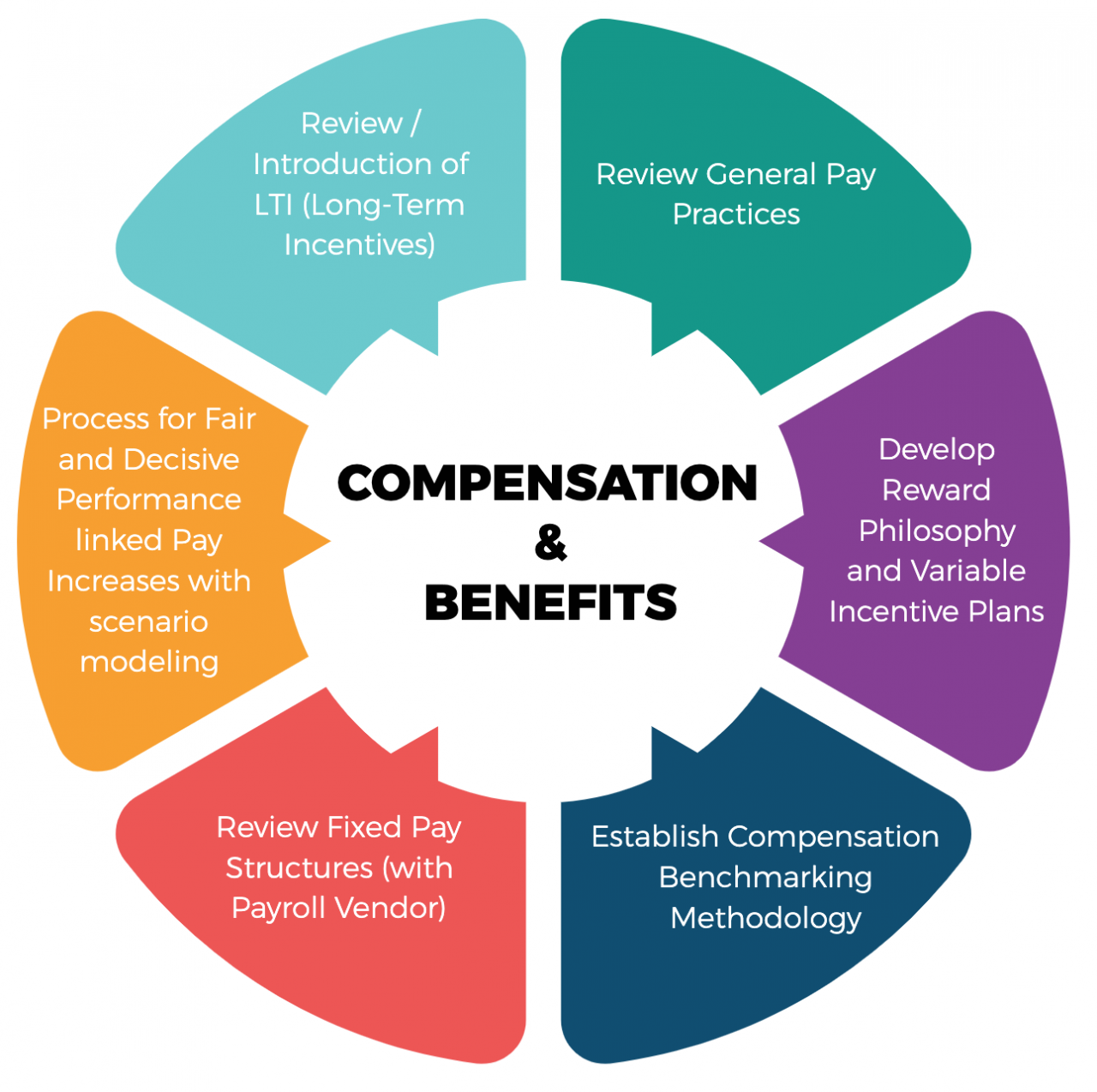

In the realm of employee motivation and retention, the 8 components of an effective employee compensation plan stand as a cornerstone. This guide unveils the secrets of crafting a compensation package that not only attracts and retains top talent but also drives performance and fosters a culture of excellence.

