An employee earns 0 per week – In the realm of employment, understanding one’s salary and its implications is crucial. This guide delves into the intricacies of an employee earning $480 per week, exploring various aspects that shape their financial well-being. From weekly salary calculations to annual salary estimations, hourly wage determinations, and salary comparisons, we’ll provide a comprehensive overview.

Furthermore, we’ll delve into salary negotiation strategies, salary budgeting principles, salary growth potential, tax implications, and the benefits and perks associated with this salary range. Whether you’re an employee seeking to maximize your earnings or an employer aiming to optimize compensation packages, this guide offers valuable insights.

Weekly Salary Calculation

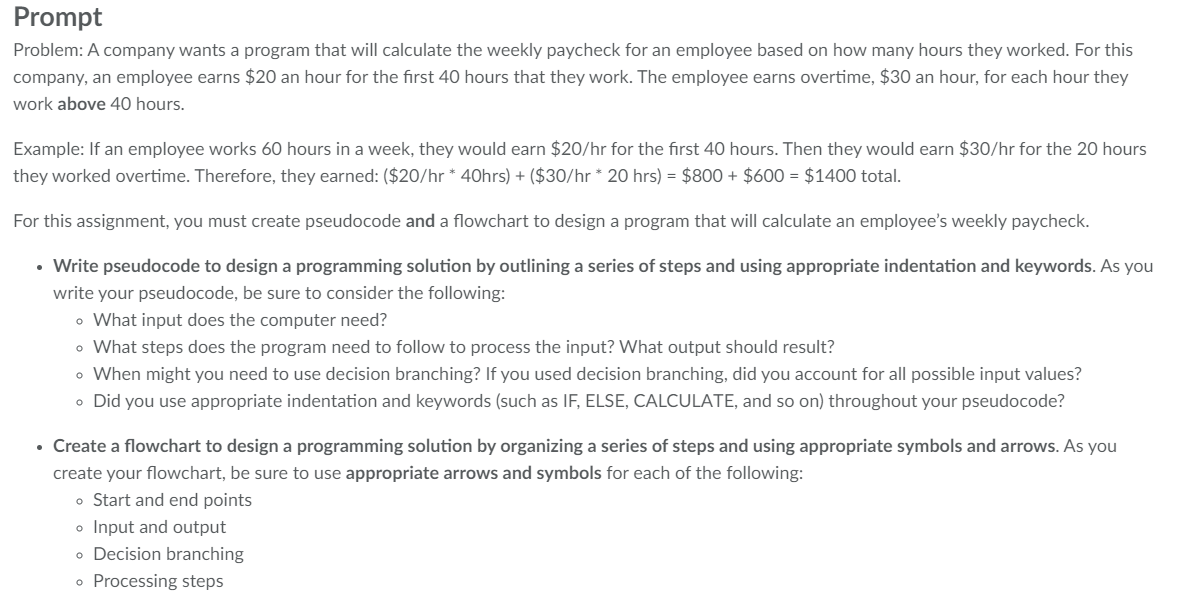

The weekly salary is calculated by multiplying the hourly rate by the number of hours worked in a week.

For example, if an employee earns $480 per week, and they work 40 hours per week, their hourly rate would be $12 ($480 / 40 = $12).

Formula

Weekly Salary = Hourly Rate × Hours Worked

Annual Salary Estimation

Estimating an employee’s annual salary from their weekly earnings is crucial for various reasons, such as financial planning, budgeting, and compensation analysis. There are several methods to approximate annual salary based on weekly earnings, each with its own advantages and considerations.

Methods for Estimating Annual Salary, An employee earns 0 per week

One common method is to multiply the weekly salary by the number of weeks in a year. This assumes that the employee works a standard 52-week schedule without any unpaid time off. For example, an employee earning $480 per week would have an estimated annual salary of $480 x 52 = $24,960.

