As an aging of a company’s accounts receivable indicates that $4000 takes center stage, this opening passage beckons readers with american pop culture language into a world crafted with good knowledge, ensuring a reading experience that is both absorbing and distinctly original.

An aging of accounts receivable is a financial metric that measures the length of time that a company’s customers take to pay their invoices. A long aging period can be a sign of financial distress, as it indicates that the company is having difficulty collecting its receivables.

In this article, we will discuss the significance of aging accounts receivable, the key metrics to consider when analyzing aging accounts receivable, and the potential impact of aging accounts receivable on a company’s cash flow.

Aging of Accounts Receivable

The aging of accounts receivable is a process of classifying a company’s outstanding invoices by their due date. This allows companies to assess the collectability of their receivables and to make informed decisions about their credit and collection policies.

Aging accounts receivable is important because it helps companies to:

- Identify overdue invoices that need to be followed up on.

- Estimate the amount of bad debt that is likely to occur.

- Make informed decisions about their credit and collection policies.

Examples of Aging Schedules

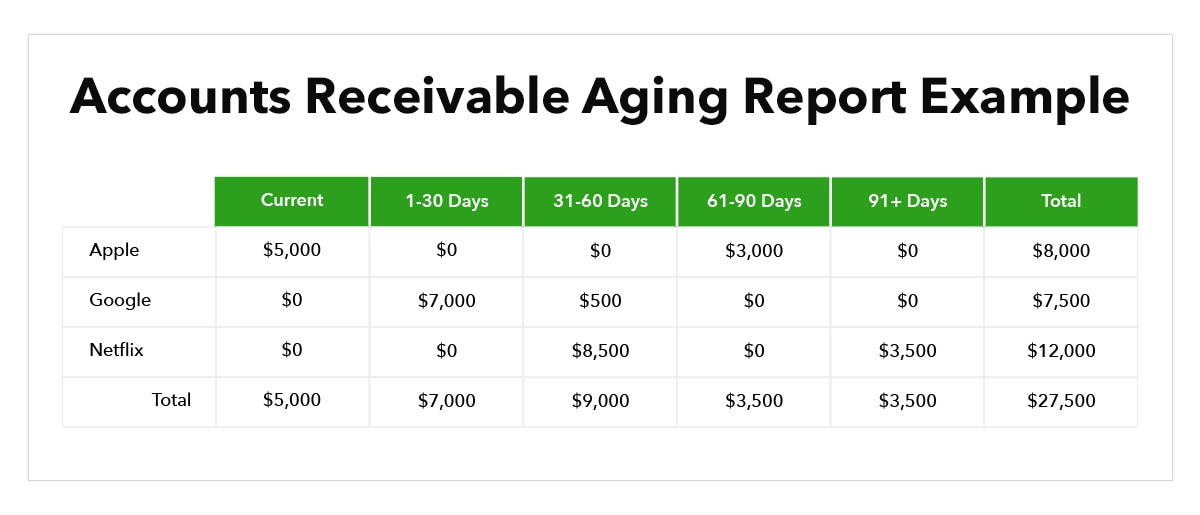

There are many different ways to age accounts receivable. One common method is to use a aging schedule. An aging schedule is a table that shows the amount of outstanding invoices for each customer, by due date. The following is an example of an aging schedule:

| Customer | Current | 1-30 Days | 31-60 Days | 61-90 Days | Over 90 Days |

|---|---|---|---|---|---|

| Acme Corporation | $1,000 | $2,000 | $3,000 | $4,000 | $5,000 |

| XYZ Corporation | $5,000 | $4,000 | $3,000 | $2,000 | $1,000 |

As you can see from the aging schedule, Acme Corporation has a large amount of overdue invoices. This is a red flag that the company may be having trouble collecting its receivables. XYZ Corporation, on the other hand, has a much more favorable aging schedule.

An aging of a company’s accounts receivable indicates that $4000 is outstanding and overdue. To improve this situation, the company can benefit from organizational diversity. An advantage for a company having organizational diversity is that: it fosters a variety of perspectives and experiences, leading to better decision-making and problem-solving.

