Payroll information sheets are essential documents that provide a clear and concise snapshot of an employee’s earnings, deductions, and other important financial details. Understanding what an employee payroll information sheet should include is crucial for both employers and employees, ensuring accuracy, transparency, and compliance with regulations.

This comprehensive guide will delve into the key elements that make up an effective payroll information sheet, empowering you with the knowledge to create a document that meets the specific needs of your organization and employees.

Payroll Details

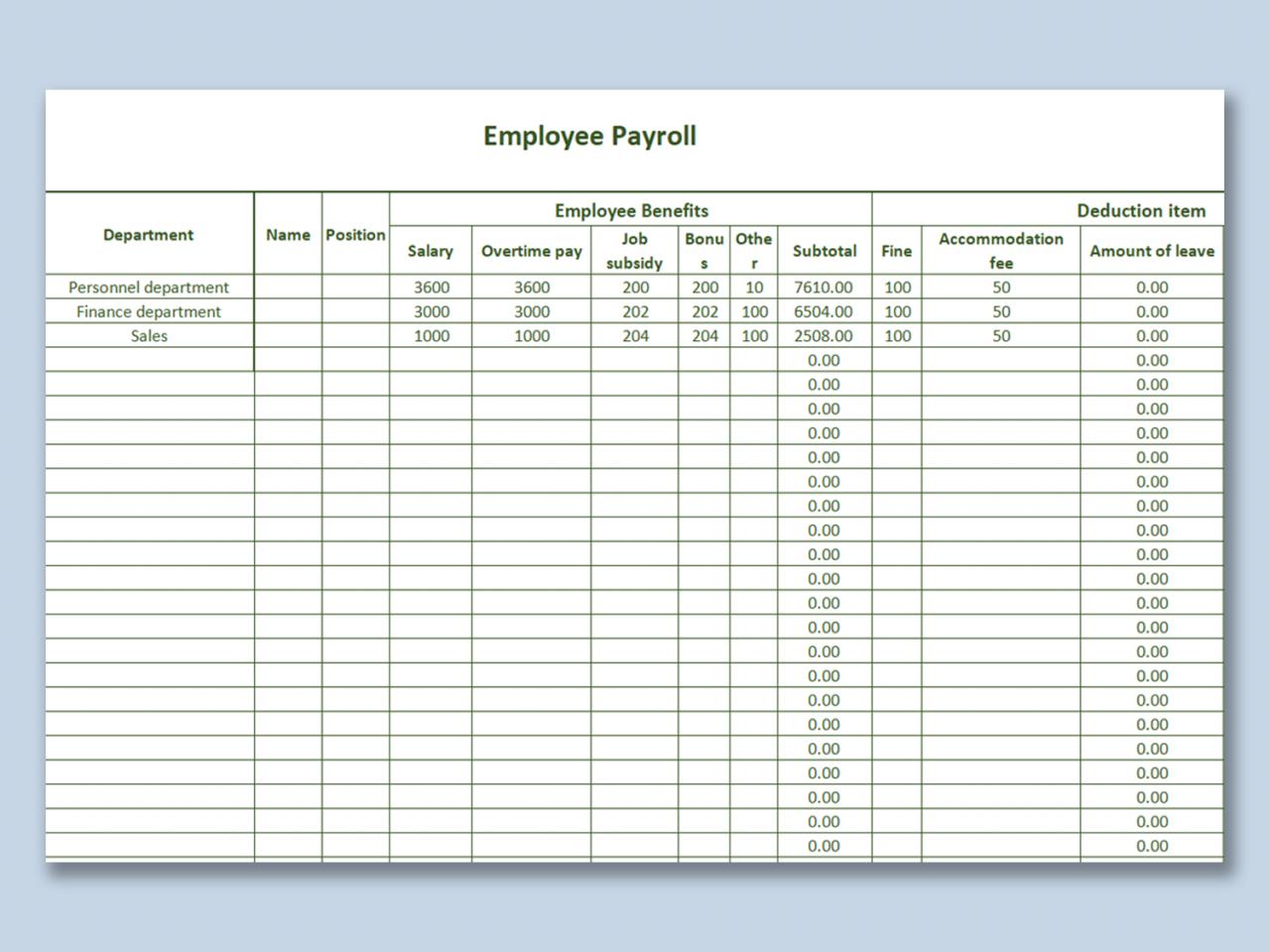

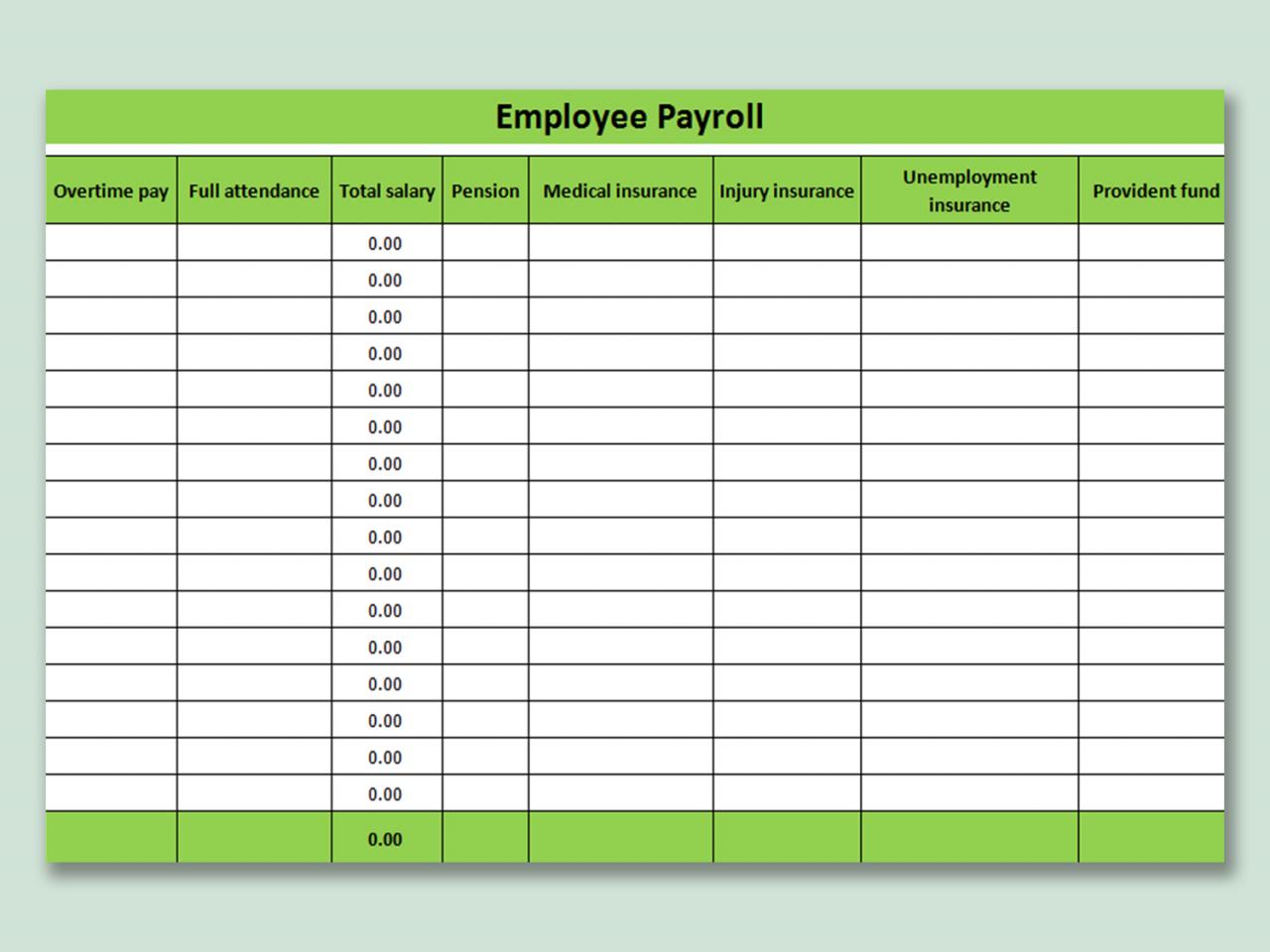

The payroll information sheet should include essential details such as pay period, gross pay, and net pay. These details provide a clear overview of the employee’s earnings and deductions.

