An aging of a company accounts receivable – An aging of a company’s accounts receivable is a critical financial management tool that provides valuable insights into the health of a business. By understanding the concept, methods, and importance of accounts receivable aging, businesses can optimize their financial performance and mitigate risks.

This comprehensive guide will delve into the intricacies of accounts receivable aging, empowering you with the knowledge and strategies to effectively manage your company’s receivables.

Definition of Accounts Receivable Aging

Accounts receivable aging is a financial management technique that categorizes a company’s outstanding invoices based on their age, from the most recent to the oldest.

Aging of accounts receivable can be a headache for any company, but it’s especially important for insurance companies. That’s because the actuarial department needs to be able to accurately predict how much money the company will need to pay out in claims.

If the aging of accounts receivable is not managed properly, it can lead to the company underestimating its liabilities and having to raise rates or cut benefits.

Its purpose is to provide insights into the creditworthiness of customers, identify potential bad debts, and assess the efficiency of the company’s credit and collection policies.

Aging accounts receivable can be a real headache for businesses. But did you know that companies can now store confidential data in an Amazon Aurora PostgreSQL ? This cloud-based database service can help businesses improve their security and compliance, while also reducing their costs.

And with its high availability and scalability, Aurora PostgreSQL can help businesses of all sizes keep their data safe and accessible.

Importance of Accounts Receivable Aging

- Early Detection of Bad Debts:Aging analysis helps identify customers who are slow to pay or have a history of late payments, allowing companies to take proactive measures to prevent potential losses.

- Improved Cash Flow Management:By understanding the aging of receivables, companies can estimate the timing of cash inflows, enabling better cash flow planning and forecasting.

- Optimization of Credit Policies:Accounts receivable aging provides data to evaluate the effectiveness of existing credit policies and make adjustments to improve credit terms, payment terms, and collection strategies.

Methods of Accounts Receivable Aging

Aging accounts receivable is a critical process for businesses to manage their cash flow and reduce the risk of bad debts. There are several methods that businesses can use to age their accounts receivable, each with its own advantages and disadvantages.

The most common methods of accounts receivable aging include:

- Weighted Average Method:This method assigns a weight to each invoice based on its age. The weight is typically based on the number of days past due. The weighted average age of accounts receivable is then calculated by multiplying the weight of each invoice by its age and dividing the total by the total weight.

- Straight-Line Method:This method assigns the same weight to each invoice, regardless of its age. The straight-line age of accounts receivable is then calculated by dividing the total amount of accounts receivable by the total number of invoices.

- FIFO Method:This method assumes that the oldest invoices are collected first. The FIFO age of accounts receivable is then calculated by adding the age of each invoice in the order in which it was issued.

- LIFO Method:This method assumes that the newest invoices are collected first. The LIFO age of accounts receivable is then calculated by adding the age of each invoice in the reverse order in which it was issued.

The choice of which aging method to use depends on the specific needs of the business. The weighted average method is the most accurate method, but it can be more complex to calculate than the other methods. The straight-line method is the simplest method to calculate, but it can be less accurate than the other methods.

An aging of a company accounts receivable can be a real pain in the neck. It’s like trying to use your AirPods with an Android phone – it just doesn’t work well. But unlike AirPods, you can’t just switch to a different pair of headphones.

You need to find a way to fix the problem. And that’s where we come in. We’ll help you get your accounts receivable aging under control so you can focus on more important things, like whether or not you can use your AirPods with an Android phone .

The FIFO method is a good choice for businesses that have a high volume of invoices, while the LIFO method is a good choice for businesses that have a low volume of invoices.

Procedures for Performing Accounts Receivable Aging

Accounts receivable aging is a crucial process for businesses to manage their credit sales effectively. It involves categorizing outstanding receivables based on their age to assess the creditworthiness of customers and identify potential bad debts. The process typically involves the following steps:

Data Gathering

The first step is to gather relevant data, including:

- Customer invoices and payment records

- Customer credit history and payment patterns

- Aging period (e.g., 30, 60, 90 days)

Analysis

Once the data is collected, it is analyzed to determine the age of each outstanding receivable. This can be done manually or using accounting software.

