An aging of a company’s accounts receivable indicates that a company is having trouble collecting money from its customers. This can be a major problem, as it can lead to cash flow problems, profitability issues, and even bankruptcy. In this article, we’ll discuss the causes, consequences, and strategies for managing accounts receivable aging.

The content of the second paragraph that provides descriptive and clear information about the topic

Identify Indicators of Aging Accounts Receivable

Aging of accounts receivable refers to the process of categorizing and analyzing accounts receivable based on the length of time they have been outstanding. This helps businesses assess the risk of non-payment and make informed decisions about collection strategies.

An aging of a company’s accounts receivable indicates a number of things, including that the company may be having trouble collecting its debts. This can be a sign of financial distress, and it can also lead to a decrease in the company’s cash flow.

In some cases, an aging of accounts receivable can be a sign that the company is not managing its finances well. If you’re concerned about the aging of your company’s accounts receivable, you may want to consider can you access itunes from an android phone to get some help.

An aging of a company’s accounts receivable can be a serious problem, but it can be resolved with the right help.

Several indicators suggest an aging of accounts receivable, including:

Slow Payment Patterns

- Customers consistently paying invoices late

- An increase in the number of days sales outstanding (DSO)

- A decrease in the percentage of current accounts receivable

Changes in Customer Behavior

- Customers disputing invoices more frequently

- Customers requesting extended payment terms

- Customers reducing their order sizes

Financial Distress

- Customers experiencing financial difficulties

- Customers filing for bankruptcy

- Customers having negative credit ratings

Causes of Accounts Receivable Aging

The aging of accounts receivable is a common problem that can have a significant impact on a company’s cash flow. There are a number of factors that can contribute to accounts receivable aging, including both internal and external factors.

Internal factors that can contribute to accounts receivable aging include:

- Inadequate credit policies

- Inefficient billing and collection procedures

- Poor customer service

- Lack of communication between sales and accounting departments

External factors that can contribute to accounts receivable aging include:

- Economic downturns

- Changes in customer payment patterns

- Natural disasters

- Government regulations

Consequences of Accounts Receivable Aging

Aging accounts receivable can have severe financial consequences for businesses. It affects their cash flow, profitability, and liquidity, leading to financial instability and potential bankruptcy in extreme cases.

The financial impact of aging accounts receivable is significant. When customers fail to pay their invoices on time, businesses experience a delay in receiving cash. This can lead to cash flow problems, making it difficult for businesses to meet their short-term obligations such as paying suppliers, employees, and other expenses.

As a result, businesses may have to rely on external financing options like loans or lines of credit, which can increase their overall cost of operations.

An aging of a company’s accounts receivable indicates potential credit problems. In a similar vein, you might wonder if it’s possible to can i track an android phone from iphone . The answer is yes, but it requires a bit of technical know-how.

If you’re experiencing an aging of your accounts receivable, it’s important to take steps to collect on those debts as soon as possible.

Impact on Cash Flow

Aging accounts receivable can disrupt a company’s cash flow, making it difficult to meet short-term obligations. When customers delay payments, businesses experience a delay in receiving cash, which can lead to a cash flow shortage. This can make it challenging to cover expenses such as salaries, rent, and inventory purchases.

Impact on Profitability

Aging accounts receivable can also affect a company’s profitability. Uncollected accounts receivable represent lost revenue, which can reduce a company’s net income. Additionally, the cost of collecting overdue payments, such as collection fees and legal expenses, can further erode profitability.

Impact on Liquidity

Aging accounts receivable can also impact a company’s liquidity. Liquidity refers to a company’s ability to meet its short-term financial obligations. When accounts receivable age, they become less liquid, as they are not easily convertible into cash. This can make it difficult for companies to access funds quickly, which can lead to financial distress.

Methods for Analyzing Accounts Receivable Aging

Analyzing accounts receivable aging is crucial for businesses to assess the effectiveness of their credit and collection policies and identify areas for improvement. There are several techniques and tools that can be employed to analyze aging accounts receivable.

