A company receives 0 of cash as an additional investment – In the realm of finance, a company receiving $500 of cash as an additional investment is a pivotal moment, brimming with potential and strategic implications. This infusion of capital can propel a business to greater heights, opening doors to new possibilities and shaping its financial trajectory.

As we delve into the intricate details of this investment, we will uncover its impact on cash flow, balance sheet, financial ratios, and tax considerations. We will explore the potential uses of these additional funds and delve into the expected returns, risks, and rewards associated with this investment.

Impact on Cash Flow: A Company Receives 0 Of Cash As An Additional Investment

The receipt of $500 in cash as an additional investment directly increases the company’s cash flow. This positive cash flow is a result of an inflow of funds from external sources, specifically from the investor who provided the additional capital.

The increase in cash flow can have a positive impact on the company’s liquidity, which refers to its ability to meet its short-term financial obligations. With more cash on hand, the company has greater flexibility to cover expenses, pay off debt, or invest in new opportunities.

With an extra $500 in the bank, the company’s future looks brighter than ever. But wait, did you know you can access iCloud from an Android ? That’s right, now you can stay connected to your Apple devices even if you’re rocking the green side.

With this newfound freedom, the company can invest in even more opportunities and continue its upward trajectory.

Potential Impact on Liquidity

- Improved debt repayment:The increased cash flow can be used to reduce outstanding debt, lowering interest expenses and improving the company’s financial position.

- Increased working capital:The additional cash can be used as working capital, providing a buffer for unexpected expenses or seasonal fluctuations in revenue.

- Enhanced investment opportunities:The cash flow can be allocated towards new projects or investments that have the potential to generate additional revenue streams and drive growth.