Base Pay

Establishing a competitive base salary is crucial for attracting and retaining top talent. It serves as the foundation of an employee compensation plan and sets the tone for overall employee satisfaction and motivation.

With an effective employee compensation plan covering base pay, incentives, bonuses, and more, it’s also up to employees to take initiative. Follow these 15 tips to improve your performance and climb the corporate ladder. These tips will not only help you excel in your current role but also set you up for success in future endeavors.

Remember, a well-rounded compensation plan is a two-way street, so take ownership of your career and strive for greatness.

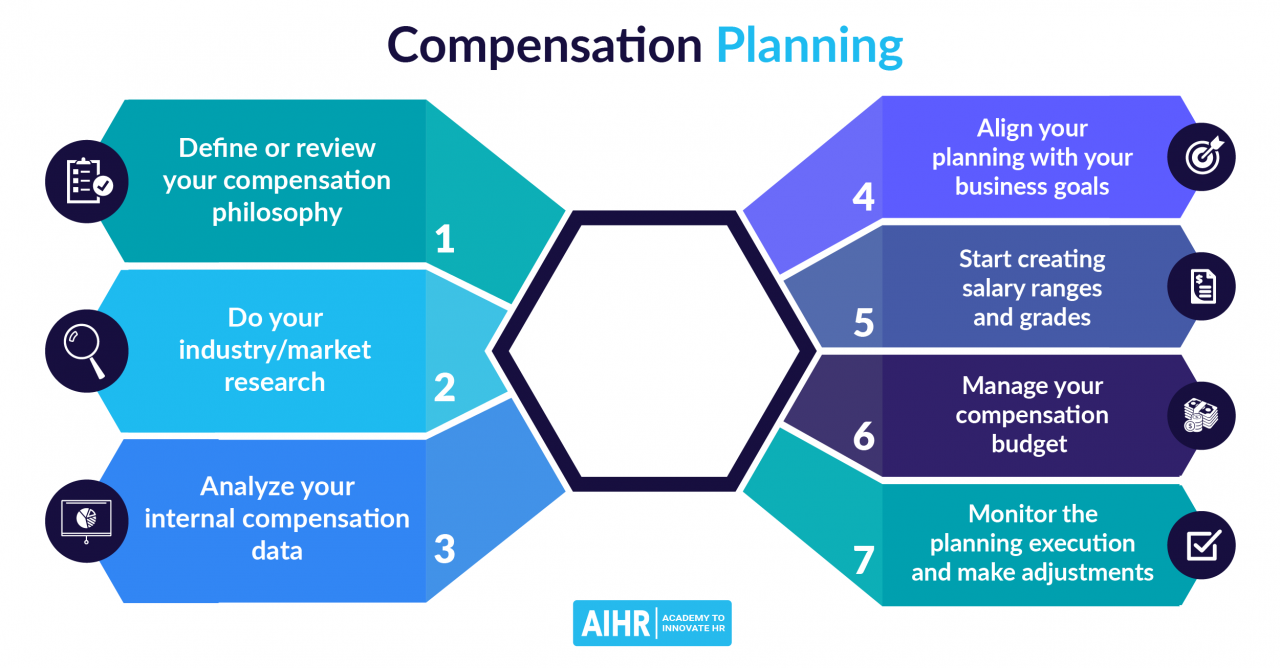

To determine fair base pay, companies typically conduct market research to analyze industry benchmarks, job descriptions, and location-specific data. They may also consider factors such as experience, skills, and performance.

Market Research

- Analyze salary surveys and industry reports.

- Conduct job evaluations to compare positions within the company.

- Gather data on salaries offered by competitors.

Variable Pay

Variable pay is a component of an employee compensation plan that is tied to performance, either individual or organizational. It is designed to motivate employees to achieve specific goals and objectives and reward them for their contributions to the company’s success.

Types of Variable Pay Structures

There are several types of variable pay structures, including:

- Bonuses:One-time payments made to employees based on achieving predetermined performance targets.

- Commissions:Payments made to employees based on the sales they generate or the revenue they bring in.

- Profit Sharing:Payments made to employees based on the company’s overall profitability.

