Understanding Management Assertions

For an auditor how are management assertions useful – Management assertions are statements made by management that provide assurance about the accuracy and completeness of financial statements. These assertions are crucial in the audit process, as they help auditors assess the reliability of financial information.

For an auditor, management assertions are essential for evaluating the reliability of financial statements. They provide an understanding of the management’s view of the organization’s financial position and performance, and can help identify areas where further investigation is necessary. In the context of change management, management assertions can be particularly useful in assessing the potential effects of changes on the organization’s financial health and the effectiveness of the change management process.

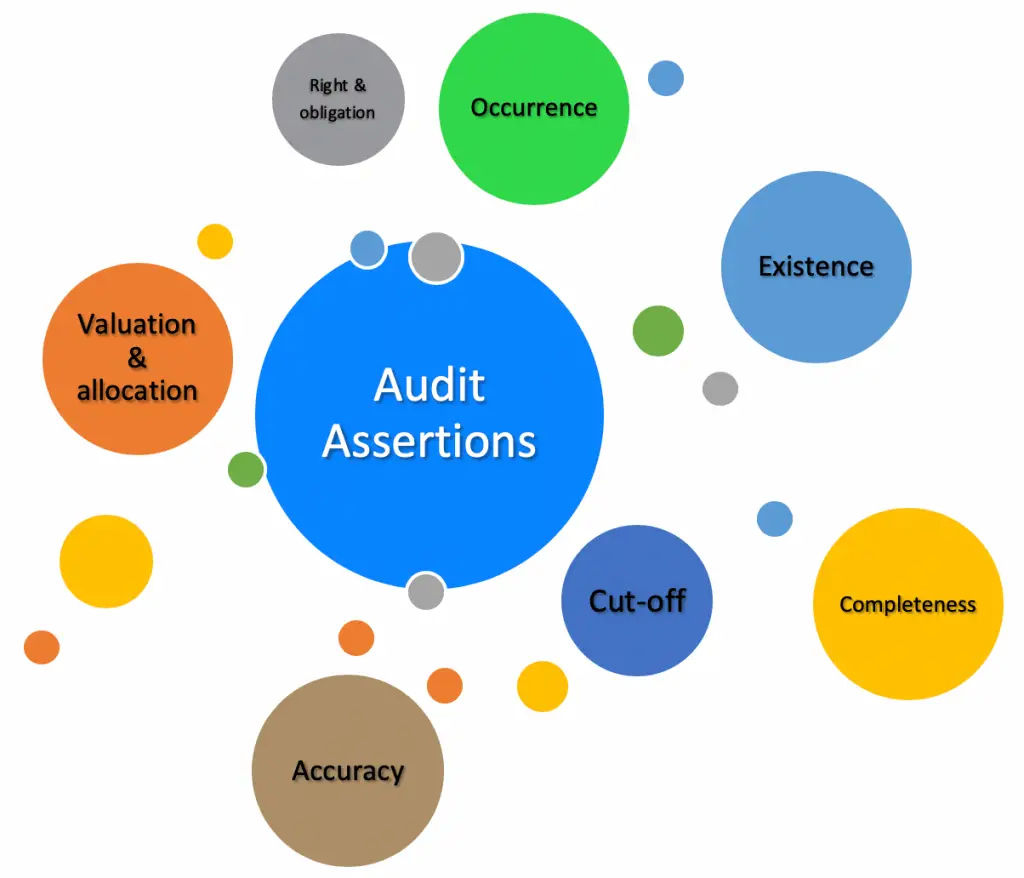

Common management assertions include:

- Existence:Assets and liabilities exist as of the balance sheet date.

- Completeness:All transactions and events have been recorded.

- Valuation:Assets and liabilities are recorded at their appropriate values.

- Presentation:Financial statements are presented fairly and without material misstatements.

Types of Management Assertions

Management assertions can be classified into four main types:

- Existence or Occurrence:Assets, liabilities, and transactions exist and have occurred as of the balance sheet or transaction date.

- Completeness:All transactions and events that should have been recorded have been recorded.

- Rights and Obligations:The entity has legal rights to its assets and is legally obligated for its liabilities.

- Valuation and Allocation:Assets, liabilities, and equity are recorded at appropriate amounts and are properly classified and allocated.

How Management Assertions Help Auditors

Management assertions assist auditors in planning and performing audits by:

- Identifying areas of risk:Assertions help auditors identify areas where there is a higher risk of material misstatement.

- Focusing audit procedures:Assertions guide auditors in determining the appropriate audit procedures to perform.