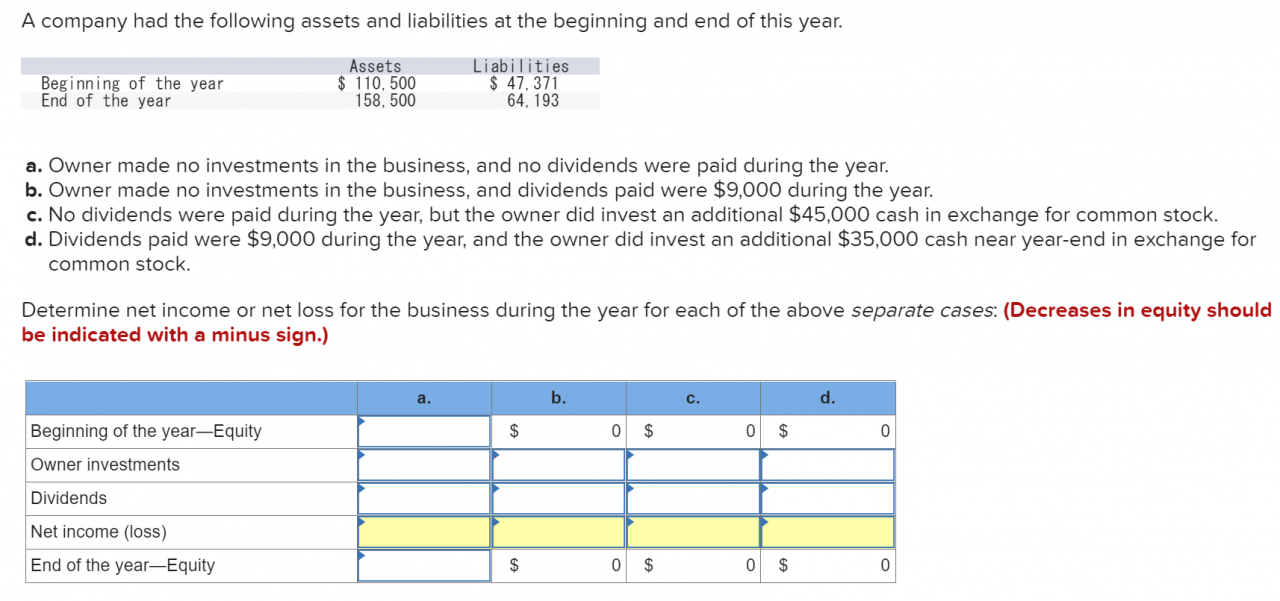

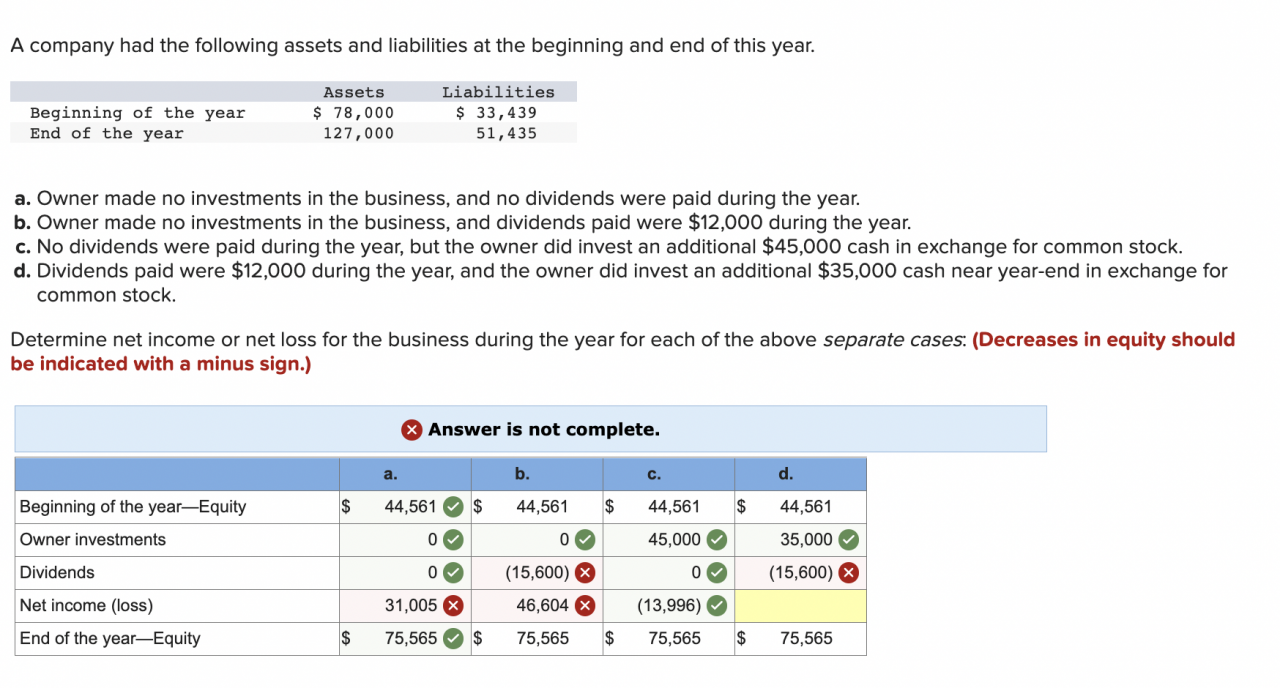

Effects on Balance Sheet

The additional investment of $500 in cash will impact the company’s balance sheet by increasing its assets and equity.

The balance sheet is a financial statement that provides a snapshot of a company’s financial health at a specific point in time. It shows the company’s assets, liabilities, and equity.

Assets

- Cash: The additional investment of $500 will increase the company’s cash balance by $500.

Liabilities

The additional investment will not impact the company’s liabilities.

Equity

- Shareholder’s equity: The additional investment will increase the company’s shareholder’s equity by $500.

Implications for Financial Ratios

The additional investment of $500 in cash will have an impact on the company’s financial ratios. Financial ratios are used to assess a company’s financial performance and health. By comparing the company’s ratios to industry averages or to its own historical ratios, investors and creditors can gain insights into the company’s strengths and weaknesses.

Liquidity Ratios

Liquidity ratios measure a company’s ability to meet its short-term obligations. The current ratio and quick ratio are two common liquidity ratios. The current ratio is calculated by dividing current assets by current liabilities. The quick ratio is calculated by dividing liquid assets (cash, cash equivalents, and marketable securities) by current liabilities.

The company received an additional investment of $500 in cash, which is a great sign of confidence in the company’s future. With this new investment, the company can now invest in new equipment and technology, such as AirTags , which can help the company track its assets and improve its efficiency.

This will help the company grow and succeed in the future.

The additional investment of $500 in cash will increase the company’s current assets and, therefore, its current ratio and quick ratio. This will indicate that the company is more liquid and has a greater ability to meet its short-term obligations.

When a company receives $500 of cash as an additional investment, it can use that money to expand its operations. For example, the company could use the money to purchase new equipment, hire new employees, or launch a new marketing campaign.

