An order to a bank to pay cash, known as a bank draft, is a crucial financial instrument that enables individuals and businesses to transfer funds securely and conveniently. This guide delves into the intricacies of bank drafts, exploring their types, procedures, legal implications, and alternatives, providing a comprehensive understanding of this essential banking tool.

Bank drafts offer several advantages over other payment methods, including guaranteed payment, reduced risk of fraud, and convenience. However, it’s essential to understand the different types of bank drafts available, the procedures involved in issuing them, and the legal implications associated with their use.

This guide provides a thorough overview of these aspects, empowering readers with the knowledge to effectively utilize bank drafts for their financial needs.

Bank Orders to Pay Cash: A Comprehensive Guide

Bank orders to pay cash, also known as cashier’s checks or money orders, are financial instruments used to pay cash in a secure and convenient manner. They offer a number of advantages over traditional cash payments, such as increased security, convenience, and peace of mind.

Types of Bank Orders to Pay Cash: An Order To A Bank To Pay Cash

There are several different types of bank orders used to pay cash, each with its own advantages and disadvantages. The most common types include:

- Cashier’s Checks:Issued by a bank and drawn on the bank’s own funds, making them highly secure and reliable.

- Money Orders:Similar to cashier’s checks, but issued by non-bank financial institutions and backed by the issuer’s funds.

- Certified Checks:Personal checks that have been verified by the bank to ensure that the funds are available, providing added security over regular checks.

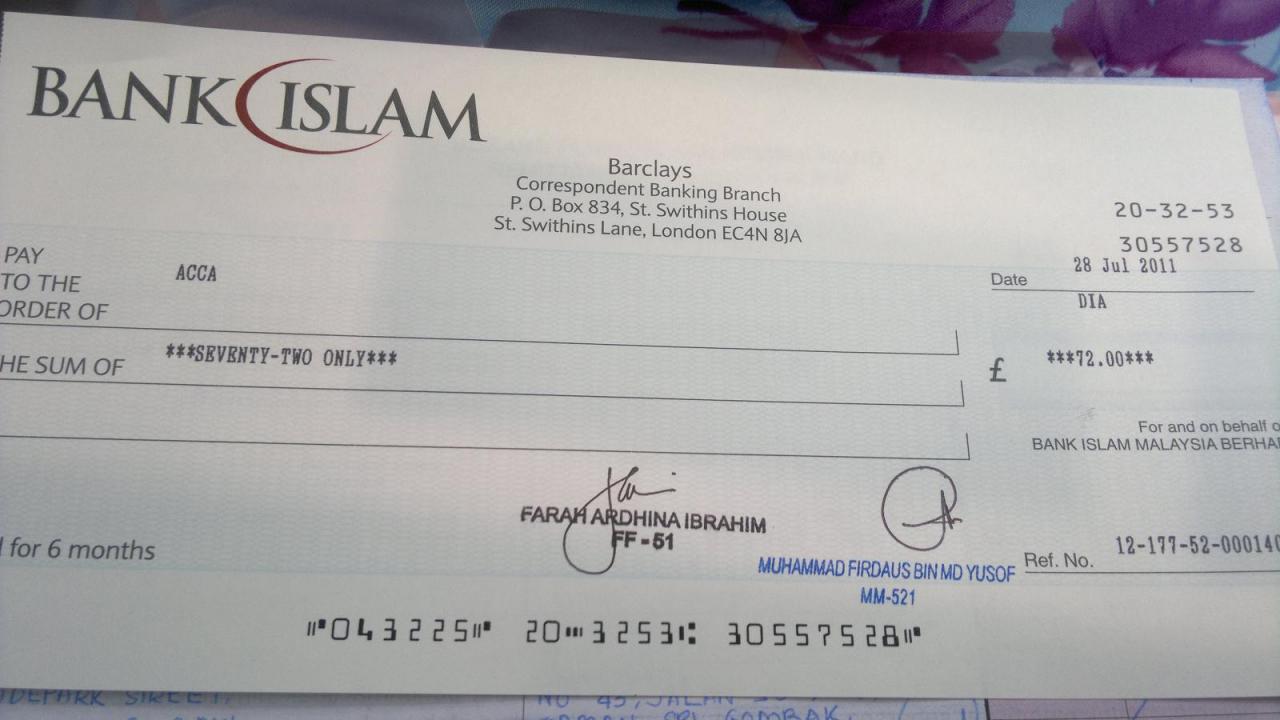

- Bank Drafts:Similar to cashier’s checks, but drawn on the account of the person making the payment rather than the bank.

Procedures for Issuing a Bank Order to Pay Cash

The process for issuing a bank order to pay cash typically involves the following steps:

- Provide Identification:You will need to provide valid identification, such as a driver’s license or passport, to the bank.

- Fill Out an Order Form:You will need to complete an order form that includes information such as the amount of the order, the recipient’s name, and your signature.

- Pay the Fee:You will need to pay a small fee for the order, which varies depending on the type of order and the bank.

- Receive the Order:Once the order is processed, you will receive the bank order, which you can then give to the recipient.

Legal Implications of Bank Orders to Pay Cash

Bank orders to pay cash are considered legal tender and can be used to make payments for goods and services. However, there are some legal implications that you should be aware of:

- Liability:Banks are liable for the amount of the order if it is lost or stolen.

- Fraud:Bank orders can be counterfeited or forged, so it is important to be aware of the signs of fraud.

- Tax Implications:Bank orders may be subject to taxes, depending on the amount of the order and the purpose of the payment.

Alternatives to Bank Orders to Pay Cash

There are a number of alternatives to bank orders to pay cash, each with its own advantages and disadvantages:

- Personal Checks:The most common alternative to bank orders, but they can be less secure and convenient.

- Credit Cards:A convenient way to pay for goods and services, but they can come with high interest rates and fees.

- Debit Cards:Similar to credit cards, but they draw directly from your bank account, reducing the risk of overspending.

- Online Payment Services:Allow you to make payments online, but they can be less secure than traditional payment methods.

Epilogue

In conclusion, an order to a bank to pay cash is a versatile and secure payment method that offers numerous benefits. By understanding the different types of bank drafts, the procedures for issuing them, and the legal implications involved, individuals and businesses can harness the power of this financial instrument to facilitate smooth and efficient cash transactions.

Whether it’s for personal or business purposes, bank drafts provide a reliable and convenient way to transfer funds, ensuring peace of mind and financial security. By embracing the insights provided in this guide, readers can confidently navigate the world of bank drafts and leverage their advantages to meet their financial goals.

FAQ Resource

What is the difference between a bank draft and a cashier’s check?

A bank draft is drawn on the funds of the issuing bank, while a cashier’s check is drawn on the funds of the bank’s customer. Bank drafts are typically used for larger transactions, while cashier’s checks are more common for smaller amounts.

Can I cancel a bank draft?

Yes, you can cancel a bank draft if it has not yet been cashed. However, there may be a fee for doing so.

What are the advantages of using a bank draft?

Bank drafts offer several advantages, including guaranteed payment, reduced risk of fraud, and convenience. They are also a secure way to transfer funds, as they are difficult to counterfeit.