Can a consultant be considered an employee? This intriguing question sparks a captivating exploration into the intricate relationship between employment and consulting. Dive into a world where definitions blur and classifications matter, as we unravel the complexities of this multifaceted topic.

Determining whether a consultant is considered an employee can be a complex issue. One recent case involving an automatic reply sparked debate on this topic. As per this article , an employee’s automatic reply stating they were no longer working for the company was deemed sufficient to terminate their employment.

This highlights the evolving nature of employment relationships and the need to consider such factors when assessing whether a consultant qualifies as an employee.

Throughout this discourse, we’ll delve into the legal nuances, tax implications, and practical considerations that shape the distinction between employees and consultants. Stay tuned for a thought-provoking journey that will illuminate the intricacies of this modern-day workforce conundrum.

So, we’ve been pondering whether a consultant can be labeled as an employee. It’s a tricky one. But hold up, let’s switch gears for a sec. Did you know that businesses can actually give money to their employees as a gift? Check it out . Now, back to our original question, the employee vs.

consultant debate continues…

Definition of Employee vs. Consultant: Can A Consultant Be Considered An Employee

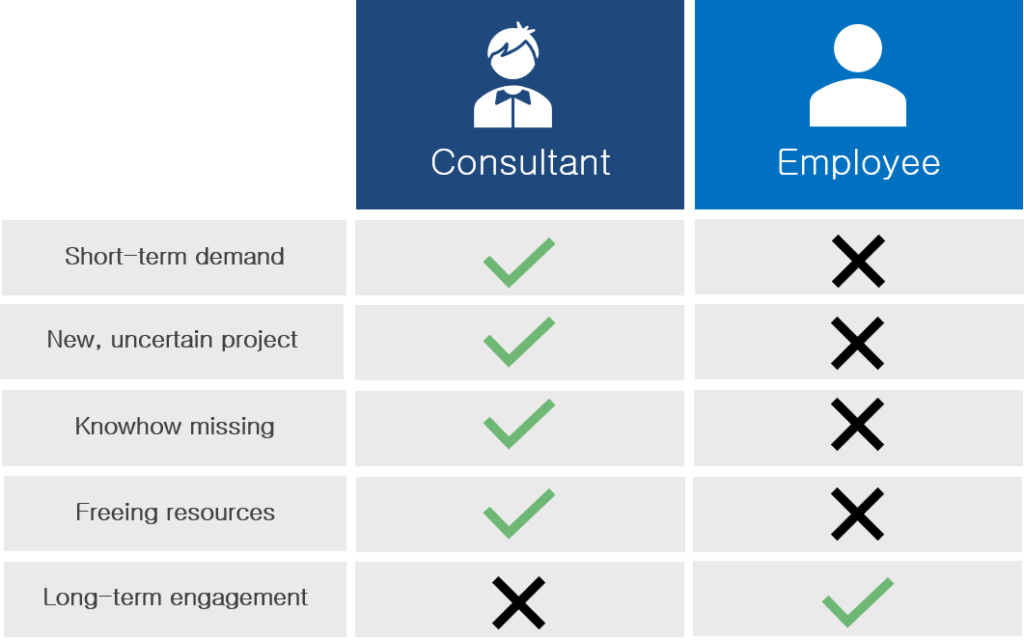

In the realm of employment, distinguishing between employees and consultants is crucial. An employee is typically defined as an individual who works for an organization under the direct supervision and control of the employer. They are subject to the employer’s policies, receive benefits such as health insurance and paid time off, and have a consistent work schedule.

Whether a consultant is an employee or not, one of the best ways to find new talent is through an employee referral program. These programs can help you find high-quality candidates who are a good fit for your company culture and have the skills and experience you need.

For more information on the benefits of an employee referral program , click here.

On the other hand, a consultant is an independent contractor who provides specialized services to a client on a project-by-project basis. They are not under the direct supervision of the client, have their own business entity, and set their own work hours.