One way to use the money could be to research if can facetime be installed on an android phone . This could help the company to reach a wider audience and increase its sales. The company could also use the money to invest in research and development, which could lead to the development of new products or services.

Whatever the company decides to do with the money, it is important to use it wisely so that it can generate a return on investment.

Solvency Ratios

Solvency ratios measure a company’s ability to meet its long-term obligations. The debt-to-equity ratio and the times interest earned ratio are two common solvency ratios. The debt-to-equity ratio is calculated by dividing total debt by total equity. The times interest earned ratio is calculated by dividing earnings before interest and taxes (EBIT) by interest expense.

The additional investment of $500 in cash will not have a direct impact on the company’s solvency ratios. However, if the company uses the cash to reduce its debt, then its debt-to-equity ratio will improve. If the company uses the cash to invest in new projects that generate additional earnings, then its times interest earned ratio will improve.

Profitability Ratios

Profitability ratios measure a company’s profitability. The gross profit margin, operating profit margin, and net profit margin are three common profitability ratios. The gross profit margin is calculated by dividing gross profit by revenue. The operating profit margin is calculated by dividing operating profit by revenue.

A company’s recent $500 cash infusion as an additional investment is a testament to its growth potential. Just like 3M, an innovative company that has consistently reinvested in research and development, this company is poised to make a mark in its industry.

The additional capital will fuel further expansion and solidify its position as a leader in its field.

The net profit margin is calculated by dividing net income by revenue.

The additional investment of $500 in cash will not have a direct impact on the company’s profitability ratios. However, if the company uses the cash to invest in new projects that generate additional revenue or reduce costs, then its profitability ratios will improve.

Tax Considerations

The additional investment of $500 cash may have tax implications for the company. Understanding these implications is crucial for making informed decisions and ensuring compliance with tax regulations.

The investment can potentially impact the company’s taxable income and tax liability. It’s important to consider the following aspects:

Tax Implications

- Increased taxable income:The additional investment increases the company’s assets, which may result in a higher taxable income. This is because the investment is considered a capital contribution and does not generate deductible expenses.

- Tax savings:In some cases, the investment may provide tax savings. For instance, if the investment is used to acquire new equipment, the company may be eligible for tax deductions or credits related to depreciation or research and development.

- Tax liability:Based on the increased taxable income, the company may have to pay additional taxes. It’s important to consult with a tax professional to determine the exact impact on the company’s tax liability.

Use of Funds

The additional funds of $500 can be utilized in various ways to enhance the company’s operations and growth. The allocation of these funds should be carefully considered to maximize their impact on the business.

One potential use of the funds is to invest in research and development (R&D). This could involve developing new products or services, or improving existing ones. R&D can help the company stay ahead of the competition and create new revenue streams.

Yo, so this company got a cool $500 cash boost. But hold up, let’s get real. In this digital age, you gotta stay sharp. Like, can an android phone be hacked remotely? Check it out , ’cause you never know when someone’s trying to swipe your data.

But hey, back to that cash infusion – now the company can flex even harder!

Expansion

- Opening new locations or expanding existing ones to increase market reach and customer base.

- Acquiring or partnering with other businesses to expand into new markets or product lines.

Marketing and Sales

- Investing in marketing campaigns to increase brand awareness and generate leads.

- Hiring additional sales staff to increase sales volume and reach new customers.

Operations, A company receives 0 of cash as an additional investment

- Purchasing new equipment or upgrading existing equipment to improve efficiency and productivity.

- Investing in employee training and development to enhance skills and boost morale.

Investment Returns

Investing $500 into the company offers the potential for both returns and risks. Understanding these factors is crucial before making an investment decision.

A company received a cool $500 cash injection, giving them the green light to buy an oil rig. Read about their oil rig purchase here. With this new investment, they’re set to drill baby, drill!

The expected return on investment (ROI) depends on the company’s financial performance and the growth of its business. A successful company can generate significant profits, leading to a high ROI for investors. However, it’s important to note that investments also carry risks.

Potential Risks and Rewards

- Potential Rewards:The company may use the investment to expand its operations, increase sales, and generate higher profits. This could result in a substantial ROI for investors.

- Potential Risks:The company may face challenges in executing its business plan, leading to lower profits or even losses. This could result in a loss of investment for investors.

Impact on Shareholders

The additional investment of $500 in cash directly impacts shareholder equity, which is the residual interest in the assets of a company after deducting its liabilities.