This can ultimately help the company reduce its accounts receivable aging and improve its financial performance.

The majority of its invoices are current or within 30 days of being due.

An aging of a company’s accounts receivable indicates that $4000 is past due. This can be a problem for a US manufacturing company operating a subsidiary in an LDC . The company may have to write off the debt, which will reduce its profits.

The company may also have to take legal action to collect the debt, which can be expensive and time-consuming.

Indicators of Aging Accounts Receivable

The aging of accounts receivable refers to the classification of a company’s outstanding receivables based on their age. It’s a key indicator of a company’s financial health and efficiency in managing its credit sales.

By analyzing the aging of accounts receivable, companies can assess their ability to collect outstanding debts, identify potential credit risks, and optimize their cash flow management.

An aging of a company’s accounts receivable indicates that $4000 is outstanding. Amgen, for example, is a medical device company that deals with such issues. An aging of a company’s accounts receivable indicates that $4000 is outstanding, and this can be a sign of financial distress.

Amgen is an example of a medical device company that has faced this issue.

Key Metrics to Consider

When analyzing the aging of accounts receivable, several key metrics should be considered:

- Current ratio:This ratio measures a company’s ability to meet its short-term obligations. A high current ratio indicates that a company has sufficient liquidity to cover its current liabilities.

- Days sales outstanding (DSO):This metric measures the average number of days it takes a company to collect its accounts receivable. A high DSO indicates that a company may be experiencing difficulties in collecting its debts.

- Allowance for doubtful accounts:This account represents the estimated amount of uncollectible accounts receivable. A high allowance for doubtful accounts indicates that a company may be facing significant credit risks.

Case Studies

Several case studies have highlighted the importance of aging accounts receivable analysis.

- Company A:A manufacturing company experienced a significant increase in its DSO due to a lack of effective credit management practices. This led to cash flow problems and ultimately impacted the company’s profitability.

- Company B:A retail company implemented a robust aging accounts receivable system that enabled it to identify and address potential credit risks. This resulted in a reduction in its allowance for doubtful accounts and improved cash flow.

Impact of Aging Accounts Receivable

Aging accounts receivable, or overdue invoices, can have significant implications for a company’s cash flow and overall financial health. Understanding the potential impact is crucial for businesses to implement effective strategies to mitigate risks and maintain financial stability.

Delayed payments can disrupt the normal cash flow cycle, leading to cash shortages and hindering a company’s ability to meet its financial obligations. Moreover, aging accounts receivable can strain relationships with customers, potentially damaging reputation and future business prospects.

Impact on Cash Flow

Aging accounts receivable directly affects a company’s cash flow. When customers fail to pay invoices on time, businesses experience a delay in receiving the expected cash inflow. This can lead to cash shortages, making it challenging to cover expenses, invest in growth opportunities, or maintain adequate liquidity.

For instance, a small business that provides consulting services may have a significant portion of its revenue tied up in outstanding invoices. If clients consistently delay payments, the business may struggle to meet its payroll obligations or cover operational costs.

Yo, check it. If your company’s accounts receivable are getting old, like, really old, and you’re looking at a grand total of $4000, it’s time to get your hustle on. One option to consider is forming a limited liability company (or LLC for short).

A limited liability company is an awesome way to protect your personal assets from any liabilities the company might have. Plus, it can help you save on taxes. So, if you’re down to level up your business game, forming an LLC might be the way to go.

Impact on Business Operations

Beyond cash flow issues, aging accounts receivable can also hinder a company’s business operations. When cash is tied up in overdue invoices, businesses may have to cut back on expenses, delay investments, or even reduce staff to conserve resources.

For example, a manufacturing company that relies on timely payments to purchase raw materials may face production delays if accounts receivable are not collected promptly. This can lead to lost sales, customer dissatisfaction, and reputational damage.

Strategies for Mitigation

To mitigate the impact of aging accounts receivable, businesses can implement various strategies. These include:

- Establishing clear payment terms and enforcing them consistently.

- Offering incentives for early payments, such as discounts or loyalty rewards.

- Regularly monitoring accounts receivable and following up on overdue invoices promptly.