Can a consultant be considered an employee? The answer is not always clear-cut. In some cases, a consultant may be considered an employee for purposes of taxes and benefits. However, in other cases, a consultant may be considered an independent contractor.

The distinction is important because it can affect the amount of taxes that the consultant owes, as well as the benefits that the consultant is entitled to. For example, if a consultant is considered an employee, the employer may be required to withhold taxes from the consultant’s paycheck.

The employer may also be required to provide the consultant with health insurance and other benefits. On the other hand, if a consultant is considered an independent contractor, the consultant is responsible for paying his or her own taxes and for providing his or her own benefits.

Business bad debt of an employee is another important consideration for consultants. Bad debt is a debt that is unlikely to be collected. If a consultant has a lot of bad debt, it can affect his or her profitability. As a result, it is important for consultants to carefully manage their credit and to avoid taking on too much debt.

Key Characteristics, Can a consultant be considered an employee

- Supervision and Control: Employees are subject to the direct supervision and control of their employer, while consultants have more autonomy.

- Benefits: Employees typically receive benefits such as health insurance and paid time off, while consultants are responsible for their own benefits.

- Work Schedule: Employees have a consistent work schedule set by their employer, while consultants have more flexibility in setting their own hours.

Summary

As we conclude our examination, it’s evident that the line between employee and consultant status is not always clear-cut. Organizations must navigate a complex landscape of factors to determine the appropriate classification, balancing legal compliance with business needs. By understanding the implications and nuances of each designation, businesses can make informed decisions that foster mutually beneficial relationships with their workforce.

Whether a consultant can be considered an employee is a complex question. One area of development for an employee is the ability to work independently. Area of development for an employee can include improving communication skills, developing leadership abilities, or enhancing technical expertise.

These skills are essential for any employee, but they are especially important for consultants who often work on their own and must be able to manage their time and resources effectively. The ability to work independently is also a key factor in determining whether a consultant can be considered an employee.

The future holds intriguing possibilities for the evolution of employment and consulting. As the workforce continues to transform, we may witness new paradigms and innovative approaches to worker classification. Stay curious and adaptable, as the journey to define the boundaries between employees and consultants remains an ongoing endeavor.

Questions and Answers

What are the key characteristics that differentiate an employee from a consultant?

Whether or not a consultant is considered an employee is a complex issue. One factor to consider is whether the consultant has a contract of employment. Benefits of having a contract of employment include regular pay, paid time off, and health insurance.

If a consultant does not have a contract of employment, they may not be considered an employee and may not be entitled to these benefits.

Employees typically have a defined work schedule, receive benefits, and are subject to the direct supervision and control of their employer. Consultants, on the other hand, are often self-employed, work on a project basis, and have more autonomy in their work.

What are the tax implications of classifying a worker as an employee vs. a consultant?

Classifying a worker as an employee generally results in higher tax obligations for both the individual and the hiring entity, including payroll taxes, Social Security, and Medicare. Consultants, as self-employed individuals, are responsible for paying their own taxes.

While it’s important to determine if a consultant qualifies as an employee, it’s also crucial to address situations like boss dating an employee . Such relationships can create conflicts of interest and ethical dilemmas. Understanding the legal implications of such situations is essential.

However, returning to the initial topic, determining whether a consultant meets the criteria of an employee remains a complex issue that requires careful consideration of various factors.

What are the legal liabilities and protections that apply to employees and consultants?

Employees are generally entitled to certain legal protections, such as minimum wage, overtime pay, and workers’ compensation. Consultants, being independent contractors, do not have the same level of legal protection.

Whether a consultant qualifies as an employee hinges on factors such as control over work and benefits. For employees, assurance is crucial, and that’s where assurance for an employee comes in, offering protection and peace of mind. However, the distinction between employee and consultant remains a complex one, requiring careful consideration of the specific circumstances.