As a result, the company’s shareholder equity will increase by $500. This increase represents the additional ownership interest that the new investor has in the company.

Potential Changes in Stock Value

The impact on stock value is not always straightforward and depends on various factors such as the company’s financial performance, industry conditions, and overall market sentiment.

A company receives $500 of cash as an additional investment. With this extra capital, the company is exploring new opportunities, including the possibility of creating non-fungible tokens (NFTs). While NFTs have traditionally been associated with digital art, it is now possible to create NFTs on a variety of platforms, including Android phones.

Check out this guide to learn can i make an nft on my android phone . With the increasing popularity of NFTs, this could be a lucrative opportunity for the company to generate additional revenue.

- Increased Demand:The additional investment can increase demand for the company’s stock, potentially leading to an increase in stock value.

- Positive Market Perception:The investment may be seen as a sign of confidence in the company, which could positively impact market perception and lead to an increase in stock value.

- Dilution of Shares:If the company issues new shares to raise the $500, existing shareholders may experience a dilution of their ownership interest, potentially leading to a decrease in stock value.

Accounting Treatment

The accounting treatment for the $500 cash investment requires recording the transaction in the company’s accounting system. This involves creating accounting entries to reflect the increase in cash and the corresponding increase in shareholder equity.

Accounting Entries

The following accounting entries are required to record the investment:

- Debit: Cash $500

- Credit: Shareholder Equity $500

Impact on Financial Statements

The investment will have the following impact on the company’s financial statements:

- Income Statement:No impact, as the investment is not an income-generating event.

- Cash Flow Statement:The investment will be reported as an inflow of cash from financing activities.

Sensitivity Analysis

Conducting a sensitivity analysis helps assess the impact of various scenarios on the company’s financial performance. By varying assumptions and inputs, we can determine how sensitive key metrics are to changes in these factors.

Impact on Key Metrics

Potential variations in outcomes include:

- Changes in net income and profitability

- Fluctuations in cash flow and liquidity

- Variations in financial ratios, such as return on assets or debt-to-equity ratio

Comparison with Similar Investments

Assessing the relative merits of the investment against comparable opportunities provides insights into its attractiveness.

Advantages include:

- Higher Return Potential:The investment may offer a more attractive return compared to similar investments, leading to greater potential gains.

- Diversification Benefits:Investing in a different asset class or industry can enhance portfolio diversification, reducing overall risk.

- Lower Fees:Some investments come with lower management fees or transaction costs, resulting in cost savings.

Disadvantages may include:

- Higher Risk:The investment may carry a higher level of risk compared to other options, potentially leading to losses.

- Limited Liquidity:Certain investments may have restricted liquidity, making it difficult to access funds quickly when needed.

- Opportunity Cost:Investing in one opportunity may mean missing out on potential gains from other investments.

Future Implications

The $500 investment has the potential to significantly impact the company’s long-term financial performance. It can fuel growth, enhance profitability, and create value for shareholders.

The investment could be used to expand operations, enter new markets, or develop new products. These initiatives can drive revenue growth and increase market share. Additionally, the investment can be allocated to improve efficiency, reduce costs, and enhance operational performance, leading to higher profitability.

Increased Financial Flexibility

- The investment provides the company with increased financial flexibility, allowing it to respond to unexpected events or capitalize on new opportunities.

- The additional capital can be used to cover unexpected expenses, invest in research and development, or make strategic acquisitions.

Enhanced Creditworthiness

- The investment can improve the company’s creditworthiness, making it easier and less expensive to obtain financing in the future.

- A stronger balance sheet with increased assets and equity can enhance the company’s ability to secure loans or lines of credit at favorable terms.

Improved Investor Confidence

- The investment can boost investor confidence in the company, signaling its financial strength and growth potential.

- Increased investor confidence can lead to higher stock prices and make it easier to raise additional capital in the future.

Final Review

In conclusion, a company receiving $500 of cash as an additional investment is a significant event that can have far-reaching consequences. By carefully considering the implications Artikeld in this discussion, businesses can harness the power of this investment to fuel growth, enhance profitability, and secure their financial future.

FAQ Guide

What are the potential uses of the additional $500 investment?

The funds can be allocated to various areas, such as expanding operations, investing in research and development, or acquiring new equipment.

How can the investment impact shareholder equity?

The investment can increase shareholder equity, potentially leading to higher stock value and dividends.