Another method takes into account paid time off, such as vacations, sick days, and holidays. To estimate annual salary using this method, multiply the weekly salary by the number of working weeks in a year. For instance, if an employee has 10 paid days off per year, the number of working weeks would be 52 – 10 = 42. Using this method, the estimated annual salary for an employee earning $480 per week would be $480 x 42 = $20,160.

An employee earning $480 per week may wonder if they are actually a contractor. To determine this, it’s crucial to understand the distinction between the two. Visit am ia contractor or an employee for a comprehensive guide that explores the key factors that differentiate contractors from employees, helping you clarify your status and ensure proper classification.

By understanding the legal implications and benefits associated with each designation, you can make an informed decision and ensure your rights are protected as an employee earning $480 per week.

Note: These methods provide estimates and may not reflect actual annual earnings due to factors such as bonuses, overtime pay, or unpaid time off.

Hourly Wage Determination

Converting a weekly salary to an hourly wage is a simple process that involves dividing the weekly salary by the number of hours worked per week.

For an employee earning $480 per week, assuming a 40-hour workweek, the hourly wage can be calculated as follows:

Hourly Wage Calculation

Hourly Wage = Weekly Salary / Number of Hours Worked

Hourly Wage = $480 / 40 hours

If an employee earns $480 per week, this figure can be optimized to provide a more comprehensive and motivating compensation package. The 8 components of an effective employee compensation plan offer a framework for crafting a plan that aligns with business objectives, attracts and retains top talent, and ensures that employees feel valued and fairly compensated.

By considering these components, employers can enhance the employee’s $480 per week earning potential and foster a positive work environment.

Hourly Wage = $12

Let’s say you have an employee who earns $480 per week. If you were to fire this employee, you would need to consider the aftermath of firing an employee . This includes things like severance pay, unemployment benefits, and the impact on employee morale.

It’s important to weigh all of these factors before making a decision to fire an employee. Even if you have a good reason for firing an employee, it’s important to do it in a way that is fair and respectful.

You should also be prepared to deal with any legal issues that may arise.

Therefore, the hourly wage for an employee earning $480 per week, assuming a 40-hour workweek, is $12.

An employee earns $480 per week, which is a decent wage for someone working at a large global firm. Employees at large global firms often have access to a range of benefits and opportunities, making it an attractive career path for many.

Even so, $480 per week is still a substantial amount of money, and it’s important to budget wisely to make the most of it.

Salary Negotiation

Negotiating a salary can be a daunting task, but it’s important to be prepared and know your worth. By researching the average salary for similar positions in your area and industry, you can get a good idea of what you should be asking for.

It’s also important to be confident in your skills and experience, and be prepared to articulate why you deserve the salary you’re asking for.

Tips for Negotiating a Salary of $480 per Week or Higher

- Research the average salary for similar positions in your area and industry.This will give you a good starting point for negotiations.

- Be confident in your skills and experience.Highlight your accomplishments and how they have benefited your previous employers.

- Be prepared to negotiate.Don’t be afraid to ask for what you want, but be willing to compromise if necessary.

- Don’t be afraid to walk away.If the employer is not willing to meet your salary demands, you may need to walk away from the negotiation.

Salary Budgeting

Salary budgeting is the process of creating a plan for how you will spend your income. It involves tracking your income and expenses, setting financial goals, and making decisions about how to allocate your money. Financial planning is the process of managing your finances to achieve your financial goals.

It involves creating a budget, saving for the future, and investing your money.

Hey there, buddy! So, you’re raking in $480 a week, huh? That’s not too shabby. But if you’re not careful, you might be getting a visit from the boss with a warning letter to an employee . So, keep your head down, do your work, and make sure you’re earning that paycheck every week.

You got this!

Principles of Salary Budgeting

There are several principles of salary budgeting that can help you create a successful budget. These principles include:

- Track your income and expenses: The first step to creating a budget is to track your income and expenses. This will help you see where your money is going and where you can cut back.