- Evaluating the reliability of financial statements:Assertions provide a basis for auditors to assess the overall reliability of financial statements.

Evaluating Management Assertions

Auditors evaluate management assertions through a combination of:

- Testing controls:Auditors assess the effectiveness of internal controls to prevent or detect material misstatements.

- Substantive procedures:Auditors perform analytical procedures and test transactions and balances to verify the accuracy of financial statements.

- Challenging management’s assertions:Auditors question management’s assumptions and seek supporting evidence to validate their assertions.

Impact of Management Assertions on Audit Reports, For an auditor how are management assertions useful

Management assertions influence the auditor’s opinion on the financial statements.

For an auditor, management assertions are useful as they provide a starting point for the audit process, helping to identify areas of risk and potential misstatement. These assertions can be classified into various categories, including existence or occurrence, completeness, valuation or allocation, and presentation and disclosure.

Understanding these assertions allows auditors to tailor their audit procedures to address specific risks and ensure the accuracy and reliability of financial statements. It’s worth noting that the duties of an executive assistant to the managing director often include assisting with the preparation of financial statements, making it essential for them to have a solid understanding of management assertions and their implications for the audit process.

- Unqualified opinion:If the auditor is satisfied with management’s assertions and the results of their audit procedures, they will issue an unqualified opinion.

- Qualified opinion:If the auditor has concerns about management’s assertions or the reliability of financial statements, they may issue a qualified opinion.

- Adverse opinion:If the auditor believes that financial statements are materially misstated, they will issue an adverse opinion.

Epilogue: For An Auditor How Are Management Assertions Useful

In conclusion, management assertions play an indispensable role in the audit process. They assist auditors in planning and executing audits, evaluating the reliability of financial statements, and communicating any concerns or misstatements to stakeholders. Auditors rely on these assertions to provide assurance that the financial information presented by companies is accurate, complete, and free from material misstatements.

Common Queries

What are the different types of management assertions?

For an auditor, management assertions are crucial for understanding a company’s financial statements. They provide insights into how management believes the financial information is presented. This knowledge can be valuable when designing an elevator product manager , as it helps to identify potential risks and areas for improvement.

By understanding management assertions, auditors can make more informed decisions and provide more accurate and reliable audit opinions.

Management assertions fall into four main categories: existence, completeness, valuation, and presentation.

For an auditor, management assertions provide valuable insights into the reliability of financial statements. These assertions cover areas such as completeness, accuracy, and authorization, helping auditors assess the reasonableness of the information presented. The duties of an operations manager in a bank, as outlined here , are relevant in this context as they involve overseeing internal controls and ensuring compliance with regulations, which contribute to the accuracy and integrity of financial data.

By understanding management assertions and the role of operations managers, auditors can gain a deeper understanding of the financial reporting process and enhance the reliability of their audits.

How do management assertions help auditors identify areas of risk?

By understanding management’s assertions, auditors can gain insights into the areas where financial misstatements are most likely to occur.

What is the auditor’s responsibility in evaluating management assertions?

Auditors have a responsibility to challenge management’s assertions and seek supporting evidence to assess their validity.

For an auditor, management assertions provide valuable insights into the reliability of financial statements. These assertions encompass management’s perspective on the accuracy and completeness of the information presented. By understanding management’s artful approach to decision-making and the assumptions underlying their assertions, auditors can assess the risk of material misstatement and determine the appropriate level of audit procedures.

Management assertions provide auditors with a framework for evaluating the accuracy of financial statements. By understanding the assertions made by management, auditors can focus their audit procedures on areas where there is a higher risk of misstatement. Customer experience management can help auditors assess the validity of management’s assertions about the effectiveness of internal controls over financial reporting.

Management assertions provide auditors with a framework for evaluating the accuracy and completeness of financial statements. This is particularly important for event managers, who are responsible for planning and executing events, and ensuring that financial resources are used appropriately. By understanding the duties of an event manager, auditors can better assess the reasonableness of management assertions and identify potential areas of risk.

Event managers are responsible for a wide range of tasks, including venue selection, vendor management, budgeting, and marketing. Auditors can use this information to assess the likelihood of material misstatements in the financial statements.

Management assertions are crucial for auditors as they provide a framework for evaluating the reliability of financial statements. These assertions, made by management, address the accuracy and completeness of the financial information. By understanding the difference between management and leadership in an organization ( difference between management and leadership in an organization ), auditors can better assess the credibility of management assertions and determine the appropriate level of audit procedures necessary.