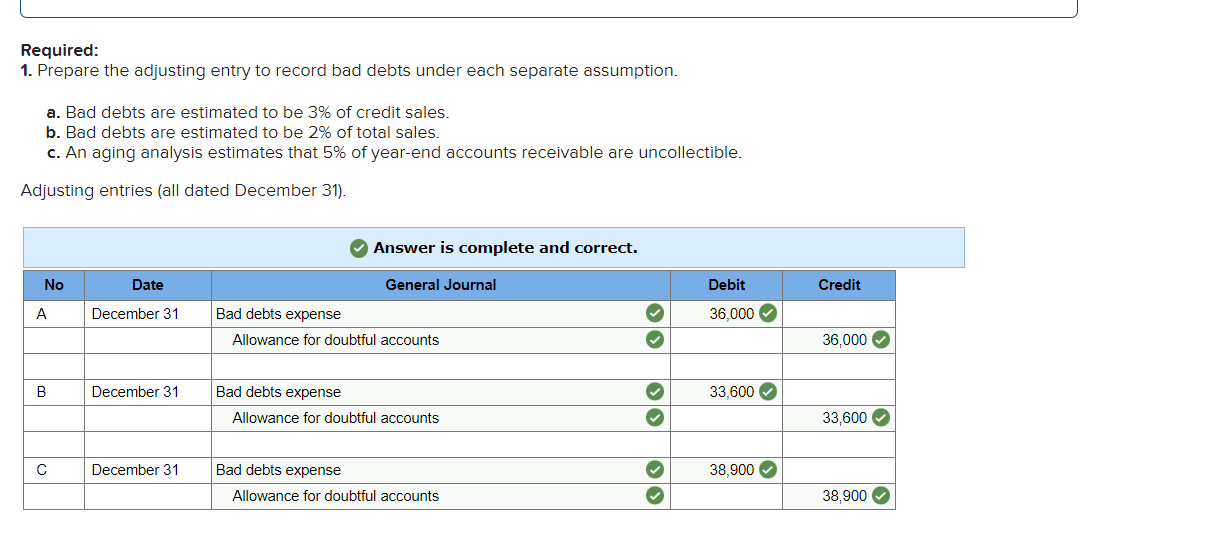

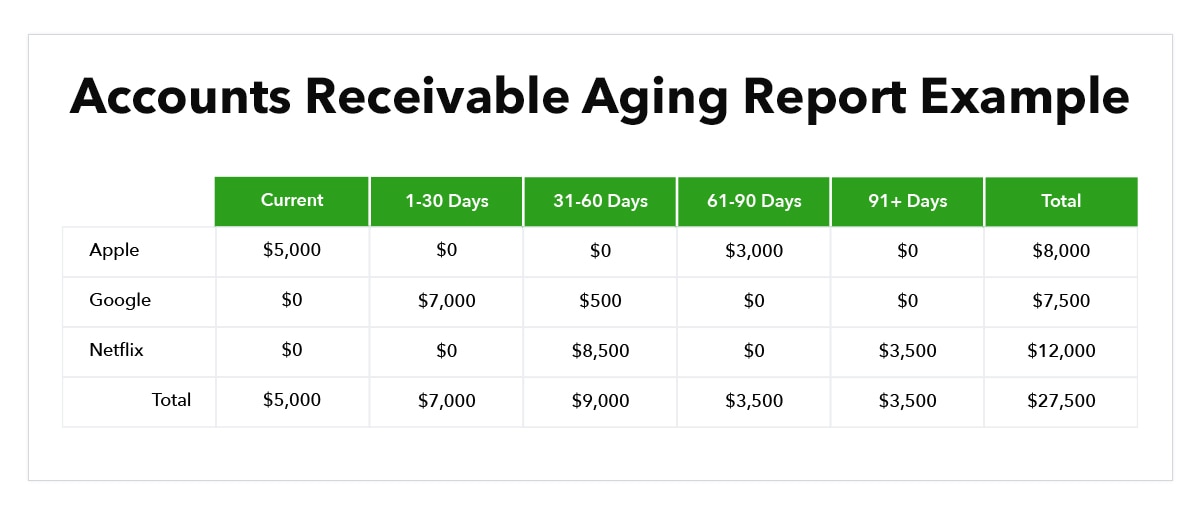

One common technique is to use aging reports, which categorize accounts receivable based on their age, such as current, 30-60 days past due, 60-90 days past due, and so on. This report provides a snapshot of the aging distribution of accounts receivable and helps businesses identify accounts that are overdue or at risk of becoming uncollectible.

Another technique is to calculate the average collection period, which measures the average time it takes for a business to collect its accounts receivable. This metric provides insights into the efficiency of the collection process and can be compared to industry benchmarks or previous performance to identify areas for improvement.

Additionally, businesses can use statistical tools such as regression analysis to identify factors that contribute to accounts receivable aging. This analysis can help businesses understand the relationship between aging and factors such as customer type, industry, payment terms, and credit history.