- Set financial goals: Once you know where your money is going, you can start to set financial goals. These goals can be anything from saving for a down payment on a house to retiring early.

- Make a budget: Once you have set your financial goals, you can create a budget. A budget is a plan for how you will spend your money each month. It should include all of your income and expenses.

- Stick to your budget: The most important part of budgeting is sticking to it. This can be difficult, but it is important to remember your financial goals and to stay on track.

Sample Budget

Here is a sample budget for an employee earning $480 per week:

- Income: $480

- Expenses:

- Rent: $200

- Utilities: $50

- Groceries: $100

- Transportation: $50

- Entertainment: $20

- Savings: $60

This budget is just an example, and you may need to adjust it to fit your own needs and circumstances.

Salary Growth Potential

Salary growth is a significant factor for employees seeking career advancement and financial stability. Understanding the factors that influence salary growth and analyzing the potential for an employee earning $480 per week can provide valuable insights for both individuals and employers.

An employee who earns $480 per week can stand out from the crowd by showcasing the qualities employers value most. From reliability and teamwork to communication skills and a positive attitude, these 10 top characteristics can make all the difference.

By embodying these traits, employees not only enhance their own career prospects but also contribute to a more productive and fulfilling work environment, ultimately leading to greater success for both the employee and the organization.

Salary growth is primarily influenced by experience, skills, and performance. As employees gain experience in their field, they accumulate knowledge, expertise, and a track record of success, which can lead to higher compensation. Similarly, developing new skills and certifications can enhance an employee’s value to the organization and increase their earning potential.

Moreover, consistently exceeding performance expectations and taking on additional responsibilities can demonstrate an employee’s dedication and capabilities, resulting in salary growth.

Experience

Experience is a crucial factor in salary growth. As employees gain years of experience in their field, they accumulate valuable knowledge, expertise, and a proven track record of success. This makes them more valuable to employers and increases their earning potential.

Skills

Developing new skills and certifications can also significantly contribute to salary growth. In today’s competitive job market, employers seek individuals with a diverse range of skills that can add value to their organization. Acquiring new skills, such as technical proficiency, project management, or leadership abilities, can enhance an employee’s marketability and increase their earning potential.

An employee who earns $480 per week is a valuable asset to any company. They are likely to be hard-working, dedicated, and have a strong work ethic. If you’re looking for ways to improve your performance at work, check out our article on 15 traits of an ideal employee . These traits can help you become a more valuable employee and earn a higher salary.

Even if you’re already earning $480 per week, there’s always room for improvement.

Performance

Consistently exceeding performance expectations and taking on additional responsibilities can also lead to salary growth. Employees who demonstrate a strong work ethic, dedication, and a willingness to go the extra mile are often rewarded with higher compensation. Additionally, taking on leadership roles or mentoring junior colleagues can showcase an employee’s potential and increase their value to the organization.

Potential for Salary Growth for an Employee Earning $480 per Week

An employee earning $480 per week has the potential for salary growth by focusing on developing their experience, skills, and performance. By gaining additional experience in their field, acquiring new skills, and consistently exceeding expectations, they can increase their value to the organization and negotiate for a higher salary.It

If you’re an employee who earns $480 per week, you might be wondering what your options are for improving your financial situation. One option is to write a query letter to an employee . This type of letter can be used to inquire about job openings, ask for a raise, or request other benefits.

If you’re not sure how to write a query letter, there are plenty of resources available online that can help you get started. With a little effort, you can write a query letter that will help you get the attention of potential employers and increase your chances of getting a better job.

is important to note that salary growth is not always linear and may vary depending on industry, company size, and individual circumstances. However, by understanding the factors that influence salary growth and taking proactive steps to enhance their skills and performance, employees can increase their earning potential and achieve their career goals.

Tax Implications

Earning a salary of $480 per week has tax implications that must be considered. These implications include federal, state, and local taxes, which can vary depending on factors such as location and filing status.