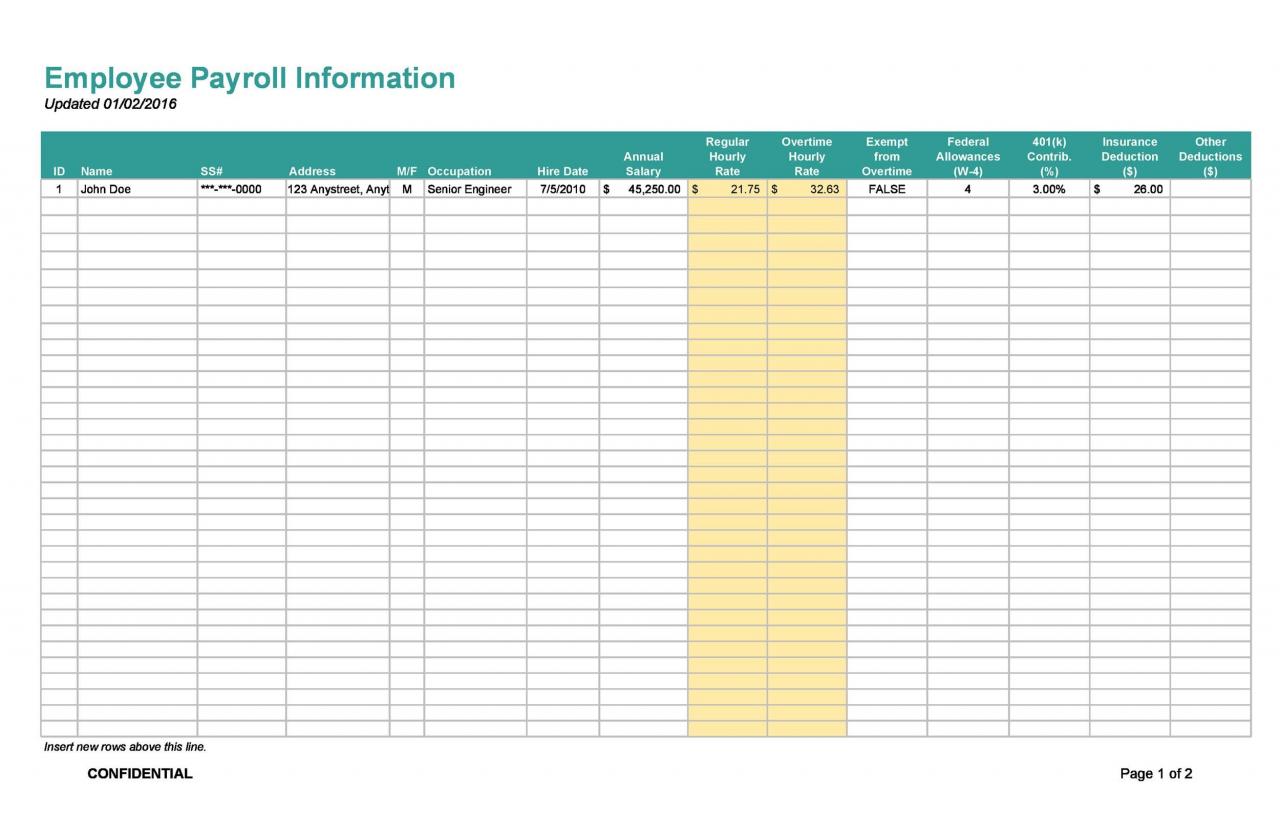

When it comes to payroll, an employee information sheet should include details like name, address, and pay rate. If you have any questions about your payroll, don’t hesitate to send a query letter to an employee . The sheet should also include deductions like taxes and insurance, as well as any other relevant information.

Additional Payroll Details

In addition to the essential details, the sheet may also include other relevant information such as overtime pay, bonuses, and deductions. These details provide a more comprehensive understanding of the employee’s compensation and benefits.

For those who are not having connectivity issues , an employee payroll information sheet should include details about their pay, benefits, and deductions. This information is important for employees to have on hand so that they can track their earnings and expenses.

Tax Information: An Employee Payroll Information Sheet Should Include

Tax information is a crucial part of a payroll sheet as it provides details about the taxes withheld from an employee’s paycheck.

Common tax deductions include:

Federal Income Tax

- Based on an employee’s taxable income and filing status.

- Determined using the federal income tax brackets and withholding tables.

Social Security Tax, An employee payroll information sheet should include

- Funds the Social Security program, which provides retirement, disability, and survivor benefits.

- Consists of two parts: Old-Age, Survivors, and Disability Insurance (OASDI) and Medicare.

Medicare Tax

- Funds the Medicare program, which provides health insurance for seniors and individuals with disabilities.

- Calculated as a percentage of an employee’s taxable income.

Deductions

Employee deductions are a crucial aspect of payroll sheets as they provide a detailed breakdown of various amounts withheld from an employee’s gross pay. These deductions play a significant role in determining the employee’s net pay, which is the amount they ultimately receive after all deductions have been made.

An employee payroll information sheet should include important details like the employee’s name, address, and pay rate. It should also include a statement defining how an organization handles employee sick days, such as this one . This information is crucial for ensuring that employees are paid accurately and on time, and that the organization is compliant with all applicable laws and regulations.

