When it comes to financial planning, endowment policies often raise the question: do you pay tax on an endowment policy? Dive into this intriguing topic as we explore the tax implications of endowment policies, uncovering the factors that influence tax liability and delving into effective tax planning strategies.

When it comes to endowment policies, the question of taxation is a common one. But did you know that there are also tax implications when inheriting property? In the UK, for instance, you may need to pay stamp duty if the property’s value exceeds a certain threshold.

To learn more about stamp duty on inherited property, check out this informative article: do i pay stamp duty on an inherited property . As for endowment policies, they typically fall under inheritance tax rules, so it’s important to consider these implications as well.

Join us on this journey to unravel the complexities of endowment policies and taxation.

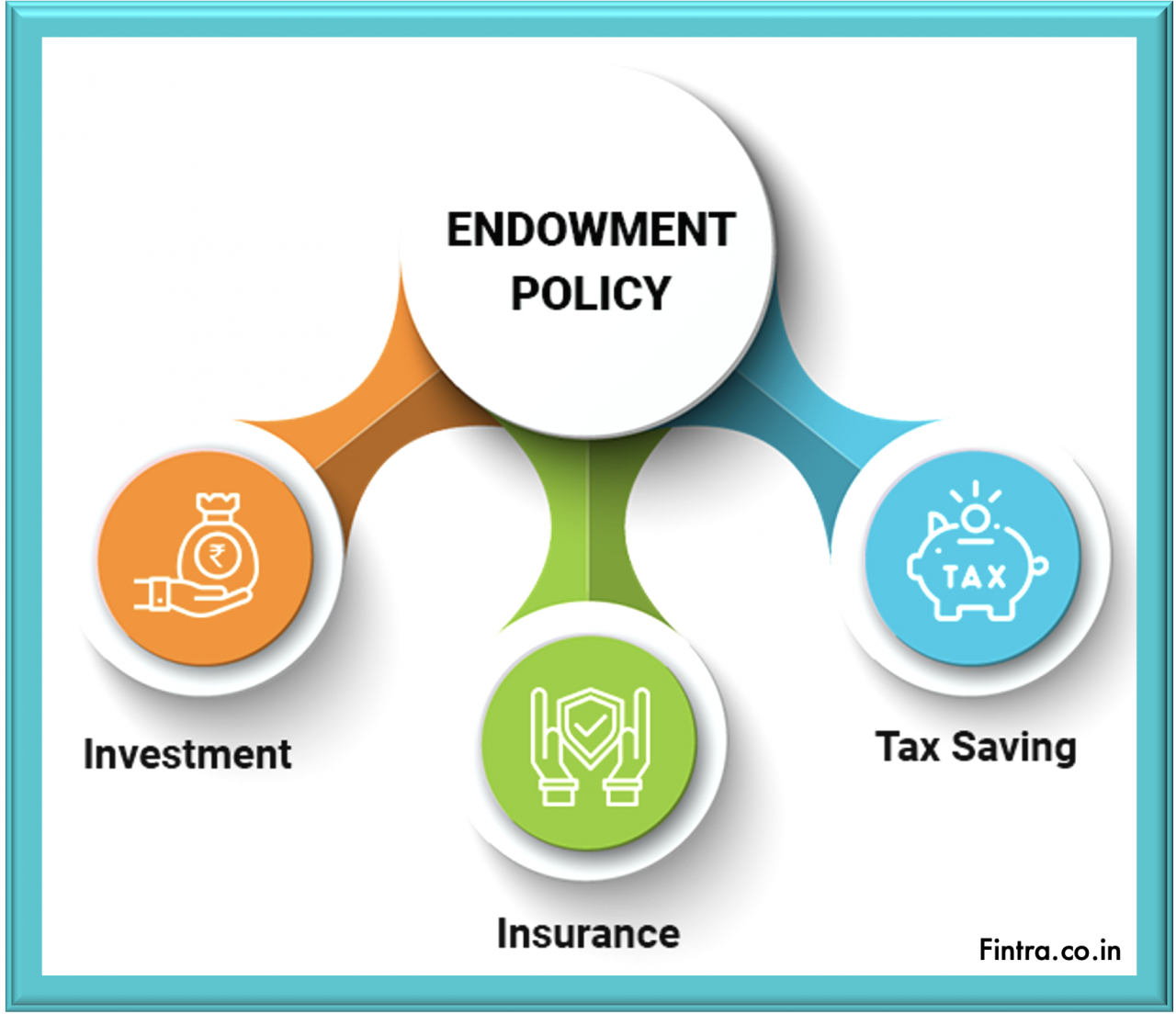

Endowment policies, designed to provide financial security and meet long-term goals, offer unique benefits and tax considerations. Understanding the tax implications of endowment policies is crucial for making informed financial decisions and maximizing returns.

Unlike taxes on endowment policies, do you pay for an amber alert ? No, it’s a free public service funded by government agencies and donations.

Definition of Endowment Policy

An endowment policy is a life insurance contract that combines savings and investment elements. It provides a lump sum payment upon the policyholder’s death or maturity of the policy.

