Algorithm to calculate gross salary of an employee – Embark on a journey into the intricacies of employee compensation with our comprehensive guide to the algorithm for calculating gross salary. This multifaceted formula unveils the secrets behind determining an employee’s total earnings before deductions, providing a solid foundation for understanding salary structures and payroll processes.

As we delve into the nuances of gross salary calculation, we’ll explore its essential components, uncover the factors that shape its magnitude, and unravel the complexities of statutory and non-statutory deductions. Our aim is to equip you with a thorough understanding of this fundamental aspect of employee compensation, empowering you to navigate the complexities of payroll management with confidence.

Definition of Gross Salary

Gross salary refers to the total amount of money an employee earns before any deductions or taxes are taken out. It represents the employee’s total earnings for the work performed during a specific period, typically a month or a year.

Gross salary includes all forms of compensation received by the employee, such as:

- Base salary: The fixed amount of money an employee receives for their regular work.

- Overtime pay: Additional compensation earned for working hours beyond the standard workweek.

- Bonuses: Performance-based or merit-based payments.

- Commissions: Payments based on sales or other performance targets.

- Allowances: Reimbursements or stipends for specific expenses, such as travel or housing.

- Benefits: Non-cash compensation, such as health insurance, paid time off, and retirement contributions.

Components of Gross Salary

Gross salary is the total amount of money an employee earns before any deductions are made. It is composed of several components, each of which plays a specific role in determining the employee’s overall compensation.

Calculating an employee’s gross salary is a crucial task for any organization. It involves considering various factors like base pay, bonuses, and allowances. Understanding the relationship between an employee and a supervisor is also essential, as it can impact salary negotiations and performance evaluations.

By utilizing the right algorithm, employers can accurately calculate gross salaries, ensuring fairness and transparency in compensation.

The main components of gross salary include:

- Base pay:This is the fixed amount of money an employee receives for their regular work hours.

- Overtime pay:This is the additional pay an employee receives for working hours beyond their regular schedule.

- Bonuses:These are payments made to employees as a reward for good performance or achieving specific goals.

- Commissions:These are payments made to employees based on the amount of sales they generate.

Each of these components contributes to the employee’s gross salary. Base pay is the most significant component, as it is the guaranteed amount of money the employee will receive each pay period. Overtime pay, bonuses, and commissions are additional payments that can increase the employee’s gross salary.

