As an incentive to pay obligations early – In today’s fast-paced business world, every dollar counts. That’s why offering early payment incentives is a smart move for businesses looking to improve their cash flow and build stronger customer relationships.

The early bird gets the worm, and as an incentive to pay your obligations early, you might just get a nice little bonus. One way to do this is to set up an order to a bank to pay cash on a specific date.

This way, you can lock in a lower interest rate and save some money in the long run. So, if you’re looking for a way to get ahead financially, paying your bills early is a great place to start.

From discounts to free products, there are a variety of ways to incentivize customers to pay their bills early. In this article, we’ll explore the different types of early payment incentives, how to determine the right one for your business, and how to communicate it effectively to your customers.

As an incentive to pay obligations early, many companies are now offering discounts and rewards. For example, some credit card companies offer cash back or points for paying your bill on time. Additionally, apple pay samsung pay are an application of near field communication (NFC) technology that lets you make payments with your smartphone.

This can be a convenient way to pay your bills on time and earn rewards.

Introduction

Paying your obligations early can be a great way to save money and improve your credit score. Many businesses offer early payment incentives to encourage customers to pay their bills on time. These incentives can take many different forms, and the best one for you will depend on your individual circumstances.

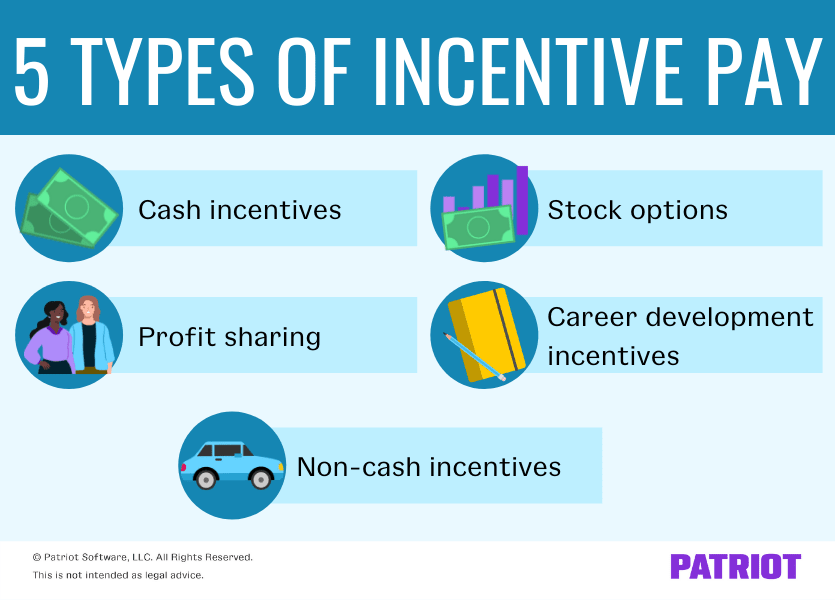

Types of Early Payment Incentives

The most common type of early payment incentive is a discount. This is a percentage off the total amount of your bill if you pay it within a certain time frame. For example, a business might offer a 2% discount if you pay your bill within 10 days of the invoice date.

Another type of early payment incentive is a rebate. This is a fixed amount of money that you will receive back if you pay your bill early. For example, a business might offer a $10 rebate if you pay your bill within 30 days of the invoice date.

With the ease and convenience of modern payment methods like apple pay 22 dollars an hour , paying obligations early is now more rewarding than ever. The ability to seamlessly settle bills and payments with a few taps on your smartphone not only eliminates the hassle of traditional methods but also provides an incentive to stay on top of your financial responsibilities.

By leveraging the benefits of digital payment platforms, you can enjoy the peace of mind that comes with timely payments and avoid potential late fees or penalties.

Finally, some businesses offer free products or services as an early payment incentive. For example, a business might offer a free gift card or a free month of service if you pay your bill early.

If you’re like most folks, you probably like to get your obligations out of the way early. There’s nothing quite like the feeling of accomplishment you get when you can check something off your to-do list. And if you’re looking for an extra incentive to pay your bills on time, consider this: an webber pay can help you save money on interest and fees.

So what are you waiting for? Get those bills paid early and reap the rewards!

Pros and Cons of Early Payment Incentives, As an incentive to pay obligations early

There are several benefits to offering early payment incentives. First, they can help you to improve your cash flow. When customers pay their bills early, you will have more money on hand to invest in your business.

Second, early payment incentives can help you to build stronger relationships with your customers. When customers feel like they are being rewarded for paying their bills early, they are more likely to continue doing business with you.

Paying your obligations early can be a great way to save money on interest and fees. If you’re looking to stop paying for an app on your Apple device, you can follow these steps: apple how to stop paying for an app . By following these steps, you can quickly and easily cancel your subscription and avoid being charged any further fees.

Paying your obligations early can be a great way to save money, so it’s worth taking the time to learn how to do it.

However, there are also some potential drawbacks to offering early payment incentives. First, they can reduce your profit margin. If you offer a large discount or rebate, you may not make as much money on each sale.

Second, early payment incentives can create a sense of urgency that can lead to customers making mistakes. For example, a customer might pay their bill early to get the discount, but then forget to include a payment for another invoice.

When you pay your obligations early, you can often get a discount or other perk. For example, if you pay your credit card bill in full before the due date, you may avoid paying interest. Similarly, if you pay your rent early, you may get a discount on your next month’s rent.

In addition, some businesses offer discounts to customers who pay with cash or check, rather than using a credit card. If you’re looking for a way to save money, paying your obligations early is a great way to do it.

apple pay geld an freunde senden This can help you avoid late fees, interest charges, and other penalties. It can also help you build a good credit history.

Summary

Offering early payment incentives is a win-win for businesses and customers alike. By providing a small incentive, businesses can encourage customers to pay their bills on time, which can lead to improved cash flow and reduced collection costs. Customers, on the other hand, appreciate the opportunity to save money or receive free products for paying early.

If you’re not already offering early payment incentives, now is the time to start. It’s a simple and effective way to improve your bottom line and build stronger customer relationships.

Question Bank: As An Incentive To Pay Obligations Early

What are the benefits of offering early payment incentives?

When it comes to paying your bills on time, a little incentive can go a long way. That’s where An Post Bill Pay comes in. This convenient service lets you set up automatic payments for your bills, so you can avoid late fees and keep your credit score in tip-top shape.

Plus, with the peace of mind that comes from knowing your bills are being taken care of, you can focus on the more important things in life, like binge-watching your favorite shows or catching up on the latest TikTok trends.

There are several benefits to offering early payment incentives, including improved cash flow, reduced collection costs, and stronger customer relationships.

What are the different types of early payment incentives?

There are a variety of early payment incentives, including discounts, rebates, and free products.

How do I determine the right early payment incentive for my business?

There are several factors to consider when determining the right early payment incentive for your business, including the size of the discount, the length of the payment period, and the target customer.

How do I communicate early payment incentives to my customers?

There are several ways to communicate early payment incentives to your customers, including email, invoices, and website.