Do you have to pay tax on an insurance settlement? It’s a common question with a not-so-straightforward answer. Dive in to learn the ins and outs of insurance settlement taxation, from the general principles to specific types of settlements. Let’s settle this once and for all!

Typically, you don’t have to pay taxes on insurance settlements. However, if you receive an inheritance, you may be wondering if you have to pay capital gains tax on it. The answer is usually no, but there are some exceptions.

To learn more about the specific rules, check out this article: Do I Pay Capital Gains Tax on an Inheritance . Going back to insurance settlements, remember that they are generally not taxable, but it’s always a good idea to consult with a tax professional to confirm your specific situation.

Insurance Settlement Taxation Overview

Insurance settlements are generally taxable if they compensate for lost income or property damage. However, certain settlements, such as those for pain and suffering, are not taxable.

Speaking of taxes, have you ever wondered if you have to pay tax on an insurance settlement? It’s a good question, but for now, let’s switch gears and talk about something else entirely: do all Targets pay $15 an hour? Find out here . Now, back to our original topic: do you have to pay tax on an insurance settlement? The answer is…it

depends.

Determining Taxability of Insurance Settlements

The taxability of an insurance settlement depends on the nature of the damages being compensated. Damages for lost income or property damage are taxable, while damages for pain and suffering are not.

In general, you don’t have to pay taxes on insurance settlements, but there are exceptions. If you receive an insurance settlement for a casualty loss, you may have to pay taxes on the amount that exceeds your adjusted basis in the property.

However, if you file an amended return to claim a deduction for the casualty loss, you may be able to reduce the amount of taxes you owe. Do you have to pay for an amended return ? It depends on the reason for filing the amended return.

If you’re filing an amended return to correct a mistake on your original return, you won’t have to pay a fee. However, if you’re filing an amended return to claim a refund, you may have to pay a fee.

Specific Types of Insurance Settlements, Do you have to pay tax on an insurance settlement

Property Damage Settlements

Property damage settlements are taxable if they compensate for lost or damaged property. However, if the settlement is used to replace or repair the damaged property, it may be non-taxable.

In general, you don’t have to pay taxes on an insurance settlement unless it’s for lost income or medical expenses. However, if you inherit an IRA, you may have to pay taxes on the withdrawals. Do I have to pay tax on an inherited IRA ? The answer depends on a few factors, including your age and the type of IRA.

But back to insurance settlements, if you’re not sure whether or not you have to pay taxes on yours, it’s always best to consult with a tax professional.

Personal Injury Settlements

Personal injury settlements are taxable if they compensate for lost wages or medical expenses. However, damages for pain and suffering are not taxable.

Do you have to pay tax on an insurance settlement? Generally, the answer is no. However, there are some exceptions. For example, if you receive an insurance settlement for lost wages, you may have to pay taxes on the amount that is considered income.

Similarly, if you receive an inheritance, you may have to pay taxes on the amount that is considered income. Do i need to pay taxes on an inheritance However, there are also some exceptions to this rule. For example, if you inherit property, you may not have to pay taxes on the value of the property until you sell it.

Business Interruption Settlements

Business interruption settlements are taxable if they compensate for lost profits or other business expenses.

If you’re wondering whether you have to pay tax on an insurance settlement, you’re not alone. It’s a common question with a complex answer. However, one thing that’s for sure is that there are plenty of CNA jobs that pay 20 an hour that can help you navigate the process.

So, if you’re looking for a job that pays well and offers a chance to help others, consider becoming a CNA. And don’t forget to consult with a tax professional to determine if you’ll owe taxes on your insurance settlement.

Exceptions and Exclusions to Taxation: Do You Have To Pay Tax On An Insurance Settlement

There are several exceptions to the general rule of taxing insurance settlements. These exceptions include:

