When it comes to annuities, the question of taxation looms large. Do you pay tax on an annuity? The answer is not always straightforward, but understanding the tax implications is crucial for making informed financial decisions. Join us as we delve into the world of annuities, exploring the different types, tax treatment, exceptions, and more, all presented in an engaging and easy-to-understand manner.

An annuity is a great way to save for retirement, but you may be wondering if you have to pay taxes on it. The answer is yes, you do have to pay taxes on an annuity, but the amount of tax you pay will depend on the type of annuity you have.

If you have a traditional annuity, you will pay taxes on the money you withdraw from the annuity. If you have a Roth annuity, you will not pay taxes on the money you withdraw, but you will pay taxes on the money you contribute to the annuity.

So, if you are looking for a way to save for retirement, an annuity is a great option, but you should be aware of the tax implications before you invest.

If you are looking for a job that pays at least $15 an hour, there are many companies that pay at least $15 an hour . These companies offer a variety of jobs, so you can find a job that fits your skills and interests.

Working for a company that pays at least $15 an hour can help you achieve your financial goals and live a comfortable life.

So, if you are wondering if you have to pay taxes on an annuity, the answer is yes. However, the amount of tax you pay will depend on the type of annuity you have. If you are looking for a way to save for retirement, an annuity is a great option, but you should be aware of the tax implications before you invest.

Types of Annuities: Do You Pay Tax On An Annuity

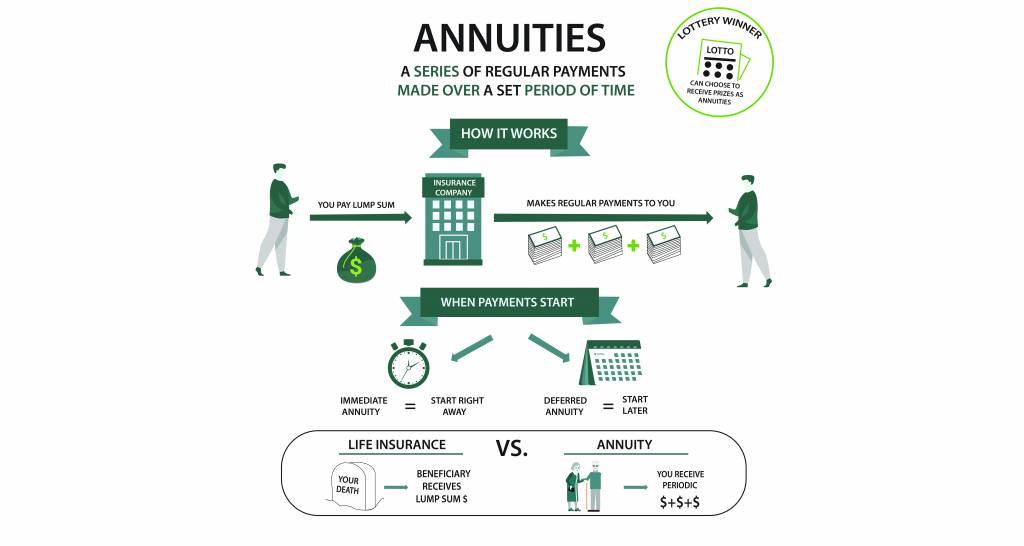

Annuities are financial products that provide a stream of income payments for a period of time. There are several different types of annuities, each with its own unique features and benefits.

The question of whether you pay tax on an annuity can be a bit tricky to answer, but it’s worth considering. In fact, even PGA golfers who pay an entry fee do pga golfers pay an entry fee might have to pay taxes on their winnings.

So, it’s important to do your research and understand the tax implications of any annuity you’re considering.

Immediate Annuities

Immediate annuities begin paying out income payments immediately after the annuity is purchased. The amount of the payments is determined by the age of the annuitant, the amount of money invested, and the terms of the annuity contract.

Annuities are a great way to save for retirement, but you may be wondering if you have to pay taxes on them. The answer is yes, you do have to pay taxes on annuities, but the amount you pay will depend on the type of annuity you have.

For example, if you have a traditional annuity, you will pay taxes on the money you withdraw. However, if you have a Roth annuity, you will not have to pay taxes on the money you withdraw. Do PGA pros pay an entrance fee to tournaments ? The answer is yes, they do.