Do you pay tax on an endowment policy? The cost to pay an invoice varies depending on the method of payment . There are several ways to pay an invoice, and each one has its own associated costs. For example, paying an invoice by credit card may incur a processing fee, while paying by check may not.

Additionally, the cost to pay an invoice may also vary depending on the amount of the invoice. For example, there may be a minimum fee for paying an invoice below a certain amount. So, if you’re wondering how much it will cost to pay an invoice, be sure to check with your payment provider to get an accurate estimate.

Endowment policies are often used to fund specific financial goals, such as education expenses, retirement, or a down payment on a house.

Types of Endowment Policies

- Traditional endowment policy:Pays out a death benefit and a maturity benefit.

- Unit-linked endowment policy:Combines a traditional endowment policy with an investment fund.

- Variable endowment policy:Provides a death benefit and a maturity benefit that varies depending on the performance of the underlying investments.

Tax Implications of Endowment Policies

The taxability of endowment policies varies depending on the jurisdiction in which they are issued and the specific terms of the policy.

I’m not sure if you have to pay tax on an endowment policy, but I do know that you don’t have to pay for an abortion in England. Here’s a link with more information about that. As for endowment policies, I’m still not sure about the tax implications.

Tax Treatment of Premiums Paid

Premiums paid into an endowment policy are generally not tax-deductible.

Tax Implications of Withdrawals

Withdrawals from an endowment policy before maturity may be subject to income tax and/or surrender charges.

Withdrawals at maturity are typically tax-free.

Factors Affecting Tax Liability, Do you pay tax on an endowment policy

Policy Terms

- Maturity period:Withdrawals made before the maturity date may be subject to tax.

- Surrender value:The surrender value of an endowment policy is the amount that can be withdrawn without penalty. Withdrawals that exceed the surrender value may be subject to tax.

Tax Laws and Regulations

Tax laws and regulations can change over time, which can affect the taxability of endowment policies.

Tax Planning Strategies

Minimizing Tax Liability

- Choose a policy with a long maturity period.This will give the investment more time to grow tax-free.

- Make withdrawals at maturity.Withdrawals at maturity are typically tax-free.

- Consider a unit-linked endowment policy.Unit-linked endowment policies offer the potential for higher returns, which can offset the tax liability on withdrawals.

Comparison to Other Financial Products

Endowment Policies vs. Life Insurance

Endowment policies provide a death benefit and a maturity benefit, while life insurance policies only provide a death benefit.

If you’re wondering if you pay tax on an endowment policy, you might also be curious about whether do all targets pay $15 an hour . The answer to both questions is a little complicated, but in general, the answer is no.

Endowment policies are not taxed in most cases, and not all Targets pay $15 an hour. However, there are some exceptions to both rules, so it’s important to check with your tax advisor or Target’s HR department to be sure.

Endowment policies are typically more expensive than life insurance policies.

Endowment Policies vs. Retirement Plans

Endowment policies are not as tax-efficient as retirement plans, such as 401(k)s and IRAs.

However, endowment policies can provide a lump sum payment that can be used for specific financial goals.

End of Discussion: Do You Pay Tax On An Endowment Policy

In conclusion, the tax implications of endowment policies vary depending on factors such as policy terms, tax laws, and individual circumstances. By carefully considering these factors and implementing effective tax planning strategies, individuals can optimize the tax efficiency of their endowment policies and harness their potential for financial growth.

Whether you’re planning for retirement, saving for a child’s education, or simply seeking financial security, understanding the tax implications of endowment policies is essential. Consult with a financial advisor to tailor a tax-efficient strategy that aligns with your financial goals and minimizes tax liability.

Whether you pay tax on an endowment policy depends on several factors, including the type of policy and the country in which you reside. Similarly, do i pay council tax on an empty house is also dependent on factors like the local laws and regulations.

However, in many cases, endowment policies are not subject to taxation, while council tax may be applicable even if the house is unoccupied.

Popular Questions

Is the maturity amount of an endowment policy taxable?

As far as the tax on an endowment policy goes, it can be a bit tricky. But there’s a similar topic that might be easier to understand: do you have to pay for an ombudsman ? An ombudsman is a person who investigates complaints against organizations.

They can help you resolve disputes without having to go to court. So, if you’re wondering about the tax on an endowment policy, it might be helpful to look into the topic of ombudsmen first.

In many jurisdictions, the maturity amount of an endowment policy is tax-free or partially tax-free, provided certain conditions are met, such as holding the policy for a specified period.

Are premiums paid towards an endowment policy tax-deductible?

Generally, premiums paid towards an endowment policy are not tax-deductible. However, in some cases, a portion of the premium may qualify for tax relief or deductions, depending on the specific tax laws and regulations.

What happens if I surrender an endowment policy before maturity?

Surrendering an endowment policy before maturity may result in tax implications. The surrender value received may be subject to income tax or capital gains tax, depending on the policy terms and tax laws.