An investment pays 18 percent interest compounded quarterly – Investing wisely is a crucial step towards financial freedom, and understanding the power of compounding interest is key. An investment that pays 18 percent interest compounded quarterly can unlock significant returns, making it an attractive option for savvy investors. Dive into the world of compounding interest and discover how it can transform your financial future.

Compounding interest allows your earnings to grow exponentially over time, creating a snowball effect that can multiply your wealth. By reinvesting the interest you earn, you set the stage for even greater returns down the road. This concept is the secret behind the impressive growth potential of an investment that pays 18 percent interest compounded quarterly.

Introduction

Interest is the compensation paid by a borrower to a lender for the use of money. When you invest, you are essentially lending money to a company or organization in exchange for a return. The return you receive is typically in the form of interest, which is calculated as a percentage of the amount you invested.Compounding

is the process of adding interest to the principal of an investment, so that the interest earned in one period is added to the principal and earns interest in the next period. This can have a significant impact on the growth of your investment over time.

Investing can be a great way to grow your money, especially when you find an investment that pays a high interest rate. For example, an investment that pays 18 percent interest compounded quarterly can double your money in just over four years.

However, even the best investments can have problems. For example, you might encounter an error while setting up Apple Pay on your watch . If this happens, don’t panic. There are a few simple steps you can take to fix the problem and get your investment back on track.

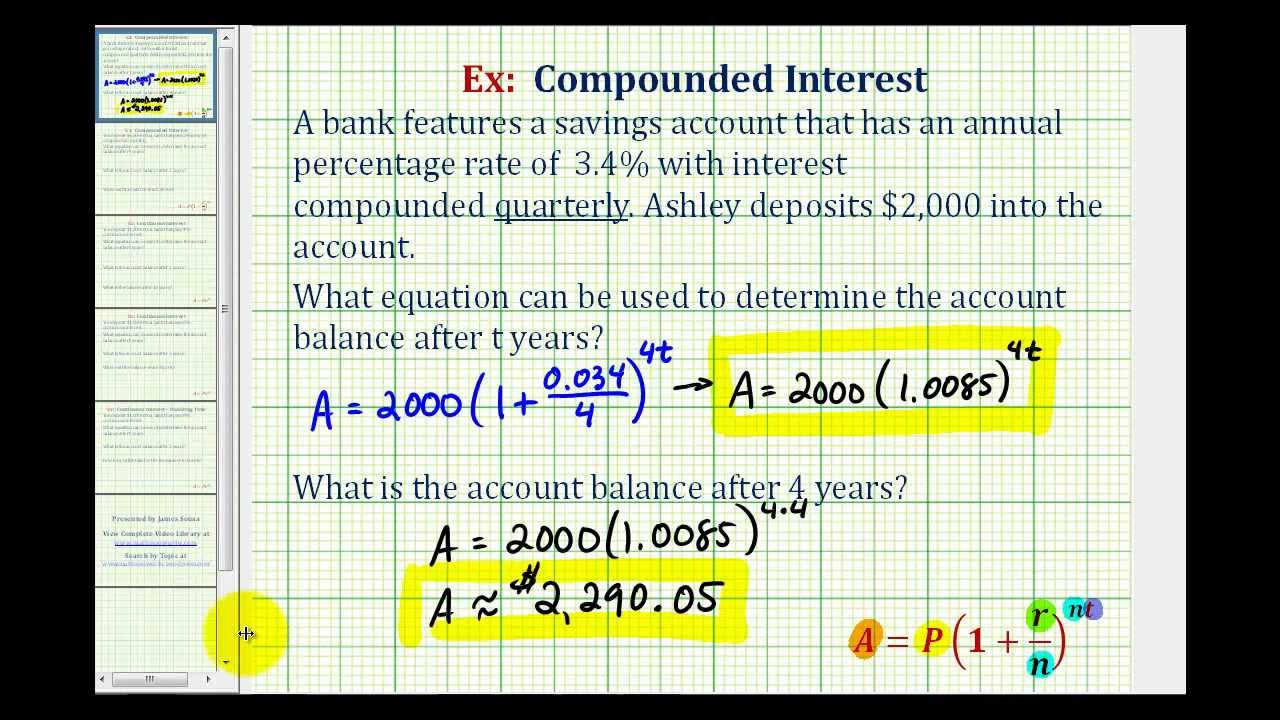

The Formula for Compounding Interest, An investment pays 18 percent interest compounded quarterly

The formula for calculating compound interest is:“`A = P(1 + r/n)^(nt)“`where:* A is the future value of the investment