Federal taxes are imposed by the Internal Revenue Service (IRS) and include income tax, Social Security tax, and Medicare tax. State taxes vary depending on the state of residence and may include income tax, sales tax, and property tax. Local taxes may include city or county income tax, property tax, and sales tax.

An employee who earns $480 per week recently addressed an issue with her boss . The issue was resolved quickly and amicably, and the employee is now back to earning $480 per week.

Federal Taxes

- Income tax is calculated based on your taxable income, which is your total income minus certain deductions and exemptions.

- Social Security tax is a 6.2% tax on your wages that funds Social Security benefits.

- Medicare tax is a 1.45% tax on your wages that funds Medicare benefits.

State Taxes

- State income tax rates vary from state to state, and some states do not have an income tax.

- Sales tax is a tax on the sale of goods and services, and the rate varies from state to state.

- Property tax is a tax on real estate and is typically assessed by local governments.

Local Taxes

- City or county income tax is a tax on your wages that is imposed by some cities or counties.

- Property tax is a tax on real estate and is typically assessed by local governments.

- Sales tax is a tax on the sale of goods and services, and the rate varies from city to city.

Benefits and Perks

Benefits and perks associated with a salary of $480 per week vary depending on the employer and industry. However, some common benefits include:

Health Insurance

- Medical, dental, and vision coverage

- Employer-sponsored health savings account (HSA)

- Flexible spending account (FSA) for healthcare expenses

Paid Time Off

- Vacation time

- Sick leave

- Personal days

Retirement Benefits

- 401(k) plan with employer matching

- Pension plan

- Profit-sharing plan

Other Benefits

- Life insurance

- Disability insurance

- Employee discounts

- Tuition reimbursement

- Professional development opportunities

When comparing benefits and perks, it’s important to consider the overall value of the package. Some employers may offer a higher base salary but fewer benefits, while others may offer a lower base salary but more comprehensive benefits. It’s important to weigh the value of each benefit to determine the best overall compensation package for your needs.

Career Advancement: An Employee Earns 0 Per Week

Career advancement plays a pivotal role in enhancing salary potential. Employees who actively pursue career growth opportunities are more likely to secure higher-paying positions with greater responsibilities.

Strategies for Career Advancement

For an employee earning $480 per week, strategies for career advancement include:

- Education and Training:Pursuing additional education or certifications can enhance skills and knowledge, making an employee more competitive in the job market.

- Networking:Building relationships with colleagues, industry professionals, and potential employers can provide opportunities for career growth.

- Mentorship:Seeking guidance from experienced professionals can provide valuable insights and support for career development.

- Internal Mobility:Exploring opportunities within the current organization for promotions or lateral moves can lead to career advancement.

- External Opportunities:Researching job openings in the industry and applying for positions that align with career goals can provide a path to higher-paying roles.

Wrap-Up

In conclusion, understanding the various aspects of an employee earning $480 per week empowers individuals to make informed decisions about their financial future. By leveraging the knowledge presented in this guide, employees can effectively negotiate salaries, manage their finances, and plan for career advancement.

Employers, too, can gain valuable insights into compensation structures and employee benefits, enabling them to create competitive and motivating work environments.

FAQ Explained

What factors influence an employee’s weekly salary?

Factors such as job title, experience, skills, industry, location, and company size can all impact an employee’s weekly salary.

How can an employee estimate their annual salary based on their weekly earnings?

To estimate annual salary, multiply the weekly salary by the number of weeks in a year, typically 52.

What strategies can an employee use to negotiate a higher salary?

Research industry benchmarks, prepare a compelling case for your worth, be confident in your value, and be willing to negotiate.

What are some common benefits and perks associated with a salary of $480 per week?

Benefits and perks may include health insurance, paid time off, retirement plans, and employee discounts.

How can an employee maximize their salary growth potential?

To maximize salary growth, employees should focus on developing their skills, seeking additional responsibilities, and pursuing career advancement opportunities.