An alphanumeric number issued by the insurance company – In the realm of insurance, an alphanumeric number holds immense significance, serving as a unique identifier that unlocks a wealth of information. Dive into the fascinating world of these alphanumeric keys and discover their role in streamlining claims processing, enhancing security, and organizing insurance records.

From the depths of their format and structure to their international variations and emerging trends, this comprehensive guide unravels the mysteries of alphanumeric numbers, empowering you to navigate the insurance landscape with ease.

Format and Structure of Alphanumeric Numbers

Insurance companies typically use alphanumeric numbers to identify policies and claims. These numbers follow a specific format and structure to ensure uniqueness and easy identification.

The format of an alphanumeric number typically includes a combination of letters and numbers. The first few characters are usually letters, followed by a series of numbers. The letters often represent the type of policy or claim, while the numbers provide a unique identifier.

An alphanumeric number issued by the insurance company, such as a policy number, can help identify specific insurance policies. Limited liability companies differ from S corporations in terms of taxation and liability protection, but both can utilize insurance policies to manage risks.

These policies often include unique alphanumeric identifiers for easy reference and tracking.

Common Patterns and Variations

There are several common patterns and variations in alphanumeric numbers used by insurance companies.

That alphanumeric number issued by the insurance company? It’s your policy ID, a unique code that connects you to the coverage you need. Speaking of connections, have you heard of alper services an alera group company ? They’re the experts in employee benefits, making sure your policy ID stays up-to-date with your changing needs.

- Prefixes:Alphanumeric numbers often start with a prefix that indicates the type of policy or claim. For example, “AUTO” may be used for auto insurance policies, while “CLM” may be used for claims.

- Numbers:The numbers in an alphanumeric number typically provide a unique identifier for the policy or claim. These numbers can be sequential, random, or a combination of both.

- Suffixes:Some alphanumeric numbers may also include a suffix that provides additional information. For example, a suffix of “R” may indicate that the policy is a renewal.

The specific format and structure of alphanumeric numbers can vary depending on the insurance company. However, the general principles remain the same.

Role in Claims Processing

Alphanumeric numbers play a crucial role in the insurance claims processing workflow. They serve as unique identifiers for each claim, enabling efficient identification, tracking, and management throughout the entire process.

Did you know that your insurance company issues an alphanumeric number to identify your policy? It’s like a secret code that only you and they know. But what if someone else gets their hands on it? Could they hack your Android phone? Can someone hack an Android phone ? The answer is yes, but it’s not as easy as you might think.

You’d need to know the victim’s Google account password, and even then, there are still some security measures in place that could prevent you from accessing their data. But if you’re really determined, it’s possible. So, keep your alphanumeric number safe, and don’t let anyone else get their hands on it.

Identification and Tracking

Each claim submitted to an insurance company is assigned a unique alphanumeric number. This number serves as a primary identifier, allowing insurance professionals to quickly and easily retrieve specific claim information from their database. The alphanumeric format facilitates systematic organization and retrieval of claims, ensuring accurate and timely processing.

Hey, have you ever wondered if you can use an AirTag with an Android phone? Check this out to find out. If you’re like me, you’ve probably got an alphanumeric number issued by your insurance company that you need to keep track of.

And if you’re also like me, you’ve probably lost it a few times.

Security Measures

Alphanumeric numbers are protected from fraud and misuse through a combination of security measures implemented by insurance companies.

These measures ensure the integrity and reliability of the numbers by preventing unauthorized access, alteration, or duplication.

The insurance company issued an alphanumeric number for the claim. You can check the status of your claim by visiting the website and entering the number. Meanwhile, a company is constructing an open-top bus for tourists. They will be able to see all the sights of the city from the top of the bus.

The insurance company will also be able to track the bus in case it is stolen.

Encryption

- Alphanumeric numbers are encrypted using industry-standard algorithms to protect them from unauthorized access.

- Encryption ensures that only authorized parties can view or use the numbers.

Access Controls

- Access to alphanumeric numbers is restricted to authorized personnel only.

