An investment company that issues a fixed number of shares – Dive into the world of investment companies that issue a fixed number of shares. This comprehensive guide unravels their key features, structure, investment strategies, and performance metrics, empowering you with the knowledge to make informed investment decisions.

An investment company that issues a fixed number of shares can be a great way to invest your money. However, it’s important to do your research before investing in any company. One company that has been in the news recently is an error occured lethal company mods . This company has been accused of misleading investors and engaging in illegal activities.

As a result, its stock price has plummeted. If you’re considering investing in an investment company, it’s important to do your research and make sure that the company is reputable.

These companies offer unique advantages and considerations, and we’ll explore them all, providing you with a clear understanding of how they operate and how to evaluate their performance.

An investment company that issues a fixed number of shares is a great way to invest your money. These companies are typically very stable and have a long history of success. An insurance company estimates that 40 of Americans are underinsured.

This means that they do not have enough insurance to cover their financial needs in the event of an accident or illness. An investment company that issues a fixed number of shares can help you to protect your financial future.

Characteristics of an Investment Company

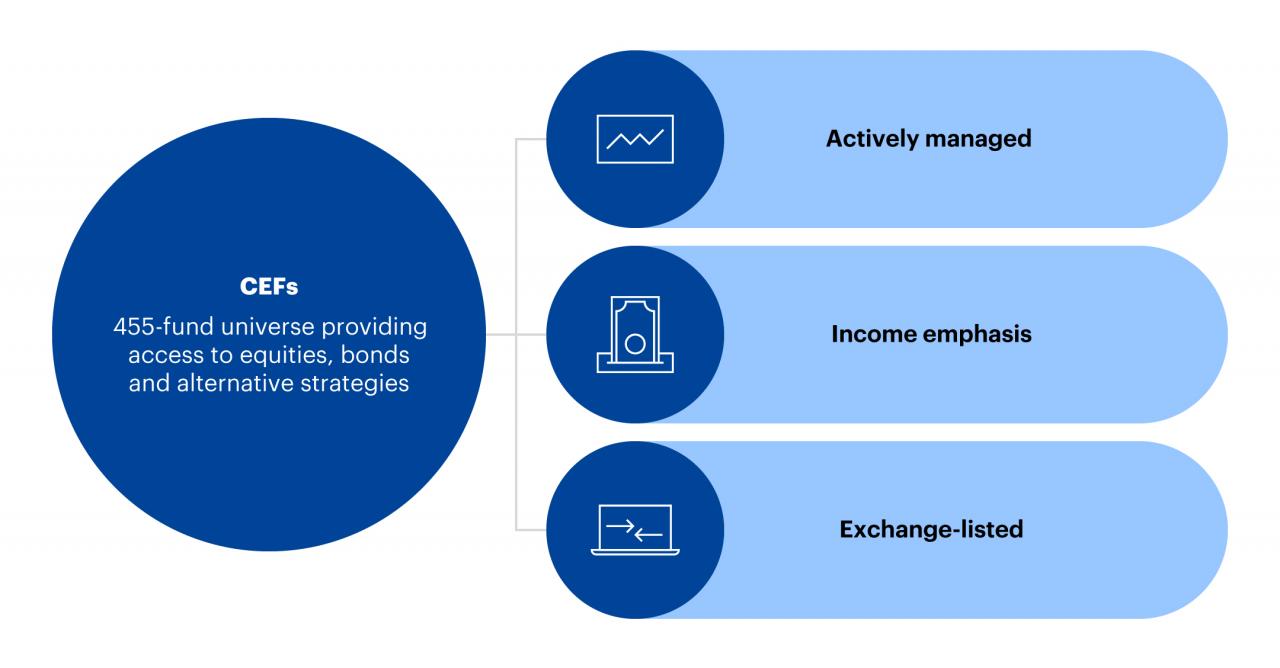

An investment company that issues a fixed number of shares is a type of investment fund that pools money from investors and invests it in a diversified portfolio of securities. These companies offer investors the opportunity to gain exposure to a wide range of investments without having to manage their own portfolios.

An investment company that issues a fixed number of shares can be a great way to invest your money. These companies typically offer a variety of investment options, including stocks, bonds, and mutual funds. They also offer a number of benefits, such as professional management, diversification, and liquidity.

An insurance company offers its policyholders a number of benefits, including financial protection, peace of mind, and tax advantages. Investment companies can also be a good way to save for retirement. They offer a variety of retirement plans, including 401(k)s and IRAs.

Key features of these companies include:

- Fixed number of shares: These companies issue a set number of shares that cannot be increased or decreased without shareholder approval.

- Diversified portfolio: The company’s portfolio is typically invested in a wide range of asset classes, including stocks, bonds, and real estate.

- Professional management: The company is managed by a team of experienced investment professionals who make investment decisions on behalf of shareholders.

- Liquidity: Shares of these companies are typically traded on a stock exchange, providing investors with liquidity and the ability to buy or sell their shares at any time.

Examples of investment companies that fall into this category include closed-end funds, unit investment trusts, and exchange-traded funds (ETFs).

Investment companies that issue a fixed number of shares are often seen as a good way to invest in a specific sector or industry. For example, an ingram micro company is a company that specializes in the distribution of technology products and services.