Reporting

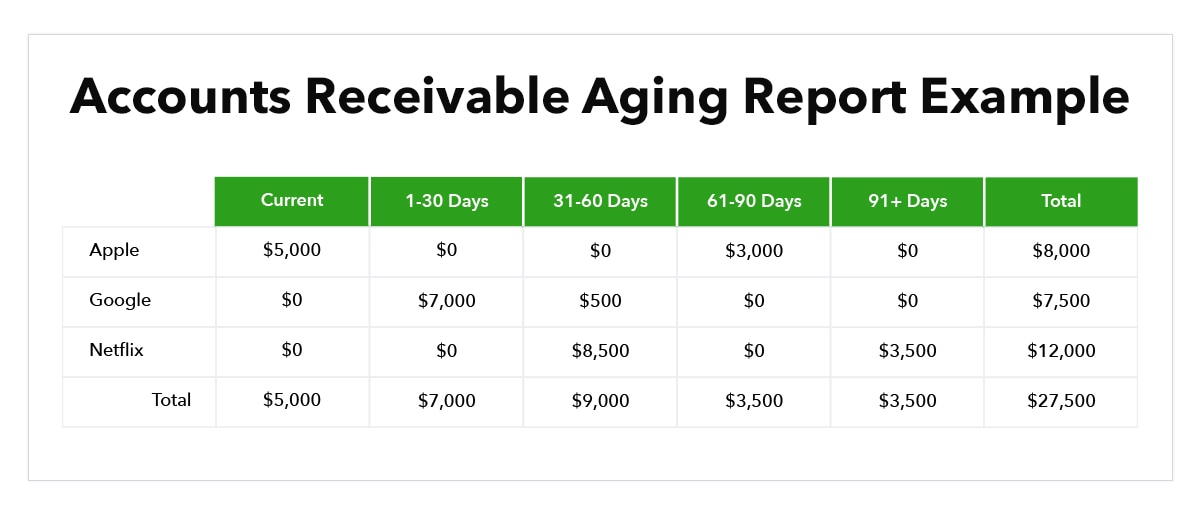

The final step is to prepare an accounts receivable aging report. This report typically includes the following information:

- Customer name and account number

- Invoice number and date

- Invoice amount

- Aging period (e.g., 0-30 days, 31-60 days, etc.)

- Current balance

Factors Influencing Accounts Receivable Aging

The aging of accounts receivable is influenced by a variety of factors, both internal and external to the company. These factors can have a significant impact on the length of time that customers take to pay their invoices, and can therefore affect the company’s cash flow and profitability.

Some of the key factors that can influence accounts receivable aging include:

Customer Payment Habits

The payment habits of customers are one of the most important factors that can influence accounts receivable aging. Customers who are slow to pay their invoices can significantly increase the average age of the company’s accounts receivable. This can be due to a variety of factors, such as financial difficulties, disputes over the invoice, or simply poor payment practices.

Industry Norms

The industry in which a company operates can also have a significant impact on accounts receivable aging. In some industries, such as construction, it is common for customers to take 60 or 90 days to pay their invoices. In other industries, such as retail, customers are expected to pay their invoices within 30 days or less.

An aging of a company’s accounts receivable can be a sign of financial distress. The longer the receivables are outstanding, the less likely they are to be collected. This can lead to a decrease in cash flow and an increase in bad debt expense.

In some cases, a company may need to purchase an asset, such as a new machine or building , to help improve its operations. However, this can also lead to an increase in debt and interest expense. Therefore, it is important for companies to carefully consider the impact of aging accounts receivable on their financial health.

Company Credit Policies

The company’s credit policies can also influence accounts receivable aging. Companies that have lenient credit policies, such as allowing customers to take extended payment terms, may find that their accounts receivable aging is longer than companies with more restrictive credit policies.

Economic Conditions

The overall economic conditions can also affect accounts receivable aging. During economic downturns, customers may be more likely to delay paying their invoices due to financial difficulties. This can lead to an increase in the average age of the company’s accounts receivable.