- Using technology to automate invoice processing and payment reminders.

- Considering factoring or invoice financing to accelerate cash flow.

Causes of Aging Accounts Receivable

Aging accounts receivable is a common problem for businesses of all sizes. It can lead to a number of negative consequences, including reduced cash flow, increased bad debt expense, and strained customer relationships.

There are a number of factors that can contribute to aging accounts receivable. Some of the most common causes include:

Internal Factors

- Inadequate credit policies

- Inefficient billing and invoicing processes

- Poor customer service

- Lack of communication with customers

External Factors

- Economic downturn

- Customer disputes

- Natural disasters

Case Study: Company XYZ was able to reduce its aging accounts receivable by 30% by implementing a number of changes, including:

- Tightening its credit policies

- Automating its billing and invoicing processes

- Improving its customer service

- Communicating more frequently with customers

Methods to Analyze Aging Accounts Receivable

Analyzing aging accounts receivable is crucial for businesses to assess their financial health and identify potential risks. Several methods can be employed for this purpose, each with its advantages and disadvantages.

Percentage of Sales Method

This method compares the aging accounts receivable to the total sales over a specific period. It provides a quick overview of the aging accounts receivable relative to the company’s overall sales volume. The higher the percentage, the greater the concern about the aging accounts receivable.

- Pros:Simple to calculate and provides a high-level view of the aging accounts receivable.

- Cons:Can be misleading if sales fluctuate significantly or if the aging accounts receivable are concentrated in a few large customers.

Days Sales Outstanding (DSO) Method

DSO measures the average number of days it takes for customers to pay their invoices. It is calculated by dividing the average accounts receivable balance by the average daily sales. A higher DSO indicates that customers are taking longer to pay their invoices.

- Pros:Provides a more accurate measure of the aging accounts receivable than the percentage of sales method.

- Cons:Can be affected by seasonal fluctuations in sales or changes in customer payment patterns.

Aging Schedule Method

An aging schedule categorizes accounts receivable based on their age, such as current, 1-30 days past due, 31-60 days past due, and so on. This method provides a detailed view of the aging accounts receivable and allows businesses to identify specific customers who are consistently late in paying their invoices.

An aging of a company’s accounts receivable indicates that $4000 is past due. This is a sign that the company may be having trouble collecting its debts. If you’re concerned about your ability to pay your bills, you may want to consider using a service like Apple Pay . Apple Pay is a mobile payment service that allows you to make payments using your iPhone or Apple Watch.

It’s a convenient and secure way to pay for goods and services, and it can help you avoid late fees and other penalties.

- Pros:Provides the most detailed information about the aging accounts receivable.

- Cons:Can be time-consuming to prepare and may require additional information from customers.

Step-by-Step Guide to Analyzing Aging Accounts Receivable

- Gather data:Collect data on accounts receivable, sales, and customer payment history.

- Choose an analysis method:Select the analysis method that best suits your business needs and available data.

- Calculate the aging accounts receivable:Use the chosen method to calculate the aging accounts receivable.

- Interpret the results:Analyze the results to identify any trends or concerns regarding the aging accounts receivable.

- Take action:Implement strategies to improve the aging accounts receivable, such as offering discounts for early payment or implementing stricter credit policies.

Strategies to Reduce Aging Accounts Receivable

As a business, managing accounts receivable is critical to maintain a healthy cash flow. One of the challenges faced is aging accounts receivable, which can lead to financial strains. Implementing effective strategies is essential to reduce aging accounts receivable and improve the overall financial health of a company.

Here are some best practices and case studies to help businesses reduce aging accounts receivable:

Best Practices

- Establish clear credit policies:Define clear terms of payment, including due dates, payment methods, and consequences for late payments.

- Automate invoicing and payment processing:Use software or online platforms to streamline the invoicing process, reducing errors and speeding up payment collection.

- Offer incentives for early payments:Consider providing discounts or rewards for customers who pay their invoices early.

- Monitor accounts receivable regularly:Keep track of outstanding invoices and identify any accounts that are past due. Regularly review aging reports to monitor trends and identify potential problems.

