Do you pay taxes on interest earned in an ira – Dive into the world of IRAs and uncover the secrets of interest taxation. Whether you’re a seasoned investor or just starting out, this guide will illuminate the complexities of IRA tax implications and help you make informed decisions about your retirement savings.

If you’re wondering whether you need to pay taxes on interest earned in an IRA, the answer is generally no. However, if you’re also wondering do you have to pay pmi with an fha loan , the answer is typically yes.

FHA loans require PMI (private mortgage insurance) to protect the lender in case you default on your loan. Returning to the topic of IRAs, keep in mind that you may have to pay taxes on withdrawals from a traditional IRA if you take them before reaching age 59½.

Let’s delve into the details and explore the nuances of interest earned in traditional and Roth IRAs, withdrawal rules, and smart investment strategies to minimize tax burdens. By the end of this journey, you’ll be armed with the knowledge to optimize your IRA earnings and secure a financially sound future.

The rules for paying taxes on interest earned in an IRA are complex, but generally, you won’t owe taxes on the interest you earn until you withdraw it. However, if you withdraw the interest before you reach age 59½, you may have to pay a 10% penalty.

Speaking of paying, do you have to pay for an emergency dentist ? The answer is yes, but there are some things you can do to reduce the cost. First, try to find an emergency dentist who offers a sliding scale fee based on your income.

Second, ask about payment plans. Many emergency dentists are willing to work with you to create a payment plan that fits your budget. Finally, consider using your dental insurance to help cover the cost of your emergency dental care.

Tax Implications of Interest Earned in an IRA

Interest earned in an IRA is generally tax-deferred, meaning you don’t pay taxes on it until you withdraw it in retirement. However, there are different types of IRAs, and the tax treatment of interest earned in each type varies.

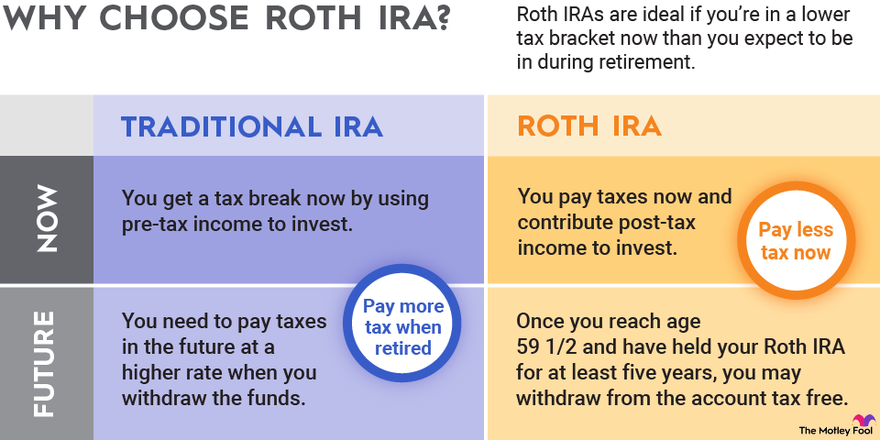

Traditional IRAs:Contributions to traditional IRAs are tax-deductible, but withdrawals are taxed as ordinary income. Interest earned in a traditional IRA is also taxed as ordinary income when withdrawn.

Roth IRAs:Contributions to Roth IRAs are not tax-deductible, but withdrawals are tax-free. Interest earned in a Roth IRA is also tax-free when withdrawn.

Example

If you contribute $1,000 to a traditional IRA and earn $100 in interest, you will not pay taxes on the $100 until you withdraw it in retirement. However, if you withdraw the $100 before retirement, you will pay taxes on it as ordinary income.

Withdrawal Rules and Taxes

The withdrawal rules for traditional and Roth IRAs are different.

Whether or not you pay taxes on interest earned in an IRA depends on the type of IRA you have. If you have a traditional IRA, the interest you earn is tax-deferred, meaning you don’t pay taxes on it until you withdraw the money.

However, if you have a Roth IRA, the interest you earn is tax-free, meaning you never have to pay taxes on it. Do you have to pay for an ambulance in Ireland ? In the US, ambulance rides can be expensive, but in Ireland, they are free.

This is because the Irish government subsidizes the cost of ambulance services. As a result, you don’t have to worry about paying for an ambulance if you need one in Ireland. Back to our initial topic, if you’re not sure whether or not you have to pay taxes on interest earned in an IRA, you should consult with a tax advisor.

Traditional IRAs:Withdrawals from traditional IRAs are generally subject to a 10% early withdrawal penalty if you are under age 59½. However, there are some exceptions to the early withdrawal penalty, such as withdrawals for medical expenses, education expenses, and first-time home purchases.

