Paying Yourself as an LLC: A Comprehensive Guide

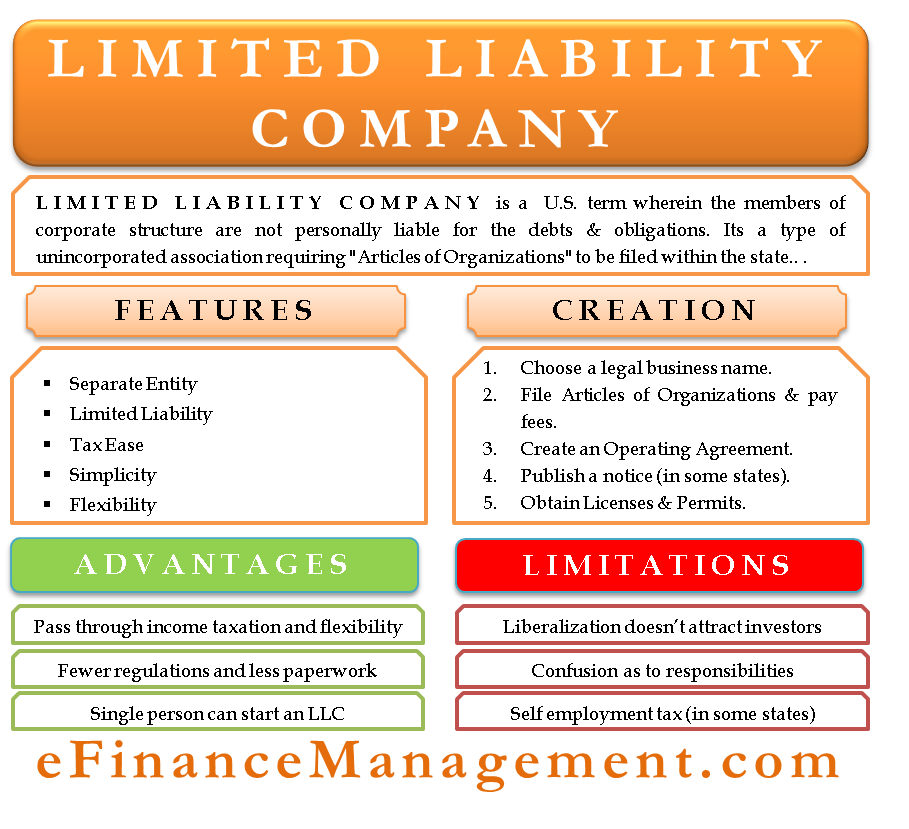

Navigating the complexities of self-payment as an LLC owner can be a daunting task. Understanding the tax implications, compensation methods, and recordkeeping requirements is crucial for managing your finances effectively. This guide will delve into the ins and outs of paying yourself as an LLC, providing you with the knowledge and strategies to optimize your … Read more