Other Factors

In addition to the factors discussed above, there are a number of other factors that can also influence accounts receivable aging. These include the company’s billing practices, the efficiency of the company’s credit and collection department, and the company’s relationships with its customers.

Best Practices for Accounts Receivable Aging

Effective accounts receivable aging is crucial for businesses to maintain a healthy cash flow and mitigate credit risk. Industry best practices include:

Adopting a proactive approach, implementing automated systems, and fostering open communication with customers are key to enhancing accuracy and efficiency.

Establish Clear Aging Categories

Define specific aging categories (e.g., current, 1-30 days, 31-60 days) to accurately assess the age of receivables.

Automate the Aging Process

Leverage accounting software or cloud-based platforms to automate the aging process, reducing manual errors and saving time.

Monitor Aging Trends Regularly

Track aging trends over time to identify patterns and potential issues, enabling proactive action to prevent overdue payments.

Communicate with Customers Proactively

Establish regular communication with customers to remind them of outstanding invoices and offer support, fostering a positive relationship and reducing the likelihood of late payments.

Offer Incentives for Early Payment

Consider offering discounts or other incentives for early payment, encouraging customers to prioritize settling invoices on time.

Implement Credit Controls

Establish clear credit policies, conduct thorough credit checks, and monitor customer payment history to minimize the risk of bad debts.

Role of Technology in Accounts Receivable Aging

Technology has revolutionized the way businesses manage their accounts receivable (AR) aging processes. Automation and streamlining have become key drivers of efficiency, accuracy, and improved cash flow.

Software and tools have emerged to support various aspects of AR aging, from data collection and analysis to reporting and follow-up.

Software and Tools for AR Aging

- Accounting Software:Integrated accounting systems often include modules specifically designed for AR management, including aging reports and automated reminders.

- Dedicated AR Software:Specialized software solutions focus solely on AR processes, providing advanced features such as customizable aging reports, credit management, and dispute resolution.

- Cloud-Based Platforms:Cloud-based AR solutions offer real-time access, remote collaboration, and seamless integration with other business systems.

Importance of Aging for Credit Risk Assessment: An Aging Of A Company Accounts Receivable

Accounts receivable aging is a critical tool in credit risk assessment, providing valuable insights into a customer’s payment behavior and creditworthiness.

When a company’s accounts receivable is aging, it’s like having an old Android phone that’s not cutting it anymore. Just like you might wonder can i use my android phone to find an iphone , it’s time to consider an upgrade.

Implementing a robust accounts receivable automation solution is the iPhone upgrade your business needs to streamline processes, improve efficiency, and stay ahead of the competition.

By analyzing the aging schedule, businesses can identify customers who are consistently paying late or not at all, indicating potential credit risks. This information allows businesses to make informed decisions about extending credit, setting credit limits, and managing collections efforts.

An aging of a company’s accounts receivable can be a major headache, but it’s one that can be easily solved with the right tools. One such tool is an AirTag, which can be used to track down lost or stolen items.

If you’re wondering can i use airtags with an android phone , the answer is yes! AirTags can be used with both Android and iOS devices, making them a versatile tracking solution. So, if you’re looking for a way to keep track of your company’s accounts receivable, AirTags are a great option.

Evaluating Creditworthiness

- Payment History:Accounts receivable aging reveals a customer’s payment history, highlighting any past due payments or payment delays.

- Aging Profile:The aging schedule provides a snapshot of the customer’s outstanding invoices, categorized by their age (current, 30-60 days past due, 60-90 days past due, etc.). This profile indicates the customer’s overall payment performance.

- Average Days Sales Outstanding (DSO):DSO is a metric that measures the average time it takes for a business to collect its accounts receivable. A high DSO can indicate potential credit risks.

Industry-Specific Considerations for Accounts Receivable Aging

The aging of accounts receivable can vary significantly across different industries. This is due to factors such as the nature of the products or services sold, the payment terms offered to customers, and the industry’s competitive landscape. It is important for businesses to understand the industry-specific factors that may influence accounts receivable aging in order to develop effective strategies for managing their credit risk.