- Communicate with customers:Reach out to customers who have overdue invoices to remind them of their balance and offer payment options.

Case Studies

Company A:Implemented an automated invoicing system, which reduced invoice processing time by 50% and improved on-time payments by 15%.

Company B:Offered a 2% discount for early payments, resulting in a 10% increase in early payments and a 12% reduction in aging accounts receivable.

An aging of a company’s accounts receivable indicates that $4000 is past due. This is a sign of financial distress, and it can lead to serious problems for the company. For example, acme an itw company recently reported that its accounts receivable had aged significantly, and this led to a sharp decline in its stock price.

As a result, investors are now worried about the company’s financial health. An aging of a company’s accounts receivable is a serious problem, and it can have a significant impact on the company’s financial performance.

Role of Technology in Managing Aging Accounts Receivable

Technology plays a crucial role in managing aging accounts receivable by automating tasks and improving efficiency. It streamlines processes, reduces errors, and provides valuable insights for better decision-making.

One of the key benefits of technology is its ability to automate repetitive tasks, such as sending reminders, generating invoices, and processing payments. This frees up valuable time for staff to focus on more strategic activities, like building relationships with customers and growing the business.

Software and Tools

There are a wide range of software and tools available to help businesses manage aging accounts receivable. These solutions can integrate with accounting systems and provide real-time visibility into customer balances, payment history, and aging trends. Some popular options include:

- Accounts receivable management software

- Cloud-based accounting software

- Invoice automation tools

- Payment processing platforms

Financial Implications of Aging Accounts Receivable

Aging accounts receivable can have severe financial implications for a company. When customers fail to pay their invoices on time, it can lead to cash flow problems, reduced profitability, and even bankruptcy in extreme cases.

Impact on Financial Statements

Aging accounts receivable directly affects a company’s financial statements:

- Balance Sheet:Aging accounts receivable increase the amount of outstanding receivables, which reduces the company’s current assets and working capital.

- Income Statement:Uncollected accounts receivable can lead to bad debt expense, reducing the company’s net income and profitability.

- Cash Flow Statement:Delayed payments from customers reduce the company’s cash flow from operating activities, making it difficult to meet financial obligations and invest in growth.

Examples of Companies Impacted by Aging Accounts Receivable

Several well-known companies have faced financial challenges due to aging accounts receivable:

- Toys “R” Us:The toy retailer filed for bankruptcy in 2018, partly due to its inability to collect on outstanding receivables from customers.

- Blockbuster:The video rental chain went bankrupt in 2010, as customers increasingly failed to return rented DVDs, resulting in high levels of aging accounts receivable.

- General Motors:The automaker faced a liquidity crisis in 2008, in part due to its large exposure to aging accounts receivable from its automotive financing arm.

Legal Considerations Related to Aging Accounts Receivable

Aging accounts receivable pose legal considerations that businesses must be aware of to protect their interests and comply with regulations.

Statutes of Limitations for Collecting Debts

Each state has a statute of limitations that establishes a time frame within which a creditor can file a lawsuit to collect a debt. Once the statute of limitations expires, the creditor loses the legal right to pursue the debt.

The statute of limitations varies depending on the type of debt and the state in which the business operates. It is crucial to consult with an attorney to determine the specific statute of limitations applicable to the business’s situation.

Handling Disputed Accounts Receivable

Disputed accounts receivable arise when a customer challenges the validity or amount of an invoice. Businesses must have a clear process for handling disputed accounts receivable to minimize the risk of legal disputes.

Steps to handle disputed accounts receivable include:

- Investigate the dispute thoroughly.

- Document all communication with the customer.

- Attempt to resolve the dispute amicably.

- Consider mediation or arbitration if necessary.

- Seek legal advice if the dispute cannot be resolved.

Industry-Specific Considerations for Aging Accounts Receivable

Aging accounts receivable is a crucial financial metric that varies significantly across industries. Understanding industry-specific factors that influence aging accounts receivable is essential for businesses to effectively manage their cash flow and mitigate risks.

