With a statement of an employee’s biweekly earnings is given below. at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american pop culture language filled with unexpected twists and insights.

Navigating the world of paychecks can be a bit like deciphering a secret code. But fear not, intrepid earner! This guide will break down your biweekly earnings statement into bite-sized pieces, so you can understand exactly where your hard-earned cash is going.

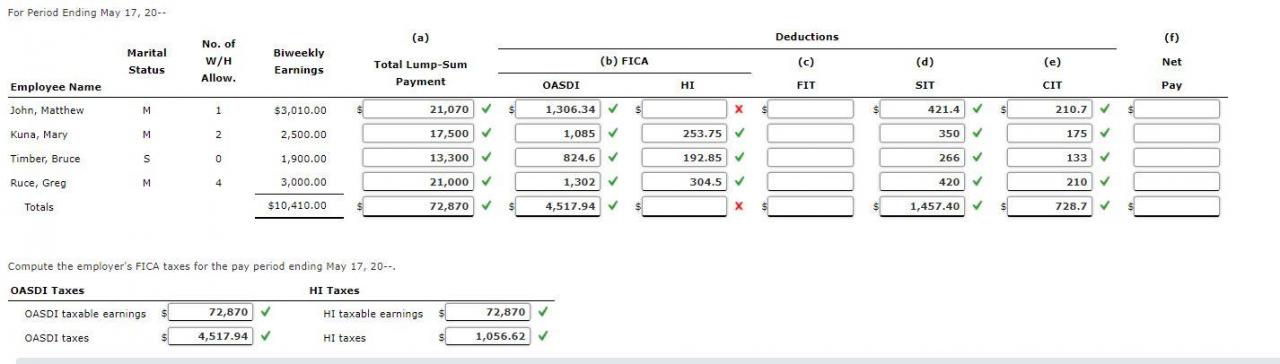

Employee Earnings Statement Overview

An employee earnings statement, often known as a pay stub or paycheck, is a document provided by employers to their employees summarizing their earnings and deductions for a specific pay period, typically two weeks (biweekly).

This statement serves as a detailed record of the employee’s financial transactions with the company, including their gross earnings, taxes withheld, and net pay. It provides employees with a clear understanding of how their compensation is calculated and distributed.

Typical Components of an Earnings Statement

A typical earnings statement includes the following components:

- Employee’s name and address

- Pay period dates

- Gross earnings: Total amount of money earned before deductions

- Federal and state income taxes withheld

- Social Security and Medicare taxes withheld

- Other deductions (e.g., health insurance premiums, retirement contributions)

- Net pay: Amount of money deposited into the employee’s bank account

Earnings Details

Earnings details provide an overview of various types of earnings an employee receives during a pay period. It includes regular wages, overtime pay, bonuses, commissions, and other forms of compensation.

These earnings are typically categorized and presented on an earnings statement to provide a clear understanding of how an employee’s total earnings are calculated.

Regular Wages, A statement of an employee’s biweekly earnings is given below.

Regular wages refer to the base pay an employee earns for the hours worked during a regular workweek. This is typically calculated based on an hourly rate or a fixed salary and forms the foundation of an employee’s earnings.

Overtime Pay

Overtime pay is earned when an employee works additional hours beyond the standard workweek. It is typically calculated at a higher rate than regular wages, incentivizing employees to work extra hours when necessary.

Bonuses

Bonuses are additional payments made to employees as a reward for achieving specific goals or milestones. They can be performance-based, project-based, or simply a way to recognize an employee’s contributions.

A statement of an employee’s biweekly earnings is given below. This statement can be used to track an employee’s progress over time. If an employee is looking to improve their performance, they can refer to the 15 tips an employee can use to improve . These tips can help employees improve their productivity, communication skills, and teamwork.

By following these tips, employees can increase their chances of success in the workplace. A statement of an employee’s biweekly earnings is given below.

Deductions and Withholdings: A Statement Of An Employee’s Biweekly Earnings Is Given Below.

Deductions and withholdings are taken out of an employee’s gross pay before they receive their net pay. These deductions and withholdings can include:

- Federal income tax: This is a tax that is paid to the federal government based on your income.

- State income tax: This is a tax that is paid to your state government based on your income.

- Local income tax: This is a tax that is paid to your local government based on your income.

- Social Security tax: This is a tax that is paid to the Social Security Administration to fund Social Security benefits.

- Medicare tax: This is a tax that is paid to the Medicare program to fund Medicare benefits.

- 401(k) contributions: This is a retirement savings plan that allows you to save money for retirement on a pre-tax basis.

- Health insurance premiums: This is the cost of your health insurance coverage.

- Dental insurance premiums: This is the cost of your dental insurance coverage.