Construction Industry, An aging of a company accounts receivable

- Progress billing is common in the construction industry, which can lead to longer payment terms and higher accounts receivable balances.

- The industry is also subject to seasonal fluctuations, which can impact cash flow and the ability to collect receivables.

- Contractors may offer discounts for early payment, which can incentivize customers to pay their invoices more quickly.

Manufacturing Industry

- Manufacturers typically have longer production cycles than other industries, which can lead to longer payment terms for their customers.

- The industry is also subject to economic cycles, which can impact demand for products and the ability to collect receivables.

- Manufacturers may offer volume discounts to customers who purchase large quantities of products, which can help to reduce accounts receivable aging.

Retail Industry

- Retailers typically have shorter payment terms than other industries, as they often sell products directly to consumers.

- The industry is also subject to seasonal fluctuations, which can impact cash flow and the ability to collect receivables.

- Retailers may offer discounts for cash purchases, which can incentivize customers to pay their invoices more quickly.

Emerging Trends in Accounts Receivable Aging

The landscape of accounts receivable aging is constantly evolving, driven by technological advancements and changing business practices. Let’s explore the emerging trends that are shaping the future of aging.

One significant trend is the adoption of artificial intelligence (AI) and machine learning (ML) algorithms. These technologies can analyze vast amounts of data to identify patterns and predict payment behavior. This enables businesses to automate the aging process, improve accuracy, and gain insights into their customers’ payment habits.

Real-Time Aging

Another trend is the move towards real-time aging. Traditional aging methods rely on periodic snapshots of data, which can lead to outdated and inaccurate information. Real-time aging provides a continuous view of accounts receivable, allowing businesses to monitor their aging status and take proactive actions as needed.

An aging of a company accounts receivable can lead to a number of problems, including reduced cash flow and increased bad debt expense. One way to mitigate these risks is to pay employees a competitive wage. A company pays its employees an average wage of $15.90 , which is above the industry average.

This helps to attract and retain qualified employees, which can improve productivity and reduce turnover. In turn, this can lead to improved cash flow and reduced bad debt expense.

Dynamic Aging

Dynamic aging is gaining traction as well. This approach considers factors such as customer payment history, industry trends, and economic conditions to adjust aging buckets and risk assessments. Dynamic aging enables businesses to tailor their aging strategies to specific customers and situations, improving the accuracy of their aging estimates.

Integration with ERP Systems

The integration of accounts receivable aging with enterprise resource planning (ERP) systems is becoming increasingly common. This integration allows for seamless data exchange and automation of the aging process. Businesses can leverage the capabilities of their ERP systems to generate aging reports, track customer payments, and manage collections.

Cloud-Based Aging Solutions

Cloud-based accounts receivable aging solutions are also on the rise. These solutions offer flexibility, scalability, and cost-effectiveness. Businesses can access their aging data and perform analysis from anywhere with an internet connection. Cloud-based solutions also provide regular updates and enhancements, ensuring businesses stay up-to-date with the latest trends and technologies.

Concluding Remarks

In conclusion, an aging of a company’s accounts receivable is a crucial aspect of financial management that requires a systematic and proactive approach. By implementing best practices, leveraging technology, and considering industry-specific factors, businesses can optimize their accounts receivable aging process, improve cash flow, and make informed decisions that drive growth and profitability.

FAQ Section

What is the purpose of accounts receivable aging?

Accounts receivable aging helps businesses assess the creditworthiness of customers, identify potential bad debts, and optimize cash flow by providing a clear picture of the age and status of outstanding invoices.

What are the different methods of accounts receivable aging?

Common methods include the current method, aging period method, and weighted average method. Each method has its own advantages and disadvantages, and the choice depends on the specific needs and circumstances of the business.

How can technology assist in accounts receivable aging?

Technology can automate and streamline the accounts receivable aging process, saving time and reducing errors. Software and tools are available to help businesses track invoices, generate aging reports, and monitor customer payment behavior.