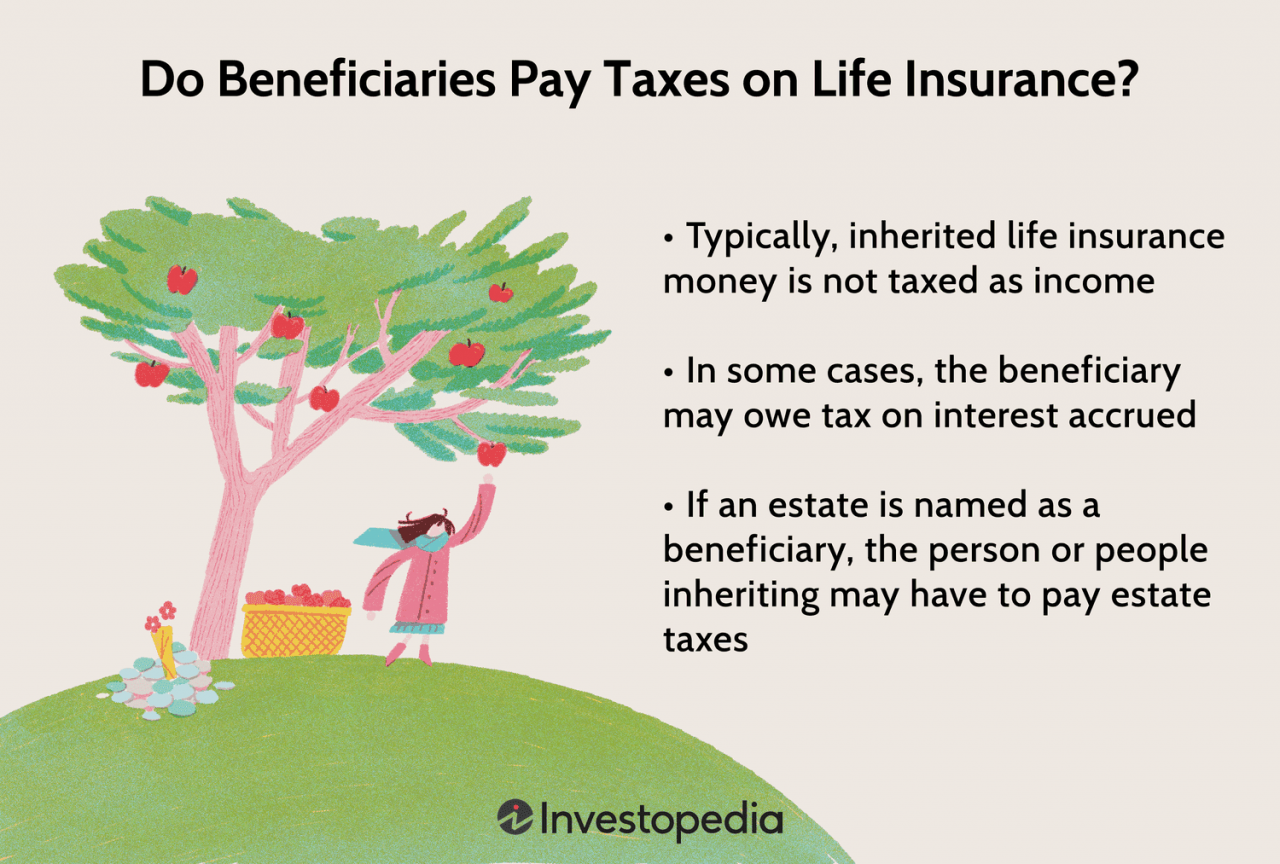

- Return of capital: Settlements that are considered a return of capital, such as those for life insurance policies, are not taxable.

- Gifts: Settlements that are considered gifts, such as those from family members, are not taxable.

Reporting Insurance Settlements on Tax Returns

Taxable insurance settlements must be reported on Form 1040. Non-taxable settlements do not need to be reported.

Closing Notes

Understanding the tax implications of insurance settlements can save you from unexpected tax bills. Remember, the taxability depends on the type of settlement, whether it’s a return of capital, and if it compensates for damages. Consult a tax professional if you’re unsure about your specific situation.

Stay informed, stay compliant, and make the most of your insurance settlements!

Detailed FAQs

Does all insurance settlement get taxed?

No, only settlements that compensate for lost income or property damage are taxable. Settlements for pain and suffering, emotional distress, and medical expenses are generally non-taxable.

What if I receive a settlement for lost wages?

Lost wages settlements are taxable as income. However, if you can prove that the lost wages were due to a physical injury or sickness, they may be excluded from taxation.

How do I report taxable insurance settlements on my tax return?

Report taxable settlements on Form 1040, Schedule A, line 10. You’ll need to provide details like the amount of the settlement, the date received, and the type of settlement.

For example, if you receive an insurance settlement for a car accident, you generally do not have to pay taxes on it. However, if you leave an apprenticeship early, you may have to pay a penalty fee. Do you have to pay if you leave an apprenticeship ? Similarly, if you receive a large inheritance, you may have to pay estate taxes on it.