An insurance company is a financial intermediary quizlet that plays a crucial role in managing risk and providing financial protection to individuals and businesses. In this quizlet, we’ll delve into the ins and outs of insurance companies, exploring their functions, regulation, and impact on the economy.

Insurance companies are businesses that provide financial protection against various risks, such as property damage, accidents, and health issues. They collect premiums from policyholders and invest those funds to generate returns that help them pay out claims when needed. By assuming risks, insurance companies allow individuals and businesses to transfer the financial burden of potential losses, ensuring their financial stability and peace of mind.

An insurance company, as a financial intermediary quizlet, plays a vital role in risk management. Similarly, an european company operating in various markets also faces unique risks. Understanding these risks and implementing appropriate strategies is crucial for both insurance companies and european companies to ensure financial stability and growth.

Definition of an Insurance Company

An insurance company is a financial institution that provides financial protection against risks to individuals and businesses. Insurance companies collect premiums from policyholders in exchange for assuming the risk of potential losses or damages.

An insurance company is a financial intermediary quizlet that connects policyholders with insurance providers. They play a crucial role in managing risk and providing financial security. Interestingly, the concept of financial intermediaries extends beyond insurance to various industries, such as the art world.

For instance, an independent artist company acts as a financial intermediary by connecting independent artists with galleries, collectors, and art enthusiasts, facilitating the exchange of creative works and financial support. Just as insurance companies bridge the gap between individuals and insurance providers, independent artist companies bridge the gap between artists and the art market, enabling the creation and appreciation of diverse artistic expressions.

There are various types of insurance companies, including life insurance companies, health insurance companies, property and casualty insurance companies, and specialty insurance companies.

An insurance company, acting as a financial intermediary, plays a crucial role in the financial market. Similarly, an FMCG company operates as an intermediary in the consumer goods industry, connecting manufacturers and consumers. Just as an insurance company manages risk and provides financial security, an FMCG company ensures the efficient distribution and marketing of everyday consumer products, making them accessible to the masses.

Insurance companies play a crucial role in the financial system by providing financial security and stability. They allow individuals and businesses to transfer the risk of potential losses to insurance companies, ensuring their financial well-being.

Functions of an Insurance Company

The primary functions of an insurance company include:

- Assessing and managing risk

- Providing financial protection against risks

- Offering various insurance products to meet different needs

Insurance companies assess and manage risk by evaluating the likelihood and potential severity of potential losses. They use actuarial science and data analysis to determine the appropriate premiums to charge policyholders.

An insurance company is a financial intermediary quizlet that helps individuals and businesses manage their risks. An Ingram Micro company is a global provider of technology products and services. They help businesses of all sizes find the right technology solutions for their needs.

An insurance company is a financial intermediary quizlet that helps individuals and businesses manage their risks.

Insurance companies offer a wide range of insurance products, including life insurance, health insurance, property insurance, casualty insurance, and specialty insurance.

An insurance company is a financial intermediary quizlet that helps individuals and businesses manage their risks. An hp company , on the other hand, is a technology company that manufactures and sells a wide range of products, including computers, printers, and software.

While these two companies operate in different industries, they both play an important role in the financial system.

Regulation of Insurance Companies: An Insurance Company Is A Financial Intermediary Quizlet

Insurance companies are subject to regulation to ensure their financial stability and protect policyholders’ interests.

An insurance company acts as a financial intermediary, facilitating transactions between policyholders and insurance providers. Understanding this concept is crucial in the insurance industry. Moreover, it’s essential to consider the security measures implemented for employees working remotely. An employee working from home accesses the company network , requiring secure protocols to protect sensitive data.

The financial intermediary role of insurance companies remains a fundamental aspect of the industry, providing a vital service in risk management.

Various regulatory bodies oversee insurance companies, such as state insurance departments and the National Association of Insurance Commissioners (NAIC).

An insurance company is a financial intermediary that acts as a middleman between an individual or business and an insurance carrier. In this role, the insurance company helps to assess the risk of a particular situation and then finds an insurance carrier that is willing to take on that risk.

This process can be complex, and insurance companies often use specialized software to help them make decisions. For example, an electronics company wants to use specialized software to assess the risk of a new product before it is released to the market.

By using this software, the company can identify potential risks and take steps to mitigate them before the product is released. This can help to reduce the likelihood of the company facing a financial loss due to a product defect.