Roth IRAs:Withdrawals from Roth IRAs are not subject to the early withdrawal penalty if you have held the account for at least five years. However, withdrawals of contributions are tax-free, while withdrawals of earnings are taxed as ordinary income.

If you’re wondering about taxes on interest earned in an IRA, you may also be curious about FHA loans. Do you have to pay PMI on an FHA loan? Check it out to learn more. Now, back to IRAs – the interest you earn is typically tax-deferred, meaning you don’t pay taxes on it until you withdraw it.

Exceptions to the Early Withdrawal Penalty

- Withdrawals for medical expenses that exceed 7.5% of your AGI

- Withdrawals for education expenses

- Withdrawals for first-time home purchases (up to $10,000)

Investment Strategies

There are a few things you can do to maximize interest earnings in an IRA.

Choose the right investments.The type of investments you choose for your IRA will affect how much interest you earn. Generally, investments with higher risk have the potential to earn higher returns, but they also come with the potential for greater losses.

Rebalance your portfolio regularly.As your investments grow, you may need to rebalance your portfolio to ensure that your asset allocation remains aligned with your risk tolerance and investment goals.

Consider a CD ladder.A CD ladder is a strategy where you invest in CDs with different maturity dates. This can help you lock in higher interest rates for longer periods of time.

Comparison to Other Retirement Accounts

IRAs are not the only type of retirement account available. Other types of retirement accounts include 401(k)s and annuities.

The tax treatment of interest earned in an IRA is similar to the tax treatment of interest earned in a 401(k). However, there are some key differences between IRAs and 401(k)s.

Contribution limits:The contribution limits for IRAs are lower than the contribution limits for 401(k)s.

Investment options:The investment options available in IRAs are more limited than the investment options available in 401(k)s.

Withdrawal rules:The withdrawal rules for IRAs are more flexible than the withdrawal rules for 401(k)s.

If you’re wondering about the tax implications of interest earned in an IRA, you might also be interested in the average hourly wage for dental assistants, which is around $20 per hour according to recent data . However, it’s important to note that the tax treatment of interest earned in an IRA depends on the type of IRA you have and your tax bracket.

Advantages and Disadvantages of Different Retirement Accounts, Do you pay taxes on interest earned in an ira

| Account Type | Advantages | Disadvantages |

|---|---|---|

| IRA | Tax-deferred growth, flexible withdrawal rules | Lower contribution limits, limited investment options |

| 401(k) | Higher contribution limits, more investment options | Tax-deferred growth, less flexible withdrawal rules |

| Annuity | Guaranteed income stream, tax-deferred growth | Less flexibility, higher fees |

Wrap-Up: Do You Pay Taxes On Interest Earned In An Ira

Navigating the tax implications of IRAs can be a daunting task, but understanding the rules and regulations is crucial for maximizing your retirement savings. This guide has provided a comprehensive overview of the topic, empowering you with the knowledge to make informed decisions about your IRA investments.

The tax implications of interest earned in an IRA can be a bit confusing, but understanding them is crucial for proper financial planning. Similarly, the tax treatment of honorariums, which are payments for professional services, can also be complex. Do you pay tax on an honorarium ? This is a question that many individuals face, and the answer depends on various factors.

Returning to the topic of IRAs, it’s important to remember that interest earned within a traditional IRA is generally tax-deferred, meaning you won’t pay taxes on it until you withdraw it in retirement.

Remember, tax laws are subject to change, so it’s always advisable to consult with a financial advisor or tax professional for personalized guidance. By staying informed and making strategic choices, you can harness the power of IRAs to build a secure financial foundation for your future.

FAQs

Do I pay taxes on interest earned in a traditional IRA?

Do you pay taxes on interest earned in an IRA? The answer is no, but this question can lead to another one: do you pay gas and electric on an empty property? Find out here . When it comes to IRAs, the interest you earn is tax-free, so you don’t have to worry about paying taxes on it.

Yes, interest earned in a traditional IRA is tax-deferred, meaning you don’t pay taxes on it until you withdraw it in retirement. However, withdrawals before age 59½ may be subject to a 10% early withdrawal penalty.

How are interest earnings taxed in a Roth IRA?

Interest earned in a Roth IRA is tax-free when withdrawn in retirement, provided certain conditions are met. Contributions are made after-tax, so there are no upfront tax benefits, but qualified withdrawals are not subject to income tax.

What investment strategies can I use to minimize taxes on interest earned in an IRA?

Consider investing in municipal bonds or other tax-free investments within your IRA. These investments generate interest that is not subject to federal income tax, potentially reducing your overall tax burden.