Using Aging Reports to Assess Aging

Aging reports provide a visual representation of the aging distribution of accounts receivable, making it easier to identify trends and patterns. Businesses can use aging reports to:

- Identify overdue accounts and prioritize collection efforts.

- Assess the effectiveness of credit and collection policies.

- Compare aging trends over time to identify areas for improvement.

li>Estimate the potential for bad debt and make appropriate provisions.

Role of Technology in Accounts Receivable Aging Management

Technology plays a crucial role in streamlining accounts receivable aging management, enabling businesses to automate collection processes and gain real-time insights into their accounts receivable performance.

An aging of a company’s accounts receivable indicates that the company is having trouble collecting its debts. This can be a sign of financial distress, and it can lead to the company having to take on more debt or even default on its existing debt.

An agent who represents only one company is in a conflict of interest, and therefore is not able to provide objective advice. This can lead to the company making poor decisions that can further damage its financial health.

Software and Automation

Accounts receivable software and automation tools provide businesses with a centralized platform to manage their accounts receivable processes. These tools automate tasks such as:

- Invoicing and payment processing

- Customer account management

- Aging analysis and reporting

- Collection reminders and notifications

By automating these tasks, businesses can reduce manual effort, improve efficiency, and minimize errors.

Real-Time Monitoring and Analysis

Technology also allows businesses to monitor and analyze their accounts receivable aging in real-time. This provides them with a clear understanding of their collection performance and enables them to identify potential problems early on.

An aging of a company’s accounts receivable indicates that a company is not collecting its debts as quickly as it should. This can be a sign of financial distress, as it means that the company is not generating enough cash to cover its expenses.

One way to address this issue is to implement an ecommerce checkout workflow that writes invoices and sends them to customers automatically. This can help to speed up the collection process and improve the company’s cash flow.

For example, businesses can use dashboards and reports to track key metrics such as:

- Average days sales outstanding (DSO)

- Percentage of invoices overdue

- Customer aging distribution

By monitoring these metrics, businesses can quickly identify customers who are consistently late in paying their invoices and take appropriate action to improve collection performance.

Case Studies of Accounts Receivable Aging Management: An Aging Of A Company’s Accounts Receivable Indicates

Several companies have effectively managed accounts receivable aging, employing innovative strategies and methods. Here are a few notable examples:

Case Study: Apple Inc.

- Apple implemented a robust credit management system that automates credit checks and approvals, reducing the risk of bad debt.

- The company offers flexible payment options, including online payments, credit cards, and installments, making it convenient for customers to pay their invoices promptly.

Case Study: Amazon.com

- Amazon leverages its vast data analytics capabilities to identify customers with a high risk of default, enabling proactive collection efforts.

- The company employs a team of dedicated collection specialists who work closely with customers to resolve outstanding invoices and minimize aging.

Impact of Accounts Receivable Aging on Business Valuation

The aging of accounts receivable significantly impacts a company’s business valuation. Investors and lenders carefully scrutinize the aging of accounts receivable to assess the company’s creditworthiness, financial health, and ability to collect outstanding debts. Older accounts receivable indicate a higher risk of non-payment, which can negatively affect the company’s valuation.

Investors’ Perspective

Investors consider aging accounts receivable when evaluating a company’s financial stability. Aged accounts receivable may suggest that the company is experiencing cash flow problems or has difficulty collecting its debts. This can lead to concerns about the company’s ability to generate future cash flows, which can impact its valuation.

Lenders’ Perspective

Lenders also consider aging accounts receivable when making lending decisions. Aged accounts receivable can increase the risk of default, as older debts are more likely to become uncollectible. Lenders may adjust the loan terms, such as interest rates or collateral requirements, to mitigate this risk.

In some cases, lenders may even decline to provide financing if the aging of accounts receivable is excessive.

An aging of a company’s accounts receivable indicates that customers are taking longer to pay their bills. This can be a sign of financial distress, as customers may be struggling to meet their own obligations. However, it could also be a sign that the company is not doing a good job of collecting its debts.

If you’re wondering can i use apple pay with an android phone , the answer is no. Apple Pay is only available on Apple devices. An aging of a company’s accounts receivable can also be a sign that the company is not growing as quickly as it used to.

As a result, the company may have to take on more debt to finance its operations, which can lead to financial distress.

Legal and Regulatory Implications of Accounts Receivable Aging

Failing to effectively manage aging accounts receivable can have serious legal and regulatory implications for companies. Governments and regulatory bodies have established laws and regulations to protect businesses and consumers from financial losses due to unpaid invoices. Companies that fail to comply with these regulations may face penalties, fines, or even legal action.

