A limited liability company differs from an s corporation in – In the realm of business structures, a limited liability company (LLC) and an S corporation stand out as two popular choices. While both offer distinct advantages, they also differ in several key aspects. Understanding these differences is crucial for entrepreneurs seeking the optimal structure for their venture.

This comprehensive guide delves into the intricacies of LLCs and S corporations, exploring their legal structures, tax treatments, liability protection, ownership and management, flexibility and control, formation and maintenance costs, eligibility requirements, and advantages and disadvantages. By comparing and contrasting these aspects, we aim to provide a clear understanding of how these structures differ, empowering you to make informed decisions for your business.

Legal Structures

Limited liability companies (LLCs) and S corporations are two popular legal structures for small businesses in the United States. Both offer liability protection to their owners, but they have different tax treatments and operating rules.

LLCs, A limited liability company differs from an s corporation in

LLCs are hybrid business structures that combine the features of corporations and partnerships. They offer the liability protection of a corporation with the tax flexibility of a partnership. LLCs are taxed as pass-through entities, meaning that the business’s income and losses are passed through to the owners and reported on their individual tax returns.

Did you know that a limited liability company differs from an s corporation in terms of tax treatment? Speaking of tech, have you ever wondered can i find an android phone from an iphone ? Regardless, an LLC’s profits are passed through to its owners, while an S corporation’s profits are taxed at the corporate level.

LLCs are suitable for a wide range of businesses, including professional services firms, small businesses, and real estate ventures.

The main distinction between an LLC and an S corporation lies in the tax treatment and liability protection they offer. Unlike an S corporation, an LLC’s owners are not personally liable for business debts and liabilities, but the company itself is taxed as a separate entity.

However, if you’re wondering can i use my android phone to find an iphone , there are apps available for that. Returning to our topic, S corporations, on the other hand, pass through their profits and losses to their owners, who are then responsible for paying taxes on their individual income.

S Corporations

S corporations are a type of corporation that elects to be taxed as a pass-through entity. This means that the corporation’s income and losses are passed through to the shareholders and reported on their individual tax returns.

S corporations are subject to certain restrictions, such as the number of shareholders they can have and the types of businesses they can operate. S corporations are suitable for small businesses that want the liability protection of a corporation with the tax flexibility of a partnership.

Unlike an S corporation, a limited liability company (LLC) provides its owners with limited liability protection. This means that the owners are not personally liable for the debts and liabilities of the LLC. However, if you’re looking to video call your friends on an Android tablet, you might be wondering can i use facetime on an android tablet . The answer is no, FaceTime is only available on Apple devices.

However, there are many other video calling apps that you can use on your Android tablet, such as Google Duo, WhatsApp, and Skype. Coming back to the topic, an LLC is a popular choice for small businesses and startups because it offers the flexibility of a partnership with the liability protection of a corporation.

Tax Treatment

LLCs and S corporations have different tax treatments. LLCs are taxed as pass-through entities, meaning that the business’s profits and losses are passed through to the owners and reported on their individual tax returns. S corporations, on the other hand, are taxed as regular corporations, meaning that the business’s profits are taxed at the corporate level and then again when they are distributed to the owners as dividends.

Pass-through Taxation

Pass-through taxation can be advantageous for businesses that want to avoid double taxation. Double taxation occurs when a business’s profits are taxed at the corporate level and then again when they are distributed to the owners as dividends. With pass-through taxation, the business’s profits are only taxed once, at the individual level.

Double Taxation

Double taxation can be a disadvantage for businesses that want to retain their profits for reinvestment. With double taxation, the business’s profits are taxed at the corporate level and then again when they are distributed to the owners as dividends.

This can make it difficult for businesses to save money for future growth.

Liability Protection

LLCs and S corporations offer varying degrees of liability protection, safeguarding business owners from personal responsibility for company debts and liabilities.

LLCs generally provide stronger liability protection than S corporations. In an LLC, the owners, known as members, are typically not personally liable for the debts and obligations of the business. This means that if the LLC is sued or incurs financial losses, the members’ personal assets, such as their homes, savings, and investments, are generally protected from creditors.

S corporations, on the other hand, offer limited liability protection to their shareholders. However, this protection is not as comprehensive as that provided by LLCs. In some cases, shareholders of S corporations may be held personally liable for the company’s debts and liabilities, especially if they are actively involved in the management of the business.

Example

For instance, if an LLC is sued for negligence and loses, the members’ personal assets are generally not at risk. However, if an S corporation is sued under similar circumstances, the shareholders could potentially be held personally liable if they were found to have been directly responsible for the negligence.