Formula for Calculating Gross Salary

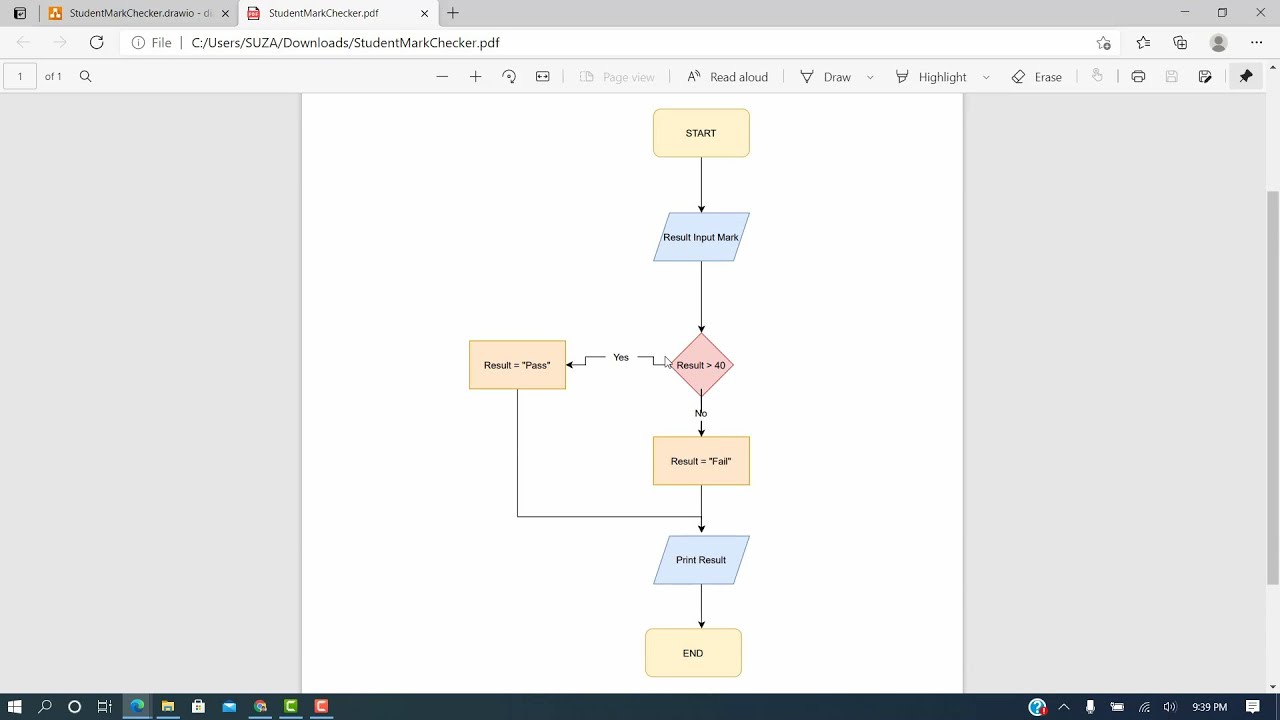

Calculating gross salary involves understanding the components that make up an employee’s total earnings before taxes and other deductions. The formula for calculating gross salary is:

Gross Salary = Basic Salary + Allowances + Commissions + Bonuses + Overtime Pay

To apply this formula, follow these steps:

Basic Salary

This is the fixed amount an employee receives for their regular work, regardless of overtime or additional hours worked.

Allowances

Allowances are additional payments made to employees to cover specific expenses, such as housing, transportation, or meal allowances.

Commissions

Commissions are payments made to employees based on their sales or performance targets.

Hey, that’s a great idea! I’ve been working on an algorithm to calculate gross salary for employees, and I think it would be a great way to implement your suggestion. You can check out a response to an employee’s idea: for more details.

This algorithm takes into account factors like base pay, overtime, bonuses, and deductions, and it provides a clear and accurate calculation of an employee’s gross salary.

Bonuses

Bonuses are one-time payments made to employees for exceptional performance or achieving specific goals.

Overtime Pay, Algorithm to calculate gross salary of an employee

Overtime pay is the additional compensation paid to employees for working hours beyond their regular schedule.

Calculating gross salary involves complex algorithms that factor in various deductions. If these calculations raise concerns, you may need to issue a warning letter to an employee . However, ensuring accurate gross salary calculations remains crucial for maintaining employee satisfaction and compliance with labor laws.

Factors Affecting Gross Salary: Algorithm To Calculate Gross Salary Of An Employee

An employee’s gross salary is influenced by a range of factors, including their job title, experience, industry, and location. These factors can significantly impact the calculation of their gross salary.

One of the primary factors that affect gross salary is the employee’s job title. Different job titles carry different levels of responsibility and require varying skill sets, which can lead to variations in salary. For example, a software engineer with a senior-level job title will typically earn a higher gross salary than a junior-level software engineer.

Experience is another important factor that influences gross salary. Employees with more years of experience in their field tend to earn higher salaries than those with less experience. This is because experienced employees have a deeper understanding of their industry and are more likely to possess valuable skills and knowledge.

The industry in which an employee works can also affect their gross salary. Certain industries, such as finance and technology, are known for paying higher salaries than others, such as retail and hospitality. This is due to the high demand for skilled professionals in these industries.

Calculating an employee’s gross salary involves algorithms that consider factors like base pay, bonuses, and deductions. However, a feedback technique in which an employee receives constructive criticism can also impact salary. Such feedback can lead to improved performance, which in turn may result in salary adjustments or promotions.