- Access controls are implemented through a combination of physical and logical security measures, such as secure storage facilities, access logs, and password protection.

Audit Trails

- All activities related to alphanumeric numbers are logged and tracked in audit trails.

- Audit trails provide a record of who accessed the numbers, when they were accessed, and what actions were taken.

Regular Reviews and Updates

- Security measures are regularly reviewed and updated to ensure they remain effective against evolving threats.

- Insurance companies work with security experts to identify and mitigate potential vulnerabilities.

Use in Insurance Records

Alphanumeric numbers play a pivotal role in organizing and managing insurance records efficiently. They serve as unique identifiers that simplify the retrieval and tracking of policyholder information.

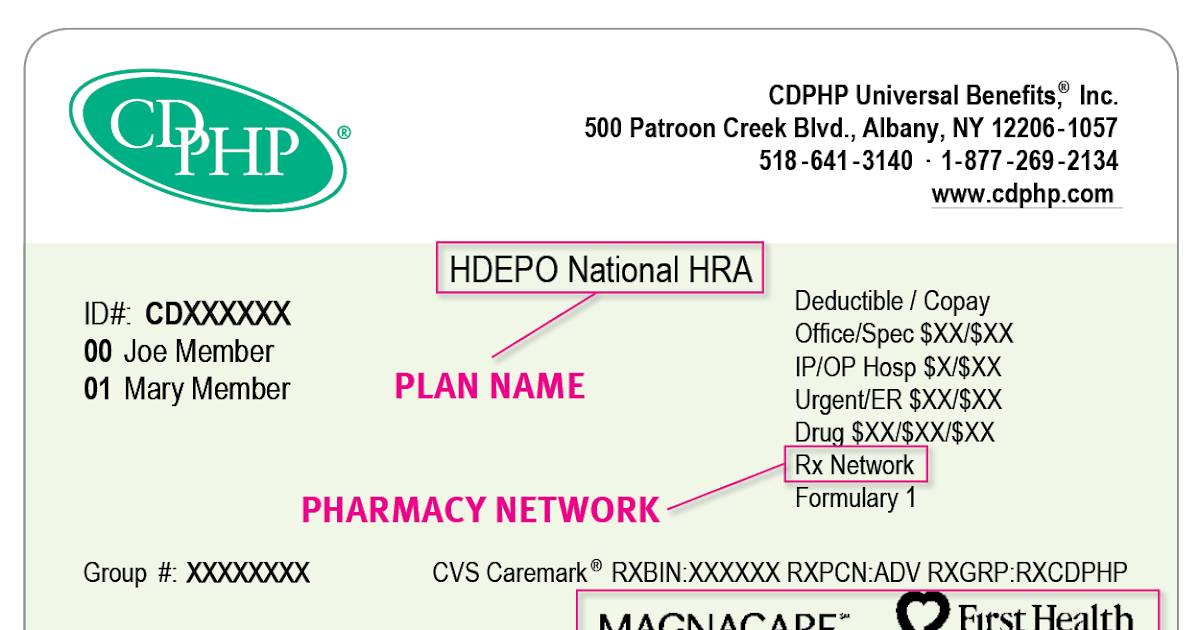

Just the other day, I was trying to figure out how to get my alphanumeric number from the insurance company. I couldn’t remember if it was on the card they sent me or if I had to call them. While I was looking for the number, I got sidetracked by a question that popped into my head: can i skype on an android phone? I did a quick search and found a helpful article that answered my question: can i skype on an android phone . It turns out, the answer is yes! You can use Skype on an Android phone by downloading the app from the Google Play Store.

Anyway, back to my original question: I finally found the alphanumeric number on the back of my insurance card.

Benefits of Using Alphanumeric Numbers

- Enhanced Organization:Alphanumeric numbers create a systematic structure for organizing insurance records, ensuring easy access to specific policies and claims.

- Efficient Record-Keeping:These numbers enable insurance companies to maintain accurate and up-to-date records, streamlining the processing of claims and policy management.