The amount of the fee varies depending on the tournament, but it can be as high as $10,000. This is a significant expense for PGA pros, but it is a necessary one if they want to compete in the biggest and best tournaments.

Deferred Annuities, Do you pay tax on an annuity

Deferred annuities do not begin paying out income payments until a later date, such as retirement. The money invested in a deferred annuity grows tax-deferred until the payout phase begins.

When it comes to annuities, you may be wondering if you have to pay taxes on them. The answer is yes, but it depends on the type of annuity you have. For example, if you have a traditional annuity, you’ll pay taxes on the money you withdraw.

However, if you have a Roth annuity, you won’t pay taxes on the money you withdraw. If you’re curious about how many paid days off you get per year, you can check out combien de jour de congé payé par an . Getting back to annuities, if you’re not sure whether you have a traditional or Roth annuity, you can contact your financial advisor.

Variable Annuities

Variable annuities are annuities that invest in a portfolio of stocks, bonds, or other investments. The value of the annuity contract will fluctuate based on the performance of the investments.

Determining whether you pay tax on an annuity depends on various factors, such as the type of annuity and how it’s funded. Understanding these factors is crucial for proper tax planning. However, if you’re an employer, you may also have questions about your responsibilities regarding sick pay.

For instance, do you have to pay sick pay as an employer? To find answers to these important questions, explore our comprehensive guide on sick pay for employers . Returning to the topic of annuities, remember that tax implications can vary depending on factors like the annuity’s funding source and the type of annuity you choose.

Tax Treatment of Annuities

The tax treatment of annuities can be complex. In general, the money invested in an annuity grows tax-deferred until the payout phase begins. This means that you do not pay taxes on the investment earnings until you start receiving income payments.

Taxes During the Payout Phase

When you start receiving income payments from an annuity, the payments are taxed as ordinary income. This means that the payments are taxed at your regular income tax rate.

Exceptions to Tax Deferral

There are a few exceptions to the tax deferral rules for annuities. These exceptions include:

- Taking a loan from your annuity

- Surrendering your annuity contract

- Receiving a death benefit from an annuity

Tax-Free Annuities

Certain annuities can be tax-free. These annuities are called Roth annuities. Roth annuities are funded with after-tax dollars, which means that you do not get a tax deduction for the money you invest. However, the money invested in a Roth annuity grows tax-free and the income payments are also tax-free.

In the realm of personal finance, the question of whether you pay tax on an annuity lingers. Shifting gears to the world of professional golf, a curious query arises: do these elite athletes pay an entry fee for tournaments? Unveiling the truth behind this golf-related enigma , we return to the realm of annuities, where the intricacies of taxation await further exploration.

Requirements for Tax-Free Annuities

To qualify for a tax-free annuity, you must meet the following requirements:

- You must be at least 59½ years old

- You must have held the annuity for at least five years

- The income payments must be made over your lifetime or over the lifetime of your beneficiary

State Tax Considerations

The tax treatment of annuities can vary from state to state. Some states have specific tax rules for annuities. For example, some states do not tax the income payments from annuities. It is important to check with your state tax authorities to determine how annuities are taxed in your state.

Ultimate Conclusion

The tax treatment of annuities can be complex, but with a clear understanding of the rules and exceptions, you can make informed decisions about how to use annuities as part of your financial plan. Remember, tax laws are subject to change, so it’s always a good idea to consult with a tax professional for the most up-to-date information.

FAQ

What is an annuity?

An annuity is a contract with an insurance company that provides regular payments over a period of time.

What are the different types of annuities?

There are three main types of annuities: immediate, deferred, and variable.

How are annuities taxed?

Do you pay tax on an annuity? It depends on the type of annuity and how it is structured. If you receive payments from an annuity that you purchased with after-tax dollars, then you will not have to pay taxes on those payments.

However, if you receive payments from an annuity that you purchased with pre-tax dollars, then you will have to pay taxes on those payments. This is similar to how you would have to pay taxes on insurance settlements if you receive them.

So, it’s important to understand the tax implications of annuities before you purchase one.

Annuities are taxed differently during the accumulation phase and the payout phase.

Are there any exceptions to the tax deferral rules?

Yes, there are a few exceptions to the tax deferral rules, such as if you withdraw money from an annuity before age 59 1/2.

Can annuities be tax-free?

Yes, certain annuities, such as Roth IRAs and 401(k) plans, can be tax-free.