- P is the principal (the amount you invested)

- r is the annual interest rate

- n is the number of times per year that the interest is compounded

- t is the number of years

For example, if you invest $1,000 at an annual interest rate of 18% compounded quarterly (4 times per year), the future value of your investment after 5 years would be:“`A = 1000(1 + 0.18/4)^(4*5)A = $1,593.84“`

Calculating the Future Value of an Investment

You can use the formula for compound interest to calculate the future value of any investment. Simply plug in the values for the principal, interest rate, number of times per year that the interest is compounded, and the number of years.Here

With an investment that pays a hefty 18 percent interest compounded quarterly, you’re sure to see your money grow exponentially. But don’t forget, as the saying goes, an investment in knowledge always pays the best interest source . So keep investing in yourself, and watch your returns skyrocket even higher than that 18 percent!

are some examples of how the future value of an investment can grow over time, assuming an annual interest rate of 18% compounded quarterly:* $1,000 invested for 5 years: $1,593.84

$1,000 invested for 10 years

$2,437.95

$1,000 invested for 15 years

$3,589.27

An investment that pays 18 percent interest compounded quarterly is a great way to grow your money. However, it’s important to remember that all investments come with some risk. That’s why it’s important to have adequate insurance coverage, like an auto insurance policy that will pay for damage to both your car and the other driver’s car in the event of an accident.

An investment that pays 18 percent interest compounded quarterly can be a great way to reach your financial goals, but it’s important to make sure you’re protected in case of an unexpected event.

$1,000 invested for 20 years

$5,159.87

If you’re looking for a solid investment, consider one that pays 18 percent interest compounded quarterly. That’s a great return! For a comparison, an account that pays 5 percent would give you a much lower return. So, if you’re looking for a great investment, consider one that pays 18 percent interest compounded quarterly.

The Impact of Compounding Frequency

The frequency of compounding has a significant impact on the growth of an investment. The more frequently the interest is compounded, the faster your investment will grow.For example, if you invest $1,000 at an annual interest rate of 18%, the future value of your investment after 5 years would be:* Compounded annually: $1,469.33

Compounded quarterly

$1,593.84

Who needs an investment that pays 18 percent interest compounded quarterly when you can land one of these 30 an hour paying jobs ? That’s a potential income of over $60,000 a year! So, why settle for a measly 18 percent return when you can potentially earn so much more? Plus, with a job that pays $30 an hour, you’ll have the flexibility to invest your earnings in other high-yield opportunities, further multiplying your wealth.

Compounded monthly

An investment that pays 18 percent interest compounded quarterly is a great way to grow your money. If you’re looking for a job that pays 15 an hour, there are plenty of options available. Check out this article for more information.

An investment that pays 18 percent interest compounded quarterly is a great way to grow your money over time.

$1,628.89

Yo, check it out! You got an investment that’s paying a sick 18 percent interest, compounded quarterly? That’s dope! But hold up, if you’re in a partnership, you better be ready to cough up some extra dough for that additional business income tax . But don’t worry, after you pay your dues, that 18 percent interest is still gonna be lit!

Compounded daily

$1,643.00As you can see, the future value of your investment is significantly higher when the interest is compounded more frequently.

The Importance of Time Horizon

The time horizon of an investment is the amount of time that you plan to invest your money. The longer the time horizon, the greater the potential return on your investment.This is because the longer your money is invested, the more time it has to compound.

For example, if you invest $1,000 at an annual interest rate of 18%, the future value of your investment after 5 years would be $1,593.84. However, if you invest the same amount of money for 10 years, the future value of your investment would be $2,437.95.

Final Summary

In the realm of investing, an investment that pays 18 percent interest compounded quarterly stands out as a beacon of growth. By harnessing the power of compounding, investors can witness their wealth soar to new heights. Remember, time is your ally when it comes to compounding interest.

The longer you stay invested, the more your money works for you, generating substantial returns that can secure your financial future.

Top FAQs: An Investment Pays 18 Percent Interest Compounded Quarterly

What is compounding interest?

Compounding interest is the interest calculated on the initial principal plus any accumulated interest. Over time, this snowball effect leads to exponential growth of your investment.

How does quarterly compounding affect my investment?

Quarterly compounding means your interest is calculated and added to your principal every three months. This more frequent compounding accelerates the growth of your investment compared to annual or monthly compounding.

Is an 18% interest rate realistic?

While 18% interest rates are not common, they may be offered by certain investment vehicles such as high-yield bonds or private equity funds. It’s important to carefully assess the risks associated with these investments before committing.