- Reduced Errors:By using alphanumeric numbers, insurance companies minimize the risk of errors in record-keeping, as these numbers provide a clear and unambiguous way to identify each policyholder.

Comparison with Other Identification Systems

Alphanumeric numbers are commonly used in the insurance industry, but they are not the only identification system available. Other systems include:

- Sequential numbers: These are simply numbers assigned in order, starting from 1. They are easy to generate and use, but they can be difficult to remember and they do not provide any information about the policyholder.

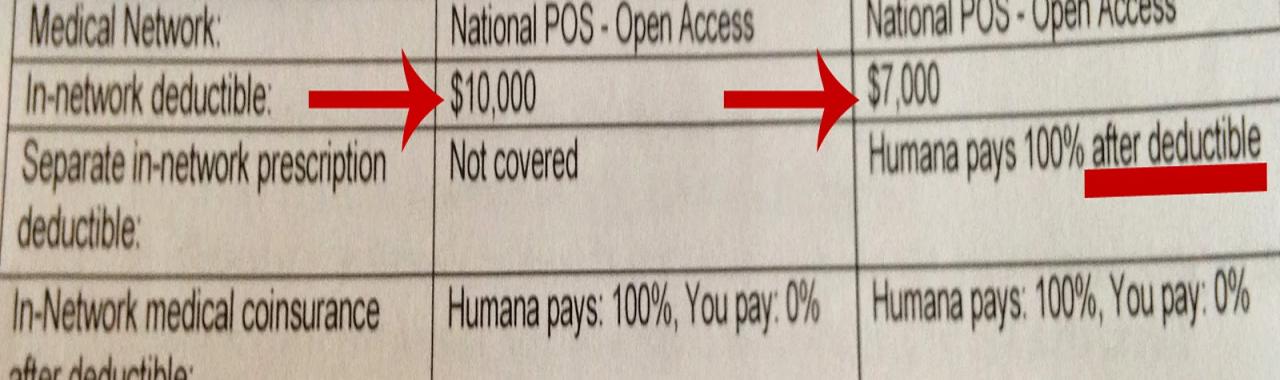

- Policy numbers: These are unique numbers assigned to each insurance policy. They are typically longer than sequential numbers and they may include a combination of letters and numbers. Policy numbers are easier to remember than sequential numbers, and they can also provide some information about the policy, such as the type of coverage and the policyholder’s name.

- Social Security numbers: These are unique numbers assigned to each individual by the Social Security Administration. They are often used to identify policyholders in the United States. Social Security numbers are easy to remember and they provide a lot of information about the policyholder, such as their name, date of birth, and gender.

Each of these identification systems has its own advantages and disadvantages. Alphanumeric numbers are a good choice for situations where a unique and memorable identifier is needed. Sequential numbers are a good choice for situations where simplicity is important. Policy numbers are a good choice for situations where it is important to have some information about the policyholder.

Social Security numbers are a good choice for situations where it is important to have a lot of information about the policyholder.

Advantages of Alphanumeric Numbers

- Unique and memorable

- Can be used to identify policyholders and policies

- Can be used to track claims and other insurance-related activity

- Can be used to generate reports and statistics

Disadvantages of Alphanumeric Numbers

- Can be difficult to generate and use

- Can be difficult to remember

- Do not provide any information about the policyholder

International Variations

Alphanumeric numbers issued by insurance companies exhibit variations across different countries and insurance markets. These variations are influenced by several factors, including:

Regulatory Frameworks

- Insurance regulations and standards vary from country to country, which can impact the format and structure of alphanumeric numbers used by insurance companies.

- For example, some countries may require insurance companies to include specific information in the alphanumeric number, such as the type of insurance policy or the policyholder’s name.

Insurance Market Practices

- The insurance market practices in a particular country can also influence the format and structure of alphanumeric numbers.

- For instance, in some countries, it is common for insurance companies to use a combination of letters and numbers in their alphanumeric numbers, while in other countries, it is more common to use only numbers.

Cultural Factors

- Cultural factors can also play a role in the variations in alphanumeric numbers across different countries.