- Vision insurance premiums: This is the cost of your vision insurance coverage.

- Life insurance premiums: This is the cost of your life insurance coverage.

- Union dues: This is the cost of your union membership.

- Child support: This is the amount of money that you are required to pay to support your child.

- Alimony: This is the amount of money that you are required to pay to your former spouse.

The amount of deductions and withholdings that are taken out of your paycheck will vary depending on your income, your tax bracket, and your personal circumstances.

Net Pay Calculation

Calculating an employee’s net pay involves subtracting deductions and withholdings from their gross earnings. Deductions are amounts withheld from an employee’s paycheck for specific purposes, such as health insurance premiums or retirement contributions. Withholdings are amounts withheld for taxes, such as federal income tax and Social Security tax.

Gross Earnings

Gross earnings refer to the total amount an employee earns before any deductions or withholdings are taken out. This includes wages, salaries, bonuses, commissions, and other forms of compensation.

The provided statement details an employee’s biweekly earnings, a crucial aspect of employee compensation. To ensure a well-rounded compensation plan, consider the 8 components of an effective employee compensation plan . These elements, ranging from base salary to benefits and bonuses, contribute to employee satisfaction and retention.

By incorporating these components, organizations can enhance their compensation strategies and align them with the needs of their employees, ultimately driving productivity and success.

Deductions

Deductions are voluntary or mandatory amounts withheld from an employee’s paycheck. Common deductions include:

- Health insurance premiums

- Dental insurance premiums

- Vision insurance premiums

- Retirement contributions (e.g., 401(k), IRA)

- Flexible spending accounts (FSAs)

- Union dues

Withholdings

Withholdings are mandatory amounts withheld from an employee’s paycheck for taxes. The primary withholdings are:

- Federal income tax

- Social Security tax

- Medicare tax

Net Pay

Net pay is the amount of money an employee receives after all deductions and withholdings have been taken out of their gross earnings. This is the amount that is deposited into the employee’s bank account or paid to them in cash.

A statement of an employee’s biweekly earnings is given below. Understanding your rights as an employee is crucial. These include the right to a safe workplace, fair compensation, and protection from discrimination. Knowing these 5 rights of an employee empowers you to navigate the workplace with confidence.

The biweekly earnings statement provides a detailed breakdown of your pay, ensuring transparency and accountability.

Net Pay = Gross Earnings

- Deductions

- Withholdings

The impact of deductions and withholdings on net pay is significant. Higher deductions and withholdings result in a lower net pay, while lower deductions and withholdings result in a higher net pay. Employees should carefully consider the impact of deductions and withholdings when making financial decisions.

The statement of an employee’s biweekly earnings is given below. The employee is a notary who is an employee of a bank. Notaries who are employees of banks typically have a variety of responsibilities, including notarizing documents, witnessing signatures, and administering oaths.

They may also provide other services, such as preparing and filing legal documents. The statement of an employee’s biweekly earnings is given below.

Pay Frequency and Schedule

In the United States, the standard pay frequency for biweekly earnings statements is every other week, resulting in 26 pay periods per year.

A statement of an employee’s biweekly earnings is given below. The employee has suggested an idea to improve the company’s productivity. A response to the employee’s idea is given below. The response is positive and the company is willing to implement the idea.

A statement of an employee’s biweekly earnings is given below.

Pay schedules can vary between employers. Some employers may pay their employees weekly, while others may pay them monthly or even semi-monthly (twice a month).

Factors Affecting Pay Schedule

- Industry norms: Different industries may have established pay schedules that are common among employers in that field.

- Company size: Larger companies may have more formalized pay schedules, while smaller companies may have more flexibility in setting their pay schedules.

- Employee preference: Some employees may prefer to be paid more frequently, while others may prefer less frequent paychecks.

Legal Compliance

Earnings statements are legally required documents that provide employees with detailed information about their earnings and deductions. These statements are essential for ensuring that employees are paid accurately and fairly, and that they understand how their pay is calculated.

The Fair Labor Standards Act (FLSA) requires employers to provide employees with earnings statements that include the following information:

- Employee’s name

- Employer’s name

- Pay period

- Gross earnings

- Deductions

- Net pay

In addition to the FLSA, many states have their own laws that govern the content and format of earnings statements. Employers must be familiar with the laws in their state to ensure that they are providing employees with accurate and timely earnings statements.

Importance of Providing Accurate and Timely Earnings Statements

Providing accurate and timely earnings statements to employees is important for several reasons. First, it helps to ensure that employees are paid accurately and fairly. Second, it helps employees to understand how their pay is calculated, which can help them to make informed decisions about their finances.