Best Practices for Designing and Implementing Variable Pay Programs

When designing and implementing variable pay programs, it is important to consider the following best practices:

- Align with Organizational Goals:Ensure that the variable pay program is aligned with the company’s strategic objectives and goals.

- Set Clear Performance Metrics:Establish clear and measurable performance metrics that employees can understand and track.

- Communicate Effectively:Communicate the variable pay program to employees in a clear and concise manner, ensuring that they understand the program’s objectives and expectations.

- Provide Regular Feedback:Provide employees with regular feedback on their performance and progress towards achieving the variable pay targets.

Benefits

Benefits play a crucial role in attracting and retaining top talent, complementing the base and variable pay components of an effective compensation plan. They offer a range of advantages that enhance employee well-being, motivation, and loyalty.

Core benefits typically included in an employee compensation plan encompass health insurance, dental and vision coverage, paid time off, retirement savings plans, and life insurance. These benefits provide employees with peace of mind and financial security, demonstrating the employer’s commitment to their well-being.

Health Insurance

Health insurance coverage is a cornerstone of employee benefits, providing access to essential medical care. It helps employees manage healthcare costs, ensuring they receive necessary medical attention without financial strain.

Paid Time Off

Paid time off allows employees to take breaks from work for vacations, personal appointments, or family emergencies. It promotes work-life balance, reducing stress and burnout, and contributes to overall employee well-being.

Retirement Savings Plans

Retirement savings plans, such as 401(k)s and IRAs, assist employees in planning for their financial future. Employer contributions and matching programs encourage employees to save for retirement, ensuring their financial security in later years.

Retirement Plans

Retirement plans are crucial for employees to secure their financial future after retirement. They provide a systematic way to save and invest for the long term. Various types of retirement plans are available, each with its own set of features and benefits.

Types of Retirement Plans

*

-*Defined Benefit Plans

Employers guarantee a fixed monthly income upon retirement, regardless of investment performance.

The eight components of an effective employee compensation plan are essential for attracting and retaining top talent. But don’t forget the flip side of the coin: employees have responsibilities too, like performing their job duties to the best of their ability, fulfilling their assigned responsibilities , and upholding company policies.

By aligning compensation with employee contributions and responsibilities, organizations can create a win-win situation that benefits both parties.

-*Defined Contribution Plans

Employees and employers contribute to a retirement account, and the investment returns determine the final payout.

Selecting and Managing Retirement Plans

*

-*Consider your age and retirement goals

An effective employee compensation plan is the key to a happy and productive workforce. The eight components of an effective employee compensation plan are: competitive pay, bonuses, incentives, profit sharing, retirement plans, health insurance, paid time off, and employee discounts.

To ensure you’re getting the most out of your employees, check out these 10 interview questions to ask an employee . These questions will help you determine whether a candidate is a good fit for your company and will help you create a compensation plan that is tailored to their individual needs.

By following these tips, you can create an employee compensation plan that will attract and retain top talent.

Younger employees have more time to invest, while older employees may need to catch up.

-

-*Choose the right plan type

Defined benefit plans offer stability, while defined contribution plans provide flexibility and potential for higher returns.

-*Maximize contributions

Contribute as much as possible within the plan limits.

An effective employee compensation plan should include components like base pay, incentives, and benefits. To determine the right compensation, employers evaluate candidates based on their skills and qualities. Some of the top characteristics employers look for in an employee include a strong work ethic, teamwork skills, and a positive attitude.

These qualities help employees succeed in their roles and contribute to the overall success of the organization. Thus, a well-structured compensation plan should consider both the financial and non-financial aspects of employee performance.

-*Diversify investments

In the cutthroat world of compensation, it’s not just about the Benjamins. To land the big bucks, you need to bring your A-game. Like the bosses in 10 characteristics employers look for in an employee , you gotta be a team player, a go-getter, and a problem-solver.

But let’s not forget the backbone of any effective compensation plan – base pay, bonuses, benefits, incentives, and perks. Get these 8 components right, and you’ll be the MVP of the compensation game.

Spread investments across different asset classes to reduce risk and enhance returns.

-*Monitor performance

Regularly review your retirement account and make adjustments as needed.