- For example, in some cultures, it is considered lucky to have a certain number in one’s alphanumeric number, while in other cultures, it is considered unlucky.

Historical Factors

- Historical factors can also influence the format and structure of alphanumeric numbers used by insurance companies.

- For instance, some insurance companies may have been using the same format for their alphanumeric numbers for many years, and they may be reluctant to change it, even if it is no longer the most efficient or effective format.

Emerging Trends

The insurance industry is constantly evolving, and the use of alphanumeric numbers is no exception. Several emerging trends are shaping the future of insurance identification systems.

One trend is the increasing use of artificial intelligence (AI) and machine learning (ML) to automate the processing of alphanumeric numbers. This can help to improve accuracy and efficiency, and can also free up insurance professionals to focus on other tasks.

Use of Blockchain

Another trend is the use of blockchain technology to secure alphanumeric numbers. Blockchain is a distributed ledger that is tamper-proof and transparent. This makes it an ideal way to store and manage sensitive information, such as alphanumeric numbers.

Increased Use of Mobile Devices, An alphanumeric number issued by the insurance company

Finally, the increasing use of mobile devices is also having an impact on the use of alphanumeric numbers. Many insurance companies now offer mobile apps that allow customers to access their insurance information and make changes to their policies. This is making it easier for customers to manage their insurance, and is also leading to an increase in the use of alphanumeric numbers.

Legal and Regulatory Implications

Alphanumeric numbers play a vital role in insurance, and their use is subject to various legal and regulatory requirements. These requirements ensure compliance with laws and regulations, protect consumer rights, and promote transparency and accountability in the insurance industry.

Insurance companies use alphanumeric numbers to identify customers and their policies. These numbers can be used to track claims, payments, and other information. For example, a company that produces component parts for an engine might use an alphanumeric number to identify each engine they produce.

This number can be used to track the engine’s production, shipment, and installation.

Legal Requirements

The use of alphanumeric numbers in insurance is often mandated by law. For instance, in the United States, the Health Insurance Portability and Accountability Act (HIPAA) requires the use of unique health identifiers, such as alphanumeric numbers, to protect the privacy and security of patients’ health information.

Similarly, the Gramm-Leach-Bliley Act (GLBA) requires financial institutions, including insurance companies, to implement measures to protect the privacy of their customers’ personal information, including alphanumeric numbers used for identification purposes.

Regulatory Requirements

In addition to legal requirements, insurance companies are also subject to regulatory requirements that govern the use of alphanumeric numbers. For example, the National Association of Insurance Commissioners (NAIC) has developed guidelines for the use of alphanumeric numbers in insurance.

These guidelines aim to ensure that alphanumeric numbers are used in a consistent and standardized manner across the insurance industry. By adhering to these guidelines, insurance companies can improve the accuracy and efficiency of their claims processing and reduce the risk of errors and fraud.

Consumer Protection

The legal and regulatory requirements surrounding the use of alphanumeric numbers in insurance serve to protect consumer rights. By ensuring that alphanumeric numbers are used in a secure and standardized manner, these requirements help to protect consumers from identity theft, fraud, and other privacy concerns.

Additionally, the use of alphanumeric numbers helps to ensure that consumers can easily access and manage their insurance information.

Last Point

In conclusion, alphanumeric numbers are indispensable tools in the insurance industry, providing a secure and efficient means of identification and record-keeping. As the insurance landscape evolves, these numbers will undoubtedly continue to play a pivotal role, adapting to meet the ever-changing needs of the industry.

FAQ Insights: An Alphanumeric Number Issued By The Insurance Company

What is the purpose of an alphanumeric number in insurance?

An alphanumeric number serves as a unique identifier for insurance companies and policies, enabling efficient claims processing and record management.

How do alphanumeric numbers contribute to security in insurance?

Alphanumeric numbers incorporate security measures to prevent fraud and misuse, ensuring the integrity and reliability of insurance information.

Are alphanumeric numbers used internationally?

Yes, alphanumeric numbers are used globally, but their format and structure may vary across different countries and insurance markets.