Common types of deductions include:

Health Insurance Premiums

- Health insurance premiums are payments made by employees to cover the cost of their health insurance plans.

- These premiums can vary depending on the type of plan, the coverage level, and the employee’s dependents.

Retirement Contributions

- Retirement contributions are amounts set aside from an employee’s paycheck to fund their retirement savings.

- These contributions can be made to various retirement accounts, such as 401(k) plans or IRAs.

Union Dues

- Union dues are fees paid by employees who are members of a labor union.

- These dues support the union’s activities, such as collective bargaining, representation, and advocacy.

Benefits

Including a section for employee benefits on the payroll sheet is highly valuable as it provides employees with a clear and concise overview of the benefits they receive from their employer. This information is crucial for employees to make informed decisions about their finances and plan for the future.

Payroll info sheets should include name, SSN, and rate of pay. They also include info about deductions, which can reveal a lot about an employee’s relationship with their supervisor. For instance, if an employee is making charitable donations through payroll deductions, it could indicate a strong bond with their supervisor, who may have encouraged them to get involved in the community.

For more on the relationship between employees and supervisors, check out a what relationship exists between an employee and a supervisor .

Common employee benefits that could be listed in this section include health insurance, paid time off, retirement plans, and other perks such as employee discounts, tuition reimbursement, and wellness programs. By providing this information on the payroll sheet, employees can easily compare their benefits package to industry standards and make informed decisions about their employment.

Health Insurance

Health insurance is a critical benefit that helps employees cover the costs of medical expenses. It can include coverage for doctor visits, hospital stays, prescription drugs, and more. Health insurance is often a major expense for employees, so it is important for them to understand the details of their coverage and how much they are contributing towards the premiums.

Yo, check it! An employee payroll information sheet should have the basics like name, address, and social security number. But hold up, if you’re wondering “am ia contractor or an employee”, you need to know that an employee payroll information sheet also includes tax withholding and other deductions.

Head over to am ia contractor or an employee for more info on that. Then you can come back here and make sure your payroll information sheet is on point.

Paid Time Off

Paid time off (PTO) allows employees to take time off from work for various reasons, such as vacations, sick days, and personal appointments. PTO is an important benefit that helps employees maintain a healthy work-life balance. It is also important for employees to understand the details of their PTO policy, such as how much time they accrue each year and how it can be used.

An employee payroll information sheet should include details like name, address, pay rate, and deductions. An employee discovers that 0.0025 of all products are defective, which could lead to a loss of revenue for the company. Therefore, it’s important to ensure accuracy in payroll information to avoid any discrepancies or legal issues.

Retirement Plans

Retirement plans help employees save for their future retirement. There are various types of retirement plans, such as 401(k) plans and IRAs. Retirement plans offer tax advantages and can help employees build a nest egg for their future.

Year-to-Date Information

Providing year-to-date (YTD) information on an employee’s payroll sheet offers several benefits. It allows employees to track their earnings and deductions over time, enabling them to better understand their financial situation.

The YTD information provides a comprehensive view of an employee’s earnings, deductions, and taxes, helping them make informed financial decisions. It allows them to monitor their progress towards financial goals and adjust their spending habits accordingly.

Tracking Earnings and Deductions

- YTD earnings include all wages, salaries, bonuses, and other forms of compensation received by the employee during the year.

- YTD deductions include all pre-tax and post-tax deductions, such as health insurance premiums, retirement contributions, and union dues.

Understanding Tax Liability

YTD tax information helps employees understand their tax liability and make necessary adjustments to their withholding. It allows them to avoid underpaying or overpaying taxes, which can result in penalties or refunds.

An employee payroll information sheet should include basic information like name, address, and pay rate. It should also include deductions for taxes, insurance, and other benefits. If you’re dealing with microaggression as an employee, consider taking a course on dealing with microaggression as an employee . An employee payroll information sheet should also include information about direct deposit and any other relevant payroll information.

Preparing for Tax Season

YTD information simplifies tax preparation by providing a comprehensive record of an employee’s earnings and deductions. This information can be used to complete tax forms accurately and efficiently.

Compliance

Ensuring that the payroll information sheet complies with all applicable laws and regulations is of paramount importance. Failure to comply can result in penalties, fines, and legal liabilities.

Specific compliance requirements include adhering to the Fair Labor Standards Act (FLSA), which sets minimum wage, overtime pay, and recordkeeping standards. The Employee Retirement Income Security Act (ERISA) governs employee benefit plans, such as health insurance and retirement savings accounts.