Ownership and Management

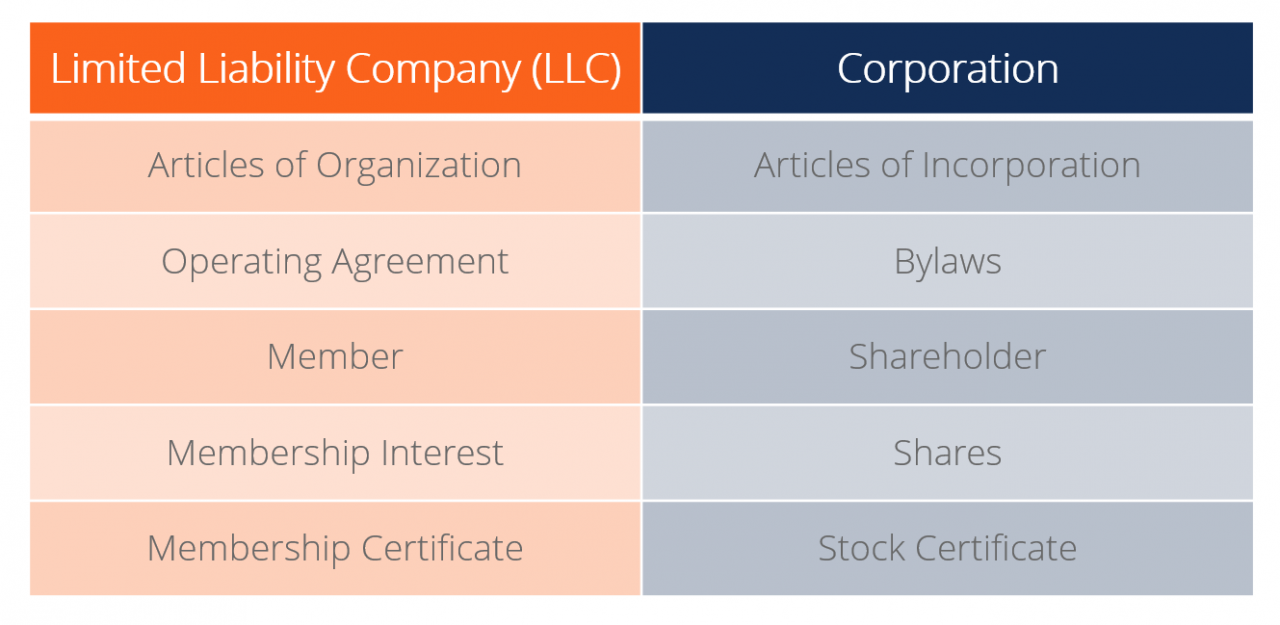

LLCs and S corporations differ in their ownership and management structures. LLCs are owned by members, while S corporations are owned by shareholders. LLCs are managed by members or managers, while S corporations are managed by a board of directors.

In the realm of business structures, a limited liability company (LLC) differs from an S corporation in terms of tax treatment and liability protection. Now, if you’re curious about another topic, have you ever wondered can i record a phone call on an android phone ? Returning to our comparison, an LLC provides limited liability to its owners, while an S corporation allows for pass-through taxation.

Roles and Responsibilities

Members of an LLC have the right to participate in the management of the company and share in its profits and losses. Shareholders of an S corporation have the right to vote for the board of directors and share in the company’s profits and losses.

The board of directors is responsible for managing the company and making decisions on its behalf.

An LLC differs from an S corporation in that it’s not subject to double taxation, but both offer liability protection. In a related vein, did you know can you block phone numbers on an android ? It’s a super easy way to keep unwanted callers at bay.

Getting back to our original topic, LLCs also provide more flexibility in terms of ownership and management.

Flexibility and Control

Both LLCs and S corporations offer flexibility and control to their owners. LLCs provide more flexibility in terms of management and ownership structure, while S corporations offer more flexibility in terms of taxation.Factors to consider when choosing a structure that offers the desired level of flexibility include:* Management structure:LLCs can be managed by their owners or by a board of managers, while S corporations must be managed by a board of directors.

Ownership structure

LLCs can have any number of owners, while S corporations are limited to 100 shareholders.

Taxation

LLCs are taxed as pass-through entities, meaning that the business’s income and losses are passed through to the owners and reported on their individual tax returns. S corporations are also taxed as pass-through entities, but they offer more flexibility in terms of how the business’s income and losses are allocated among the shareholders.

A limited liability company differs from an S corporation in that it provides more flexibility and tax benefits. If you’re looking to restrict app downloads on your Android device, you can check out can i block an app from being downloaded android . An LLC also offers limited liability protection, meaning that the owners are not personally liable for the debts and liabilities of the business.

Formation and Maintenance Costs

Forming and maintaining an LLC or S corporation involves various costs, including filing fees, annual fees, and ongoing expenses. Understanding these costs is crucial for businesses to make informed decisions about their legal structure.

In general, forming an LLC is less expensive than forming an S corporation. However, S corporations may offer tax advantages that can offset the higher formation costs over time.

A limited liability company differs from an S corporation in that it offers more flexibility and pass-through taxation. Speaking of flexibility, do you know if can i access icloud from an android ? Because that’s something I’ve been wondering about lately.

Getting back to our topic, an S corporation, on the other hand, provides limited liability protection and allows for the distribution of profits to shareholders.

LLC Formation and Maintenance Costs

- Filing fees: The cost of filing Articles of Organization for an LLC varies by state, typically ranging from $100 to $500.

- Annual fees: Most states require LLCs to file an annual report and pay an annual fee, which can range from $50 to $500.