By investing in an investment company that issues a fixed number of shares in an ingram micro company, investors can gain exposure to the technology sector without having to invest directly in individual companies.

Advantages of investing in these companies include:

- Diversification: These companies offer investors the opportunity to diversify their portfolios across a wide range of investments.

- Professional management: Investors benefit from the expertise of experienced investment professionals who manage the company’s portfolio.

- Liquidity: Shares of these companies are typically traded on a stock exchange, providing investors with liquidity.

Disadvantages of investing in these companies include:

- Fees: These companies charge management fees and other expenses that can reduce returns.

- Limited upside potential: The fixed number of shares limits the potential for capital appreciation.

- Tax implications: Dividends and capital gains distributions from these companies are taxable.

Structure and Operations: An Investment Company That Issues A Fixed Number Of Shares

The typical structure of an investment company that issues a fixed number of shares is as follows:

- Board of directors: The board of directors is responsible for overseeing the company’s operations and making major investment decisions.

- Management team: The management team is responsible for the day-to-day operations of the company, including investment management and shareholder relations.

- Shareholders: Shareholders are the owners of the company and are entitled to vote on major decisions and receive dividends.

The investment process and strategies of these companies vary depending on the company’s objectives and investment mandate. Some companies may focus on investing in a particular asset class, such as stocks or bonds, while others may invest in a more diversified portfolio.

An investment company that issues a fixed number of shares, such as a closed-end fund, can provide investors with a consistent stream of income. In contrast, an ice cream company manufactures and distributes its products to generate revenue, which can vary depending on factors such as weather and consumer preferences.

However, an investment company that issues a fixed number of shares can offer investors a more stable return on their investment.

The company’s investment decisions are typically made by a team of investment professionals who have expertise in the relevant asset classes.

When an investment company issues a fixed number of shares, it creates a closed-end fund. Like an insurance company checking police records on 582 , this type of fund offers investors a fixed number of shares that can be bought and sold on the stock exchange.

This structure provides investors with a stable investment that is not subject to the fluctuations of the stock market.

Investment Portfolio

The typical investment portfolio of an investment company that issues a fixed number of shares is diversified across a wide range of asset classes, including stocks, bonds, and real estate. The company’s investment decisions are typically based on a number of factors, including the company’s investment objectives, the current market conditions, and the risk tolerance of the company’s shareholders.

An investment company that issues a fixed number of shares is a closed-end fund. An escrow company may be licensed by the: Department of Corporations or the Department of Real Estate. Closed-end funds are not as common as open-end funds, which can issue an unlimited number of shares.

Examples of specific investments that these companies may make include:

- Stocks: These companies may invest in a variety of stocks, including large-cap, mid-cap, and small-cap stocks.

- Bonds: These companies may invest in a variety of bonds, including government bonds, corporate bonds, and high-yield bonds.

- Real estate: These companies may invest in a variety of real estate investments, including office buildings, shopping centers, and residential properties.

Share Structure

An investment company that issues a fixed number of shares typically has a single class of shares that are traded on a stock exchange. These shares are typically priced at a premium to the net asset value (NAV) of the company’s portfolio.

An investment company that issues a fixed number of shares is a closed-end fund. This type of fund is different from an open-end fund, which can issue new shares as needed. Closed-end funds are often traded on exchanges, and their share prices can fluctuate based on supply and demand.

An indra company is a type of closed-end fund that invests in a portfolio of companies. These companies are typically in the technology sector, and the fund’s goal is to provide investors with long-term capital appreciation.

The NAV is the value of the company’s assets minus its liabilities.

Shareholders of these companies have the following rights and responsibilities:

- Right to vote on major decisions: Shareholders have the right to vote on major decisions, such as the election of directors and the approval of changes to the company’s investment strategy.

- Right to receive dividends: Shareholders are entitled to receive dividends from the company’s earnings.

- Right to sell their shares: Shareholders have the right to sell their shares on a stock exchange at any time.

Performance Measurement

The key performance metrics used to evaluate an investment company that issues a fixed number of shares include:

- Total return: The total return of a company is the percentage change in the value of its shares over a period of time, including both capital appreciation and dividends.

- NAV return: The NAV return of a company is the percentage change in the value of its net asset value over a period of time.

- Expense ratio: The expense ratio of a company is the percentage of its assets that are used to pay for operating expenses.

Factors that can influence the performance of these companies include:

- Market conditions: The performance of these companies is influenced by the overall market conditions, including interest rates, inflation, and economic growth.

- Investment strategy: The performance of these companies is also influenced by their investment strategy, including the asset classes they invest in and the risk tolerance of their shareholders.

- Management team: The performance of these companies is also influenced by the management team, including their investment experience and expertise.

Summary

Whether you’re a seasoned investor or just starting out, understanding investment companies that issue a fixed number of shares is crucial for navigating the financial markets. This guide has provided you with a solid foundation, equipping you with the knowledge to make informed decisions and potentially grow your wealth.

Answers to Common Questions

What are the advantages of investing in an investment company that issues a fixed number of shares?

Diversification, professional management, and potential for capital appreciation.

What are the disadvantages of investing in an investment company that issues a fixed number of shares?

Management fees, limited liquidity, and potential for underperformance.

How do I evaluate the performance of an investment company that issues a fixed number of shares?

Consider factors such as total return, risk-adjusted returns, and consistency of performance.