?

Alpha Company has several options for utilizing its retained earnings, including investing in capital projects, expanding its product line, or pursuing acquisitions to strengthen its market position.

What are the potential implications of Alpha Company’s retained earnings for investors?

Investors should consider the company’s dividend policy, stock price performance, and growth prospects when evaluating the impact of retained earnings on their investment decisions.