- Registered agent fees: LLCs are required to have a registered agent, which is a person or company that receives legal documents on behalf of the LLC. The cost of a registered agent can range from $100 to $500 per year.

- Other expenses: LLCs may also incur other expenses, such as legal fees for drafting operating agreements or accounting fees for tax preparation.

S Corporation Formation and Maintenance Costs

- Filing fees: The cost of filing Form 2553 to elect S corporation status can range from $150 to $300.

- Annual fees: S corporations are required to file an annual report and pay an annual fee, which can range from $50 to $500.

- Registered agent fees: S corporations are required to have a registered agent, which can cost from $100 to $500 per year.

- Tax preparation fees: S corporations may incur additional tax preparation fees due to the more complex tax rules that apply to them.

Eligibility Requirements: A Limited Liability Company Differs From An S Corporation In

The eligibility requirements for forming LLCs and S corporations differ based on the specific laws and regulations of each state or jurisdiction. However, some general guidelines apply.

LLCs, A limited liability company differs from an s corporation in

- Can be formed by one or more individuals, corporations, or other legal entities.

- No restrictions on the number of owners (members).

- Can engage in any lawful business activity.

- Members can be active or passive in the management of the LLC.

S Corporations

- Must be a domestic corporation (formed in the United States).

- Can have a maximum of 100 shareholders.

- Shareholders must be individuals, estates, or certain trusts.

- Can only have one class of stock.

- Must meet specific income requirements to qualify for S corporation status.

Advantages and Disadvantages

LLCs and S corporations offer unique advantages and disadvantages that business owners should carefully consider when choosing a legal structure. The following table Artikels key differences between the two entities in terms of liability, taxation, flexibility, and costs.

Liability

- LLCs provide limited liability to their owners, meaning that they are not personally liable for the debts and liabilities of the business.

- S corporations also offer limited liability to their owners, but only to the extent of their investment in the business.

Taxation

- LLCs are taxed as pass-through entities, meaning that the business’s income and losses are passed through to the owners and reported on their individual tax returns.

- S corporations are also taxed as pass-through entities, but they have the option to elect to be taxed as a C corporation.

Flexibility

- LLCs offer more flexibility than S corporations in terms of ownership and management.

- LLCs can have an unlimited number of owners, and they can be managed by members or by a board of directors.

- S corporations are limited to 100 shareholders, and they must be managed by a board of directors.

Costs

- LLCs are generally more expensive to form and maintain than S corporations.

- LLCs are required to file annual reports with the state, and they may also be subject to other fees.

- S corporations are not required to file annual reports, and they are generally subject to lower fees.

Conversion and Dissolution

Converting an LLC to an S corporation and vice versa involves several steps and considerations. Dissolving either type of entity also requires specific procedures.

Conversion

Converting an LLC to an S corporation requires filing Form 2553 with the IRS. The LLC must meet certain eligibility requirements, such as having only one class of stock and no more than 100 shareholders.

Converting an S corporation to an LLC involves filing Form 8832 with the IRS. The S corporation must meet certain requirements, such as having no more than 100 shareholders and no passive income.

Dissolution

Dissolving an LLC involves filing a Certificate of Dissolution with the state in which the LLC is registered. The LLC must pay all outstanding debts and distribute its assets to its members.

Dissolving an S corporation involves filing Form 966 with the IRS. The S corporation must pay all outstanding debts and distribute its assets to its shareholders.

Closing Notes

Ultimately, the choice between an LLC and an S corporation depends on the specific needs and goals of your business. By carefully considering the factors Artikeld in this guide, you can select the structure that aligns best with your objectives.

Whether you prioritize liability protection, tax efficiency, flexibility, or ease of formation, understanding the distinctions between these structures will guide you towards the most suitable choice for your entrepreneurial journey.

Essential Questionnaire

What is the primary difference between an LLC and an S corporation?

The main difference lies in the liability protection they offer. LLCs provide stronger liability protection, shielding owners from personal liability for business debts and obligations, while S corporations offer pass-through taxation, allowing business income and losses to be passed directly to the owners’ personal tax returns.

Which structure offers better tax advantages?

S corporations generally provide more favorable tax treatment, as they are not subject to double taxation. However, LLCs can also achieve tax efficiency through the election of S corporation status, which allows them to enjoy pass-through taxation while maintaining the liability protection of an LLC.

Can an LLC be converted into an S corporation?

Yes, it is possible to convert an LLC into an S corporation. However, the process involves meeting specific eligibility requirements and filing the necessary paperwork with the Internal Revenue Service (IRS).

Which structure is more suitable for small businesses?

LLCs are often preferred by small businesses due to their flexibility, ease of formation, and strong liability protection. However, S corporations can also be advantageous for small businesses that prioritize tax efficiency and have a limited number of owners.

What factors should be considered when choosing between an LLC and an S corporation?

When making a decision, consider factors such as the desired level of liability protection, tax implications, ownership structure, flexibility and control, and formation and maintenance costs. By carefully evaluating these aspects, you can determine the structure that best aligns with your business goals and objectives.