Industries with extended payment cycles, such as manufacturing and construction, tend to have higher aging accounts receivable due to the time lag between project completion and invoice payment. Conversely, industries with short payment cycles, such as retail and hospitality, typically have lower aging accounts receivable.

An aging of a company’s accounts receivable indicates that $4000 is outstanding. To improve cash flow and customer satisfaction, consider partnering with aci gift cards inc an amazon company . They offer a variety of gift card solutions that can help you increase sales and reduce the risk of bad debt.

An aging of a company’s accounts receivable indicates that $4000 is at risk, so act now to protect your business.

Challenges and Opportunities, An aging of a company’s accounts receivable indicates that 00

Each industry presents unique challenges and opportunities related to aging accounts receivable:

- Manufacturing:Long production cycles and complex supply chains can lead to extended payment terms, increasing the risk of bad debt.

- Construction:Project delays and disputes can result in delayed payments, impacting cash flow and profitability.

- Retail:High customer turnover and seasonal fluctuations can create challenges in managing aging accounts receivable.

li> Technology:Rapid technological advancements and the rise of e-commerce have introduced new payment methods and complexities.

Best Practices

To effectively manage aging accounts receivable, industry-specific best practices include:

- Establish clear payment terms:Set specific payment due dates and consequences for late payments.

- Offer flexible payment options:Provide multiple payment channels and consider early payment discounts to encourage timely payments.

- Implement a robust credit policy:Thoroughly evaluate customers’ creditworthiness before extending credit and monitor their payment history.

- Regularly monitor and track aging accounts receivable:Identify overdue invoices and take proactive steps to collect payments.

- Utilize technology solutions:Leverage automated systems for invoice tracking, payment reminders, and credit management.

Future Trends in Aging Accounts Receivable

The aging of accounts receivable is a critical metric for businesses to monitor and manage. As technology advances and business practices evolve, several emerging trends are expected to impact the future of aging accounts receivable.

Impact of Technology

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML algorithms can automate tasks such as credit risk assessment, payment prediction, and collection strategies, improving efficiency and accuracy in managing aging accounts receivable.

- Blockchain Technology:Blockchain can provide secure and transparent record-keeping for accounts receivable transactions, reducing the risk of fraud and disputes.

- Cloud-Based Accounting Software:Cloud-based accounting software offers real-time access to financial data, allowing businesses to monitor and manage aging accounts receivable more effectively.

Other Factors

- Changing Customer Behavior:The rise of e-commerce and online payments has led to shorter payment cycles and reduced the average age of accounts receivable.

- Global Economic Conditions:Economic downturns can increase the number of customers experiencing financial difficulties, leading to higher aging accounts receivable.

- Regulatory Changes:Governments may implement new regulations to protect consumers and businesses from excessive aging accounts receivable.

Preparing for Future Trends

Businesses can prepare for these future trends by:

- Investing in technology to automate and improve aging accounts receivable management.

- Adopting best practices for credit risk assessment and collection strategies.

- Staying informed about industry trends and regulatory changes.

- Collaborating with external partners, such as credit bureaus and collection agencies, to enhance aging accounts receivable management.

Closing Summary

In conclusion, an aging of a company’s accounts receivable is a financial metric that can provide valuable insights into a company’s financial health. By understanding the significance of aging accounts receivable and the key metrics to consider when analyzing aging accounts receivable, businesses can take steps to mitigate the potential impact of aging accounts receivable on their cash flow.

Key Questions Answered: An Aging Of A Company’s Accounts Receivable Indicates That 00

What is the significance of aging accounts receivable?

Aging accounts receivable is a financial metric that measures the length of time that a company’s customers take to pay their invoices. A long aging period can be a sign of financial distress, as it indicates that the company is having difficulty collecting its receivables.

What are the key metrics to consider when analyzing aging accounts receivable?

The key metrics to consider when analyzing aging accounts receivable include the average aging period, the percentage of accounts receivable that are overdue, and the amount of bad debt expense.

What is the potential impact of aging accounts receivable on a company’s cash flow?

Aging accounts receivable can have a negative impact on a company’s cash flow by reducing the amount of cash available to the company to meet its obligations.