Key regulations that apply to insurance companies include:

- Solvency requirements

- Reserve requirements

- Investment regulations

- Anti-fraud measures

Financial Intermediation Role of Insurance Companies

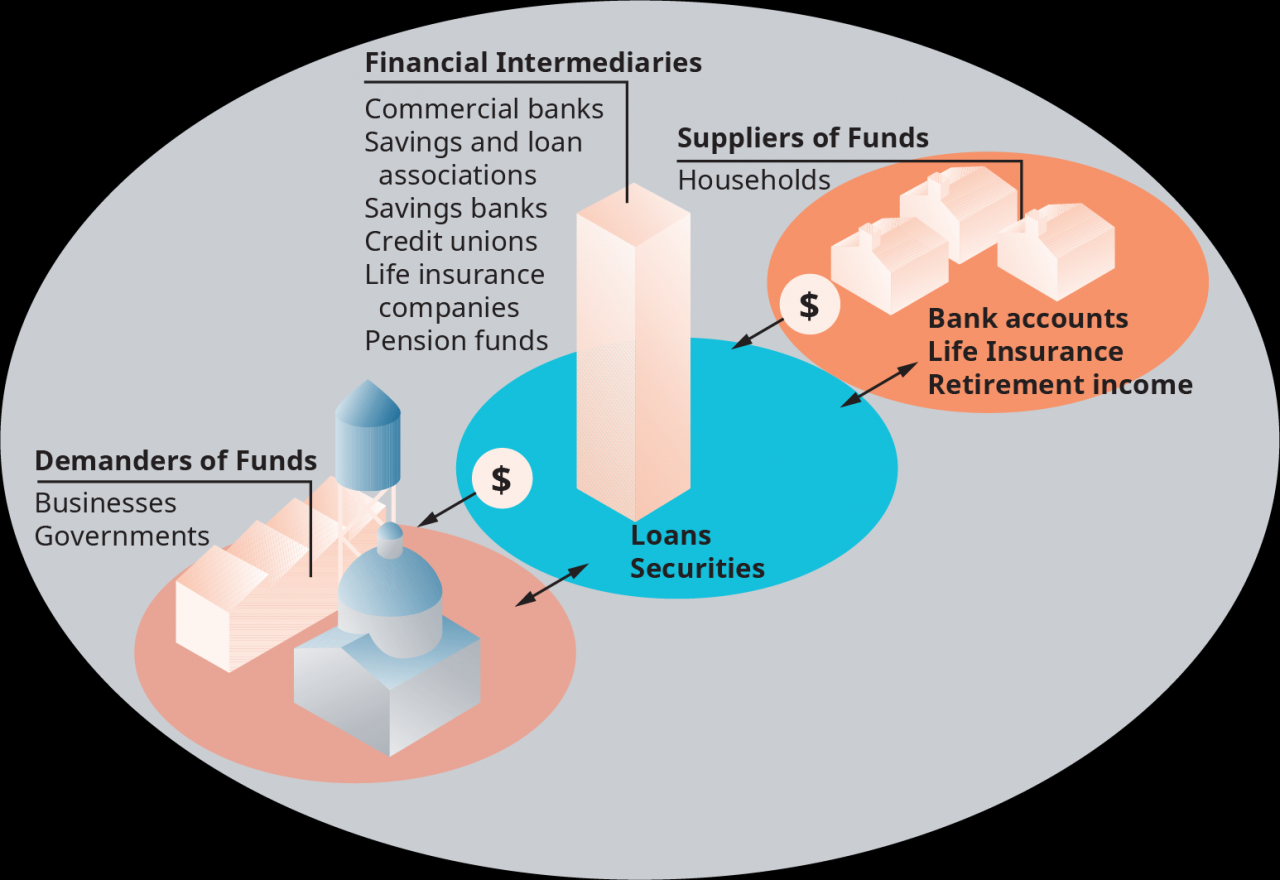

Insurance companies act as financial intermediaries by collecting premiums from policyholders and investing them to generate returns.

Insurance companies use different investment strategies, such as investing in bonds, stocks, and real estate, to maximize returns while managing risk.

The investment income earned by insurance companies helps them cover claims and expenses, and provides a source of profit.

Insurance companies act as financial intermediaries, facilitating the transfer of risk between individuals and businesses. Similarly, in the realm of electronics, companies specialize in manufacturing communication devices, connecting people and businesses across vast distances. These devices, such as smartphones and networking equipment, enable seamless communication , fostering collaboration and bridging geographical gaps.

Returning to the concept of financial intermediaries, insurance companies play a crucial role in managing risk and providing financial security, ensuring the smooth functioning of markets and economies.

Impact of Insurance Companies on the Economy

Insurance companies have a positive impact on the economy by:

- Providing financial security and stability

- Promoting economic growth and stability

- Encouraging investment and innovation

Insurance companies also have the potential to have negative impacts on the economy, such as:

- Increasing costs for businesses and consumers

- Reducing competition in certain markets

- Contributing to systemic risk in the financial system

Last Recap

In conclusion, insurance companies are vital financial intermediaries that provide essential risk management and financial protection services. Their role in the economy is multifaceted, contributing to economic growth, stability, and the overall well-being of individuals and businesses. Understanding the functions and regulations governing insurance companies is crucial for informed decision-making and navigating the complex world of insurance.

Commonly Asked Questions

What is the primary function of an insurance company?

To provide financial protection against various risks by collecting premiums and investing them to pay out claims when needed.

Why are insurance companies regulated?

To ensure their financial stability, protect policyholders’ interests, and maintain public trust in the insurance industry.

How do insurance companies contribute to economic growth?

By providing financial security, encouraging investment, and facilitating business expansion.