Ultimately, the algorithm for calculating gross salary considers not only objective factors but also subjective evaluations that influence an employee’s earning potential.

Finally, the location of an employee’s workplace can also impact their gross salary. The cost of living in different areas can vary significantly, and this can affect the salaries that employers offer. For example, employees working in large metropolitan areas, such as New York City or San Francisco, will typically earn higher salaries than those working in smaller cities or rural areas.

Methods of Payment

The payment of an employee’s gross salary can be done through various methods, each with its own advantages and disadvantages. These methods include direct deposit, checks, and payroll cards.

Direct deposit involves the electronic transfer of the employee’s salary into their bank account. It is a convenient and secure method that ensures the employee receives their salary on time, regardless of their location.

Checks

Checks are a traditional method of payment that involves the employer issuing a paper check to the employee. The employee can then deposit the check into their bank account or cash it at a financial institution. Checks offer flexibility, as the employee can choose when and where to cash them.

Payroll Cards

Payroll cards are prepaid debit cards that are loaded with the employee’s gross salary. Employees can use these cards to make purchases, withdraw cash, or pay bills. Payroll cards offer convenience and flexibility, but they may come with fees associated with their use.

Statutory Deductions

Statutory deductions are those mandated by law to be withheld from an employee’s gross salary. These deductions contribute to various government programs and social security benefits.

The most common statutory deductions include:

Income Tax

- Calculated based on the employee’s taxable income, which is their gross salary minus certain eligible deductions and exemptions.

- Progressive tax system, meaning higher earners pay a higher percentage of their income in taxes.

Social Security

- Contributes to the Old-Age, Survivors, and Disability Insurance (OASDI) program, providing retirement, survivor, and disability benefits.

- Calculated as a percentage of the employee’s gross salary, up to a maximum taxable amount.

Medicare

- Contributes to the Medicare program, providing health insurance for seniors and individuals with disabilities.

- Calculated as a percentage of the employee’s gross salary, without any maximum taxable amount.

Statutory deductions reduce an employee’s take-home pay but ensure they contribute to essential government programs that provide financial security and social benefits.

Non-Statutory Deductions

In addition to statutory deductions, employees may also have non-statutory deductions taken from their gross salary. These deductions are not required by law but are typically offered by employers as voluntary benefits or as a way for employees to save for the future.

Common non-statutory deductions include:

- Health insurance premiums

- Retirement contributions

- Union dues

The amount of each deduction is typically calculated as a percentage of the employee’s gross salary or as a fixed amount. For example, an employee may have a health insurance premium of $100 per month deducted from their paycheck. Or, an employee may contribute 5% of their gross salary to a retirement plan.

Non-statutory deductions can reduce an employee’s take-home pay, but they can also provide valuable benefits. For example, health insurance can help to protect employees and their families from the high cost of medical care. Retirement contributions can help employees to save for the future and achieve their financial goals.

Calculating an employee’s gross salary is a crucial step in payroll processing, but it’s not the only important factor to consider. A clear statement defining how an organization handles employee sick days is equally essential for maintaining a healthy and productive work environment.

By combining accurate salary calculations with well-defined sick day policies, organizations can ensure both employee satisfaction and financial accuracy.

Net Salary

Net salary refers to the amount of money an employee receives after all deductions and taxes have been taken out of their gross salary. It is the amount that is actually paid to the employee and is used to cover their living expenses.The

formula for calculating net salary is:Net Salary = Gross Salary

- Deductions

- Taxes

Payroll Systems

Payroll systems are used by organizations to manage employee salaries. They can be manual, automated, or cloud-based.

Manual payroll systems are the most basic type of payroll system. They involve manually calculating employee salaries and deductions. This can be a time-consuming and error-prone process.

Automated payroll systems use software to calculate employee salaries and deductions. This can save time and reduce errors.

Calculating gross salary with an algorithm is essential for payroll accuracy. However, it’s equally crucial to foster a respectful workplace by taking a dealing with microaggression as an employee course . This will create a positive environment where employees feel valued and supported.

