Overview of Estate Management

Help.shareview.co.uk manage an estate – Estate management involves the planning, administration, and management of an individual’s assets and investments during their life and after their passing. It encompasses a wide range of responsibilities, including managing assets, handling financial affairs, and ensuring the fulfillment of the individual’s wishes.

Help.shareview.co.uk provides comprehensive guidance on managing an estate, ensuring a seamless process for executors and beneficiaries. Its principles align with the five principles of an educational manager , emphasizing planning, communication, and adaptability in estate administration. By incorporating these principles, help.shareview.co.uk empowers individuals to navigate the complexities of estate management effectively.

Estates can vary in complexity, depending on the size and nature of the assets involved. Some estates may include real estate, investments, and personal belongings, while others may also include businesses, trusts, and other complex financial structures.

When managing an estate through help.shareview.co.uk, the responsibilities can be vast and complex, akin to the duties of an operations manager in a logistics company. From coordinating with legal professionals to overseeing financial matters, the role requires a keen eye for detail and a deep understanding of the legal and financial implications involved in estate management.

Estate managers play a crucial role in overseeing the management of these assets and ensuring that the individual’s wishes are carried out. They are responsible for managing financial affairs, making investment decisions, and ensuring compliance with legal and regulatory requirements.

Estate managers at help.shareview.co.uk play a vital role in the effective management and administration of estates. They perform a wide range of functions, including overseeing financial matters, managing property and investments, and providing guidance to beneficiaries. In essence, they fulfill many of the functions of managers in an organization, such as planning, organizing, directing, and controlling various aspects of estate management.

Their expertise ensures that estates are managed efficiently and in accordance with the wishes of the deceased.