Additional Tips

*

-*Take advantage of employer matching

Many employers offer matching contributions, which can significantly boost your retirement savings.

-

-*Consider Roth options

Roth plans allow for tax-free withdrawals in retirement, but contributions are made after-tax.

-*Get professional advice

Consult with a financial advisor to create a personalized retirement plan that aligns with your specific needs.

Paid Time Off

Paid time off (PTO) is a type of employee compensation that allows employees to take time off from work with pay. There are various types of PTO, including vacation, sick leave, and personal days.Offering PTO has several benefits for both employees and employers.

For employees, PTO provides flexibility, work-life balance, and the opportunity to rest and recharge. For employers, PTO can improve employee morale, reduce absenteeism, and increase productivity. However, there are also some challenges associated with offering PTO, such as the cost to the employer and the potential for abuse by employees.

Types of PTO

There are several different types of PTO, each with its own purpose and rules.

- Vacation:Vacation time is typically used for rest, relaxation, or travel. It is usually accrued over time, and employees can take it whenever they want, with the approval of their supervisor.

- Sick leave:Sick leave is used when an employee is unable to work due to illness or injury. It is usually accrued over time, and employees can take it when they need it, with the approval of their supervisor.

- Personal days:Personal days can be used for any reason, such as personal appointments, errands, or family events. They are usually accrued over time, and employees can take them whenever they want, with the approval of their supervisor.

Equity Compensation

Equity compensation is a form of compensation that gives employees ownership interest in the company they work for. This can be a powerful motivator, as it aligns the interests of employees with those of the company. When the company does well, employees benefit financially.There

are several different types of equity compensation, including stock options, restricted stock units, and employee stock purchase plans. Stock options give employees the right to buy a certain number of shares of company stock at a set price. Restricted stock units are shares of company stock that are granted to employees but cannot be sold until certain conditions are met, such as the employee staying with the company for a certain period of time.

Employee stock purchase plans allow employees to buy shares of company stock at a discounted price.Equity compensation can be a valuable tool for motivating employees and aligning their interests with those of the company. However, it is important to design an equity compensation plan carefully to ensure that it is fair and effective.

Getting an effective employee compensation plan right requires balancing at least 8 components. From base pay to bonuses and perks, it’s like a dance. And just like the perfect dance partner, you want an employee who embodies the 15 traits of an ideal employee . They’re the ones who make the compensation plan sing, driving productivity and loyalty.

So, while crafting your compensation plan, keep those 8 components in mind, and don’t forget to look for the ideal dance partner – the employee who’ll make it all worthwhile.

Types of Equity Compensation

The most common types of equity compensation are:

- Stock options give employees the right to buy a certain number of shares of company stock at a set price, known as the exercise price. The employee can exercise the options at any time, but they are typically most valuable when the stock price is higher than the exercise price.

With 8 components making up an effective employee compensation plan, understanding employee classifications is key. Take 1099 as an employee , for instance. They’re not traditional employees, yet their compensation should still align with the plan’s structure. From base pay to bonuses, incentives, and benefits, each component plays a crucial role in attracting, motivating, and retaining top talent.

- Restricted stock units (RSUs) are shares of company stock that are granted to employees but cannot be sold until certain conditions are met, such as the employee staying with the company for a certain period of time or until the company achieves certain performance goals.

- Employee stock purchase plans (ESPPs) allow employees to buy shares of company stock at a discounted price. The employee typically has to contribute a certain amount of money to the plan each pay period, and the company will match the employee’s contribution with shares of stock.

Perquisites

Perquisites, also known as perks, are non-cash benefits provided to employees in addition to their base salary and benefits package. These perks can range from tangible items like company cars and executive dining to intangible benefits like gym memberships and tuition reimbursement.

Tax Implications

Perquisites are typically taxable, meaning that employees must pay taxes on the value of the perk. The tax implications of perquisites vary depending on the type of perk and the employee’s tax bracket. For example, the value of a company car is taxed as income, while the value of a gym membership is typically not taxable.