By addressing both gross salary calculations and microaggressions, organizations can ensure a comprehensive approach to employee well-being.

Cloud-based payroll systems are hosted on the internet. This allows employees to access their payroll information from anywhere with an internet connection.

Advantages and Disadvantages of Different Payroll Systems

- Manual payroll systemsare relatively inexpensive to implement and maintain. However, they can be time-consuming and error-prone.

- Automated payroll systemscan save time and reduce errors. However, they can be more expensive to implement and maintain than manual payroll systems.

- Cloud-based payroll systemsoffer the benefits of both manual and automated payroll systems. They are relatively inexpensive to implement and maintain, and they can save time and reduce errors.

Payroll Errors

Payroll errors are mistakes that can occur during the calculation of gross salary. These errors can have a significant impact on an employee’s paycheck and can lead to financial hardship.There are many different types of payroll errors that can occur.

To calculate an employee’s gross salary, we need to consider various factors. For instance, a statement of an employee’s biweekly earnings would provide insights into their income over a specific period. This information can then be used to determine the employee’s gross salary using an appropriate algorithm.

Some of the most common include:

- Incorrectly calculating hours worked

- Using the wrong pay rate

- Failing to withhold taxes

- Making deductions that are not authorized

- Paying employees for time they did not work

The consequences of payroll errors can be significant. Employees who are underpaid may not be able to meet their financial obligations, while employees who are overpaid may have to pay back the excess funds. Payroll errors can also lead to penalties and interest charges from the IRS.There

are a number of things that employers can do to prevent payroll errors. These include:

- Using a payroll software program

- Having a system in place to verify employee hours worked

- Training payroll staff on how to calculate gross salary correctly

- Reviewing payroll records regularly for errors

By taking these steps, employers can help to ensure that their employees are paid accurately and on time.

Legal Considerations

The calculation and payment of gross salary are subject to various legal considerations that employers must adhere to. These legal requirements aim to protect the rights of employees and ensure fair compensation practices.

One of the most important legal considerations is compliance with minimum wage laws. These laws establish the minimum hourly or daily wage that employers are legally obligated to pay their employees. Failure to comply with minimum wage laws can result in legal penalties and fines.

Another crucial legal consideration is overtime regulations. Overtime pay is typically required when employees work beyond a certain number of hours per week or day. Overtime regulations vary by jurisdiction, and employers must be familiar with the specific requirements applicable to their business.

Complying with legal requirements related to gross salary calculation and payment is essential for employers. It helps them avoid legal disputes, maintain a positive reputation, and foster a fair and equitable work environment.

Minimum Wage Laws

- Establish the minimum hourly or daily wage that employers must pay their employees.

- Protect employees from being underpaid and ensure they receive fair compensation.

- Failure to comply with minimum wage laws can result in legal penalties and fines.

Overtime Regulations

- Require employers to pay overtime pay to employees who work beyond a certain number of hours per week or day.

- Overtime regulations vary by jurisdiction, and employers must be familiar with the specific requirements applicable to their business.

- Complying with overtime regulations ensures that employees are fairly compensated for their extra work.

Final Summary

In conclusion, the algorithm for calculating gross salary serves as a cornerstone in determining an employee’s total earnings. By mastering this formula and understanding its intricacies, you gain the ability to accurately assess compensation structures, ensure compliance with legal requirements, and foster a transparent and equitable payroll system.

Remember, a well-calculated gross salary is not merely a number but a reflection of an employee’s contributions and a foundation for their financial well-being.

Expert Answers

What are the key components of gross salary?

Gross salary typically encompasses base pay, overtime pay, bonuses, commissions, and allowances.

How does job title influence gross salary?

Job title often determines the base pay, which is a significant component of gross salary.

What is the difference between gross and net salary?

Gross salary represents total earnings before deductions, while net salary is the amount received after statutory and non-statutory deductions.

What are common payroll errors related to gross salary calculation?

Common errors include incorrect calculation of overtime pay, bonuses, and statutory deductions.