An employee payroll information sheet should include details of an employee’s earnings and deductions. This information is used to calculate the employee’s net pay. A statement of an employee’s biweekly earnings is given below. The statement includes the employee’s gross pay, deductions, and net pay.

An employee payroll information sheet should also include information about the employee’s benefits.

FLSA Compliance

- Minimum wage and overtime pay rates must be met.

- Accurate records of hours worked and wages paid must be maintained.

- Employee classifications (exempt vs. non-exempt) must be correct.

ERISA Compliance

- Benefit plan documents must be clear and comprehensive.

- Plan assets must be managed prudently.

- Employees must be provided with regular disclosures about their benefits.

Security

Maintaining the confidentiality and security of employee payroll information is paramount to safeguard sensitive data and protect both the organization and employees.

An employee payroll information sheet should include basic details like name, address, and job title. It should also include information about pay rate, deductions, and benefits. If an employee has any issues with their payroll, they should address them with their boss . The payroll information sheet can be used to help resolve any disputes.

Best practices to protect payroll data include:

Encryption

- Encrypting payroll data at rest and in transit prevents unauthorized access to sensitive information.

- Use strong encryption algorithms, such as AES-256, to ensure data protection.

Access Controls

- Implement access controls to restrict access to payroll information only to authorized personnel.

- Use role-based access control (RBAC) to grant access based on job responsibilities.

- Regularly review and update access permissions to ensure they remain appropriate.

Data Backup and Recovery

- Implement regular data backups to protect against data loss due to hardware failure, malware, or other incidents.

- Store backups securely, preferably off-site, to prevent unauthorized access or data loss.

- Test data recovery procedures regularly to ensure they are effective.

Employee Education

- Educate employees about the importance of protecting payroll information and the potential risks of data breaches.

- Train employees on security best practices, such as strong password creation and phishing awareness.

- Remind employees to report any suspicious activity or potential security breaches promptly.

Regular Security Audits

- Conduct regular security audits to identify and address potential vulnerabilities in the payroll system.

- Use security scanning tools and penetration testing to assess the effectiveness of security measures.

- Review audit reports and implement recommendations to enhance security.

Design and Layout

A well-designed payroll information sheet is crucial for ensuring that employees can easily understand their pay details. A clear and user-friendly design can help employees quickly find the information they need, such as their gross pay, deductions, and net pay.

This can help reduce errors and improve employee satisfaction.

There are a number of effective design elements that can be used to create a clear and user-friendly payroll information sheet. These include:

Tables

Tables are a great way to organize and present data in a clear and concise way. They can be used to show employee pay details, deductions, and benefits. Tables should be formatted with clear headings and rows, and they should be easy to read and understand.

Charts and Graphs

Charts and graphs can be used to visualize data and make it easier to understand. For example, a pie chart can be used to show the breakdown of an employee’s deductions, or a bar chart can be used to show the employee’s year-to-date earnings.

Additional Considerations

When creating an employee payroll information sheet, several additional factors should be taken into account to ensure its effectiveness and suitability for the specific organization and employees.

The size of the organization, the industry in which it operates, and the specific needs of the employees are all important considerations that can impact the design and content of the payroll information sheet.

Size of the Organization

The size of the organization can influence the complexity and level of detail required on the payroll information sheet. Smaller organizations may have simpler payroll processes and require less detailed information on the sheet, while larger organizations with more complex payroll structures may need to provide more comprehensive information.

Industry

The industry in which the organization operates can also affect the content of the payroll information sheet. Different industries have different payroll regulations and requirements, and the payroll information sheet should be tailored to meet the specific needs of the industry.

Specific Needs of the Employees

The specific needs of the employees should also be considered when creating the payroll information sheet. For example, employees who are not familiar with payroll terminology may need more detailed explanations, while employees who are more familiar with payroll may prefer a more concise format.

Final Review

In summary, an employee payroll information sheet should be a comprehensive and user-friendly document that accurately reflects an employee’s financial standing. By incorporating the essential elements Artikeld in this guide, you can create a valuable tool that streamlines payroll processes, ensures compliance, and fosters trust between employers and employees.

FAQ Insights

What are the key elements that an employee payroll information sheet should include?

An employee payroll information sheet should include basic employee information, payroll details, tax information, deductions, benefits, year-to-date information, compliance details, security measures, and a clear and user-friendly design.

Why is it important to include year-to-date information on a payroll information sheet?

Year-to-date information allows employees to track their earnings and deductions over time, helping them plan for taxes and other financial obligations.

What are some common types of deductions that may be included on a payroll information sheet?

Common types of deductions include health insurance premiums, retirement contributions, union dues, and child support payments.