Paying Yourself as an S Corp: A Guide for Business Owners

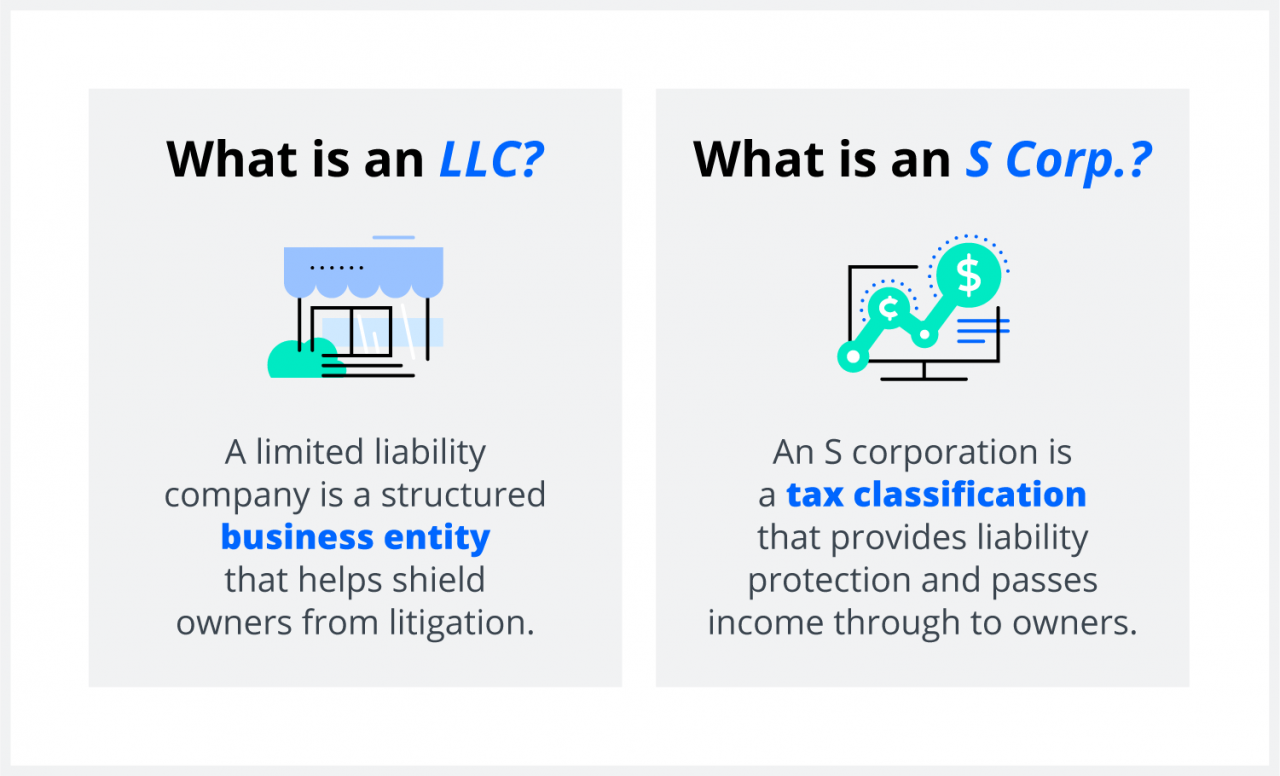

Paying yourself as an S corporation owner is a crucial aspect of running your business. It offers several tax benefits and financial flexibility. In this guide, we’ll explore the steps involved in setting up an S corporation, calculating your salary, and optimizing your tax situation. Paying yourself a reasonable salary as an S Corp owner … Read more