Ethical Considerations, 8 components of an effective employee compensation plan

There are also ethical considerations to keep in mind when offering perquisites. Employers should ensure that perquisites are offered fairly and equitably to all employees. Additionally, employers should avoid offering perquisites that could create a conflict of interest or that could be seen as excessive.

Performance Management

Performance management is the systematic process of evaluating employee performance to ensure that it meets the organization’s goals. It is a key component of an effective compensation plan because it provides the basis for determining rewards and incentives.

There are many different methods used to evaluate employee performance, including:

- Goal-setting:This method involves setting specific, measurable, achievable, relevant, and time-bound (SMART) goals for employees. Their performance is then evaluated based on how well they achieve these goals.

- Behavior-based evaluation:This method focuses on observing and evaluating employee behaviors that are critical to job success. It is often used in conjunction with goal-setting.

- 360-degree feedback:This method involves collecting feedback from multiple sources, such as supervisors, peers, and subordinates. It provides a comprehensive view of employee performance.

- Self-evaluation:This method involves employees evaluating their own performance. It can be a valuable tool for identifying areas for improvement.

Compensation Surveys

Compensation surveys are a valuable tool for organizations to gather data on the compensation practices of similar organizations. This data can be used to ensure that the organization’s compensation plan is competitive and internally equitable.

There are many benefits to conducting compensation surveys, including:

- Ensuring that the organization’s compensation plan is competitive.

- Identifying areas where the organization’s compensation plan is not competitive.

- Identifying opportunities to reduce compensation costs.

- Providing data to support compensation decisions.

There are a number of different ways to design and conduct compensation surveys. The most common approach is to use a third-party vendor to collect and analyze the data. However, organizations can also conduct their own surveys.

When designing a compensation survey, it is important to consider the following factors:

- The purpose of the survey.

- The scope of the survey.

- The methodology to be used.

- The budget for the survey.

Once the survey has been designed, it is important to conduct it in a way that ensures that the data is accurate and reliable. This includes:

- Using a valid and reliable methodology.

- Collecting data from a representative sample of organizations.

- Ensuring that the data is confidential.

The results of a compensation survey can be used to make informed decisions about the organization’s compensation plan. The data can be used to identify areas where the plan is not competitive, as well as opportunities to reduce compensation costs.

Legal and Regulatory Compliance

The legal and regulatory environment surrounding employee compensation is complex and ever-changing. To ensure compliance with these requirements, employers must stay up-to-date on the latest laws and regulations.

Failure to comply with legal and regulatory requirements can result in significant penalties, including fines, back taxes, and even criminal charges. In addition, non-compliance can damage an employer’s reputation and make it difficult to attract and retain top talent.

Federal Laws

- The Fair Labor Standards Act (FLSA) sets minimum wage, overtime pay, and recordkeeping requirements.

- The Equal Pay Act (EPA) prohibits employers from discriminating on the basis of sex in the payment of wages.

- The Age Discrimination in Employment Act (ADEA) prohibits employers from discriminating against employees who are 40 years of age or older.

- The Americans with Disabilities Act (ADA) prohibits employers from discriminating against employees with disabilities.

- The Family and Medical Leave Act (FMLA) entitles eligible employees to take unpaid, job-protected leave for certain family and medical reasons.

State Laws

In addition to federal laws, there are also a number of state laws that govern employee compensation. These laws vary from state to state, so it is important for employers to be familiar with the laws in the states where they operate.

Importance of Compliance

Ensuring compliance with legal and regulatory requirements is essential for any employer. By complying with the law, employers can avoid costly penalties and protect their reputation. In addition, compliance can help employers attract and retain top talent.

Final Thoughts

By embracing the 8 essential components Artikeld in this guide, organizations can empower their employees, enhance their bottom line, and establish themselves as employers of choice. The time has come to redefine compensation and unlock the true potential of your workforce.

Query Resolution: 8 Components Of An Effective Employee Compensation Plan

What is the significance of establishing a competitive base salary?

A competitive base salary is crucial for attracting and retaining qualified employees. It ensures that the organization remains competitive in the job market and demonstrates its commitment to fair compensation.

How do you determine fair base pay?

Fair base pay can be determined through market research, industry benchmarks, and internal salary surveys. These methods help organizations align their salaries with the prevailing market rates.