A statement of an employee’s biweekly earnings is given below. Most employers have certain expectations and look for certain qualities in an employee. These include integrity, teamwork, a positive attitude, and effective communication skills. For more on this topic, check out 10 characteristics employers look for in an employee . The statement of an employee’s biweekly earnings is further broken down into gross pay, deductions, and net pay.

Third, it can help to prevent disputes between employers and employees over pay.

Importance of Earnings Statements

Earnings statements play a crucial role in empowering employees with a clear understanding of their financial situation. They provide an itemized breakdown of earnings, deductions, and withholding, serving as a valuable tool for budgeting, tax preparation, and overall financial planning.

Budgeting

Earnings statements allow employees to track their income and expenses effectively. By examining their earnings and deductions, they can identify areas where adjustments can be made to optimize their financial well-being. This enables them to make informed decisions about saving, spending, and debt management.

Tax Preparation

Earnings statements serve as a comprehensive record of an employee’s income and withholding throughout the year. This information is essential for accurate tax preparation, ensuring that employees fulfill their tax obligations and receive appropriate refunds or minimize potential liabilities.

Financial Planning

Earnings statements provide a snapshot of an employee’s financial situation, enabling them to make informed decisions about their financial future. They can assess their earning potential, identify opportunities for advancement, and plan for major expenses such as homeownership or retirement.

Electronic Earnings Statements

Electronic earnings statements (e-statements) are digital versions of traditional paper pay stubs. They offer several advantages and disadvantages compared to paper statements.

A statement of an employee’s biweekly earnings is given below. If you have any questions regarding the statement, you can refer to a query letter to an employee to compose a letter to send to your employer. A statement of an employee’s biweekly earnings is given below.

Benefits of Electronic Earnings Statements

- Convenience:E-statements are easily accessible online, eliminating the need for physical storage or retrieval.

- Timeliness:They are typically available sooner than paper statements, providing employees with timely access to their earnings information.

- Environmental friendliness:E-statements reduce paper waste, contributing to environmental sustainability.

- Enhanced security:E-statements can employ robust security measures to protect sensitive financial data.

- Accessibility for remote employees:E-statements are easily accessible for employees working remotely or traveling.

Drawbacks of Electronic Earnings Statements

- Internet access requirement:E-statements require internet access to view and download, which may not be available to all employees.

- Potential for technical issues:E-statements can be affected by technical glitches or outages, causing accessibility problems.

- Lack of physical copies:Unlike paper statements, e-statements do not provide a physical record for employees to keep.

- Accessibility challenges for visually impaired:E-statements may not be easily accessible for visually impaired individuals without assistive technology.

Security Measures and Accessibility Considerations for Electronic Earnings Statements

E-statements should employ robust security measures to protect sensitive financial information, such as:

- Encryption:Encrypting data during transmission and storage to prevent unauthorized access.

- Password protection:Requiring employees to create strong passwords to access their e-statements.

- Multi-factor authentication:Implementing additional security measures, such as SMS or email verification, to enhance account protection.

Accessibility considerations for e-statements include:

- Accessible file formats:Providing e-statements in accessible formats, such as PDF or HTML, for individuals with disabilities.

- Alternative access methods:Offering alternative access methods, such as phone or mail, for employees without internet access.

Understanding Earnings Statements

Understanding your earnings statement is crucial for financial management. It provides a clear picture of your income, deductions, and net pay. Here are some tips to help you decode and utilize your earnings statement effectively:

Review your earnings statement regularly, paying attention to changes and any discrepancies. Keep track of your income and expenses to identify areas for improvement or potential savings.

Using Earnings Statements for Financial Management

Earnings statements are valuable tools for financial planning and budgeting. By understanding your income and expenses, you can:

- Create a realistic budget that aligns with your income and financial goals.

- Identify areas where you can reduce expenses or increase savings.

- Plan for major expenses, such as a down payment on a house or a vacation.

- Make informed decisions about investments and retirement planning.

By actively engaging with your earnings statement, you can take control of your finances and make informed decisions that support your financial well-being.

Conclusive Thoughts

So, there you have it, folks! A comprehensive guide to understanding your biweekly earnings statement. Remember, it’s not just a piece of paper; it’s a roadmap to your financial well-being. Use it wisely, and may your paychecks always be bountiful!

Q&A

What’s the difference between gross and net pay?

Gross pay is the total amount you earn before any deductions, while net pay is what you take home after deductions like taxes and insurance.

Why are there so many deductions on my paycheck?

Deductions cover a range of things, from taxes to health insurance to retirement contributions. They’re like little slices of your paycheck that go towards important stuff.

Can I change the frequency of my paychecks?

It depends on your employer’s policies. Some companies offer weekly, biweekly, or even monthly pay schedules.