One of the primary legal implications of aging accounts receivable is the potential for bad debt expense. When a company is unable to collect on an invoice, it must write off the amount as a bad debt expense. This can have a negative impact on the company’s financial statements, reducing its profitability and potentially triggering tax implications.

In addition, companies that fail to manage aging accounts receivable may also face legal challenges from creditors. Creditors may file lawsuits to recover unpaid invoices, which can result in costly legal fees and judgments against the company. In some cases, creditors may even seek to have the company declared bankrupt if it is unable to pay its debts.

An aging of a company’s accounts receivable indicates that the company is having trouble collecting its debts. This can be a sign of financial distress. If you’re looking for a way to track down your lost iPhone, can you add an android to find my iphone ? You might be able to use an Android phone to locate it.

An aging of a company’s accounts receivable indicates that the company is having trouble collecting its debts. This can be a sign of financial distress.

To avoid these legal and regulatory implications, companies should implement effective accounts receivable management practices. These practices should include:

- Establishing clear credit policies and procedures

- Monitoring accounts receivable balances and aging reports

- Taking prompt action to collect on overdue invoices

- Working with customers to resolve disputes and payment issues

By following these best practices, companies can minimize the risk of legal and regulatory problems associated with aging accounts receivable.

An aging of a company’s accounts receivable indicates that the company is having trouble collecting its debts. This can be a sign of financial distress, as customers who are unable to pay their bills may be experiencing financial difficulties themselves.

Amgen , for example, is a medical device company that has been facing challenges in collecting its accounts receivable. The company’s aging accounts receivable have increased in recent years, indicating that customers are taking longer to pay their bills.

Best Practices for Accounts Receivable Aging Management

To effectively manage accounts receivable aging, businesses should implement a comprehensive set of best practices. These practices aim to minimize the risk of bad debts, improve cash flow, and enhance the overall financial health of the company.

Here’s a comprehensive list of recommendations for companies to follow:

Establishing Clear Credit Policies

- Define clear credit terms, including payment due dates and penalties for late payments.

- Conduct thorough credit checks on new customers to assess their creditworthiness.

- Establish credit limits for each customer based on their credit history and financial stability.

Effective Invoicing and Billing, An aging of a company’s accounts receivable indicates

- Issue invoices promptly after the goods or services are delivered.

- Ensure invoices are accurate, detailed, and easy to understand.

- Use technology to automate the invoicing process and reduce errors.

Regular Monitoring and Follow-Up

- Monitor accounts receivable aging reports regularly to identify overdue invoices.

- Contact customers promptly to remind them of overdue payments.

- Establish a systematic follow-up process to escalate overdue accounts to management.

Collections Strategies

- Develop a clear collections policy outlining the steps to be taken for overdue accounts.

- Use a combination of phone calls, emails, and letters to communicate with customers about overdue payments.

- Consider offering discounts or incentives for early payment.

Customer Communication

- Maintain open and transparent communication with customers.

- Explain the company’s credit policies and payment expectations clearly.

- Respond promptly to customer inquiries and resolve disputes amicably.

Technology Utilization

- Implement an accounts receivable software system to automate tasks and improve efficiency.

- Use cloud-based platforms to access accounts receivable data remotely.

- Integrate accounts receivable software with other business systems, such as ERP and CRM.

Regular Review and Improvement

- Review accounts receivable aging management practices regularly to identify areas for improvement.

- Make necessary adjustments to policies, procedures, and technology to enhance efficiency.

- Seek professional advice from accountants or financial consultants to optimize accounts receivable management.

By following these best practices, businesses can effectively manage accounts receivable aging, reduce the risk of bad debts, and improve their overall financial performance.

Outcome Summary

Managing accounts receivable aging is a critical part of financial management. By understanding the causes, consequences, and strategies for managing accounts receivable aging, companies can improve their cash flow, profitability, and liquidity.

User Queries

What are the causes of accounts receivable aging?

There are many causes of accounts receivable aging, including slow-paying customers, disputes over invoices, and errors in billing.

What are the consequences of accounts receivable aging?

Accounts receivable aging can have a number of negative consequences, including cash flow problems, profitability issues, and even bankruptcy.

What are the strategies for managing accounts receivable aging?

There are a number of strategies for managing accounts receivable aging, including offering discounts for early payment, setting clear payment terms, and following up on overdue invoices.