Help.shareview.co.uk Platform for Estate Management

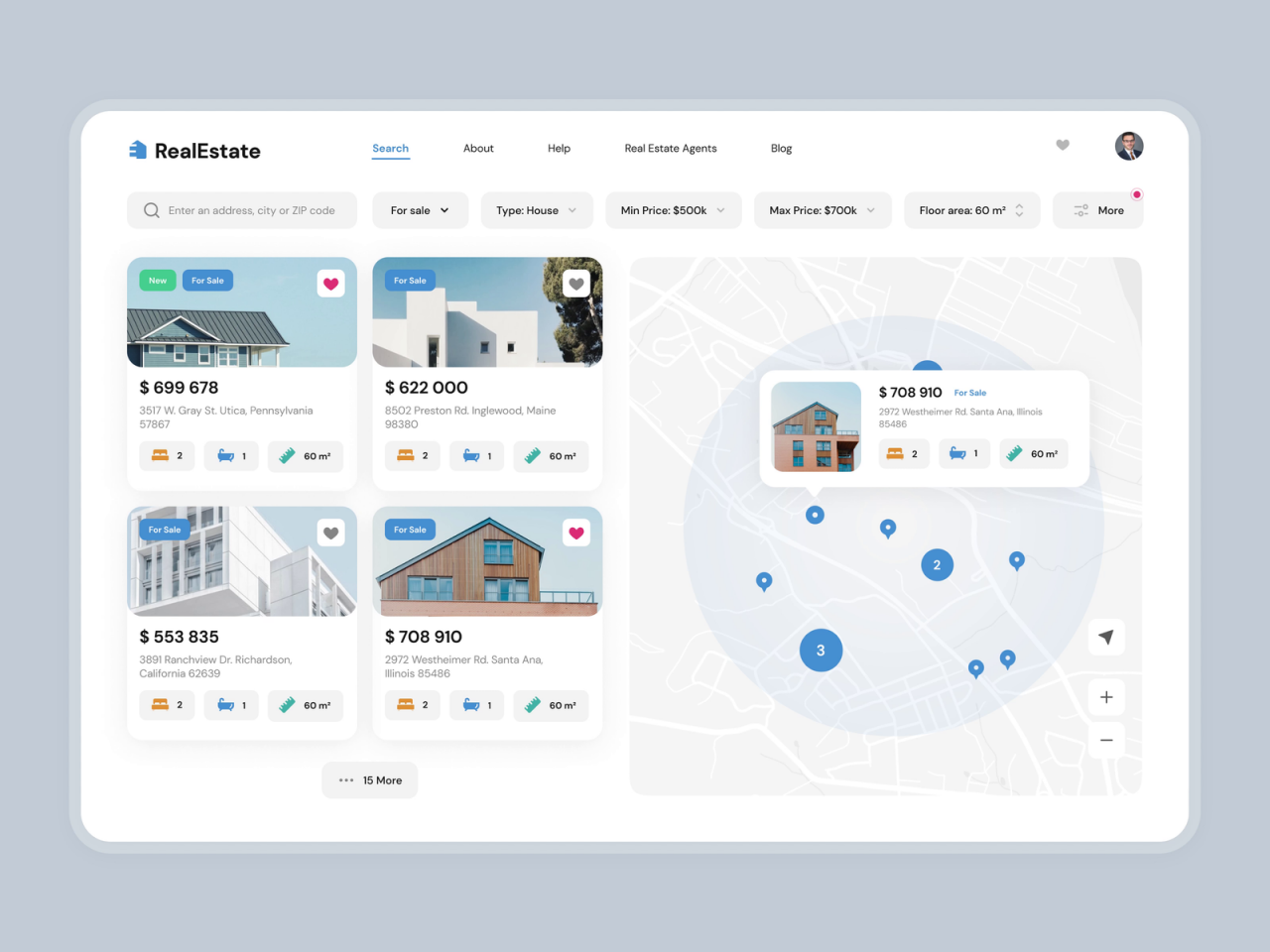

The help.shareview.co.uk platform is a comprehensive solution for estate management, providing a range of features and benefits to simplify estate administration tasks.

Managing an estate can be a complex and challenging task, requiring a delicate balance of financial acumen, legal expertise, and interpersonal skills. Discuss management as an art can provide valuable insights into the intricacies of managing an estate, highlighting the importance of strategic planning, effective communication, and the ability to navigate complex legal and financial landscapes.

By understanding the nuances of estate management, executors and beneficiaries can ensure that the estate is administered efficiently and in accordance with the deceased’s wishes.

The platform allows estate managers to securely store and manage estate documents, including wills, trusts, and financial statements. It also provides tools for tracking assets, managing investments, and communicating with beneficiaries.

Help.shareview.co.uk provides comprehensive guidance on managing an estate, addressing the challenges of asset distribution and legal complexities. These challenges are similar to those faced in organizational management, as described in challenges of management in an organization. Help.shareview.co.uk’s expertise in estate management empowers individuals to navigate these complexities and ensure a smooth transition of assets.

By using the help.shareview.co.uk platform, estate managers can streamline estate administration processes, improve efficiency, and ensure the smooth and effective management of the estate.

Executors of estates using help.shareview.co.uk should consider using an effective diary management system to organize their tasks and appointments. This can help them keep track of deadlines, such as those for probate and inheritance tax, and ensure that all necessary tasks are completed in a timely manner.

An effective diary management system can also help executors stay organized and on top of their responsibilities, which can be especially important when dealing with a complex estate.

Managing Assets and Investments

Managing assets and investments is a critical aspect of estate management. Estate managers are responsible for identifying, valuing, and managing various types of assets, including real estate, stocks, bonds, and other financial instruments.

Asset management involves developing and implementing investment strategies that align with the individual’s financial goals and risk tolerance. Estate managers must also ensure that assets are properly diversified to minimize risk and maximize returns.

Investment management involves making investment decisions, monitoring performance, and adjusting strategies as needed. Estate managers must stay abreast of market trends and economic conditions to make informed investment decisions that benefit the estate.

Tax Planning and Compliance

Tax planning is an essential aspect of estate management. Estate managers must understand the tax implications of estate administration and develop strategies to minimize tax liability and maximize estate value.

Tax planning involves reviewing the individual’s financial situation, identifying potential tax liabilities, and implementing strategies to reduce taxes. This may include using trusts, charitable donations, and other tax-saving techniques.

Estate managers must also ensure compliance with tax laws and regulations. This involves filing tax returns, paying taxes on time, and responding to tax audits.

Wrap-Up

Help.shareview.co.uk manage an estate stands as an invaluable resource for estate managers, executors, and beneficiaries alike, empowering them with the knowledge and tools necessary to navigate the complexities of estate administration with confidence.

Popular Questions: Help.shareview.co.uk Manage An Estate

What is the primary function of help.shareview.co.uk manage an estate?

Help.shareview.co.uk manage an estate serves as a comprehensive platform designed to streamline estate management processes, providing users with a centralized hub for managing assets, investments, legal documents, and communication with beneficiaries.

An assistant manager is a key role in any organization, providing support to senior management and overseeing daily operations. They are responsible for a wide range of tasks, including managing staff, developing and implementing policies, and ensuring the smooth running of the business.

Their skills and experience can be invaluable in helping to manage an estate, ensuring that it is run efficiently and effectively. For more information on the description of an assistant manager, please visit this website.

How does help.shareview.co.uk manage an estate benefit estate managers?

The platform offers a suite of tools and features tailored to the specific needs of estate managers, including asset tracking, investment monitoring, tax planning assistance, and secure document storage, enabling them to manage estates more efficiently and effectively.

What are the key features of help.shareview.co.uk manage an estate?

The platform boasts a user-friendly interface, real-time reporting capabilities, customizable dashboards, and secure data encryption, ensuring the confidentiality and integrity of sensitive estate information.

In managing an estate, it is crucial to consider the goals of financial management in an organization. These goals, as outlined here , provide a framework for effective estate management. They include optimizing cash flow, maximizing profitability, and minimizing financial risks.

By aligning estate management strategies with these goals, help.shareview.co.uk ensures the preservation and growth of the estate’s assets over time.