Educational Background: How To Become A Managing Director At An Investment Bank

How to become a managing director at an investment bank – To become a Managing Director at an investment bank, individuals typically possess a strong academic foundation. An MBA degree from a top-tier business school is highly valued, providing candidates with a comprehensive understanding of business principles, financial analysis, and leadership skills.

Relevant undergraduate degrees include those in finance, economics, mathematics, or related fields. These programs equip students with a solid foundation in quantitative analysis, financial modeling, and economic theory.

Industry Experience, How to become a managing director at an investment bank

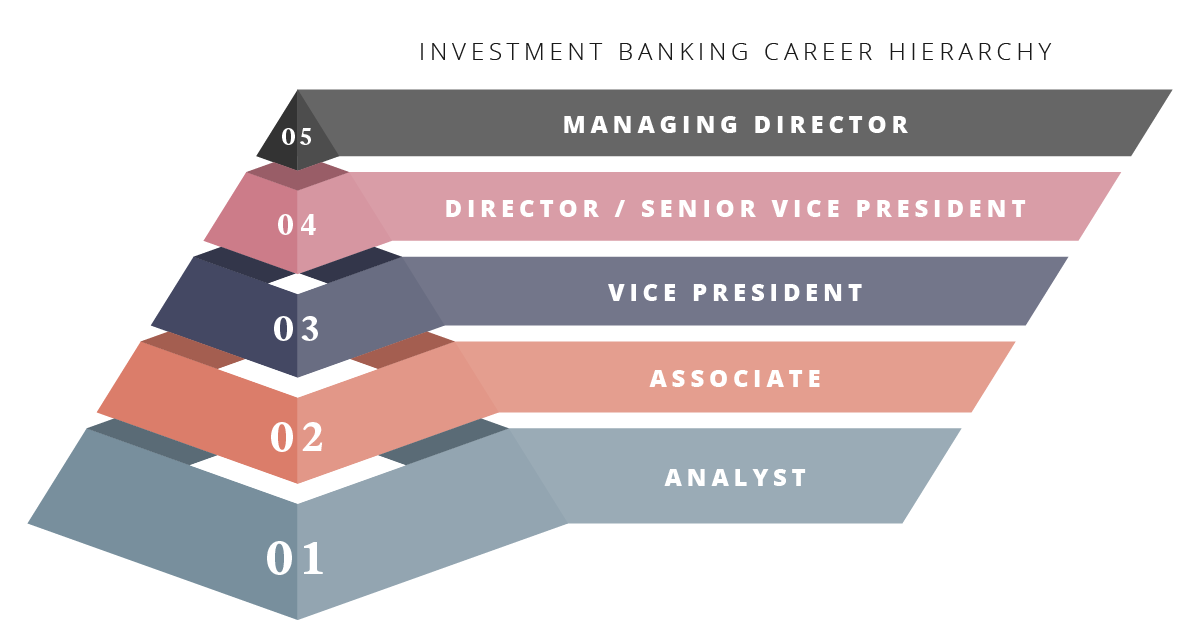

Advancing to the Managing Director level requires significant industry experience. Individuals typically follow a career path within investment banking, starting in analyst roles and progressing through associate and vice president positions.

The path to becoming a managing director at an investment bank is paved with challenges, but it is a rewarding one. To succeed, you will need to develop a strong understanding of the industry, as well as the technical skills necessary to manage a team and make sound investment decisions.

You will also need to be able to work long hours and under pressure. If you are interested in learning more about the role of a managing director at an investment bank, you can find more information here: draw an er diagram for hospital management system.

This article provides a detailed overview of the responsibilities of a managing director, as well as the skills and experience required to succeed in this role.

In these roles, they gain exposure to various aspects of investment banking, including mergers and acquisitions, capital markets, and structured finance. Strong performance, a track record of successful transactions, and leadership potential are key factors in career progression.

While understanding the intricacies of developing an organizational chart for health information management here is important, aspiring managing directors at investment banks should prioritize building strong relationships, developing analytical skills, and demonstrating exceptional leadership qualities to ascend the corporate ladder.

Skillset and Competencies

Managing Directors possess a wide range of skills and competencies essential for success. Technical expertise in financial analysis, modeling, and valuation is paramount. They must be able to analyze financial statements, build complex models, and provide sound investment advice.

Becoming a Managing Director at an investment bank requires a combination of hard work, technical expertise, and leadership skills. One crucial aspect that often goes unnoticed is the role of human resource management. As every manager is an HR manager , understanding and effectively managing people can significantly enhance your chances of success.

By fostering a positive work environment, developing talent, and resolving conflicts, you can create a cohesive team that drives results and contributes to your career advancement as a Managing Director.

Beyond technical skills, leadership, communication, and interpersonal skills are crucial. Managing Directors are responsible for leading teams, managing clients, and building strong relationships. They must be able to communicate effectively, negotiate, and inspire their colleagues.

Becoming a managing director at an investment bank requires a combination of technical expertise, networking, and leadership skills. Those seeking to advance their careers in this field can benefit from resources such as Health Information Management Technology: An Applied Approach, 3rd Edition , which provides insights into the latest industry trends and best practices.

By leveraging knowledge from both industry-specific and general management sources, aspiring managing directors can enhance their understanding of financial markets, operations, and people management, ultimately increasing their chances of success in this competitive industry.

Networking and Relationships

Networking is a vital aspect of success in investment banking. Managing Directors have extensive networks of clients, colleagues, and industry professionals. They actively participate in industry events, conferences, and professional organizations.

The path to becoming a Managing Director at an investment bank is arduous, requiring years of experience and exceptional performance. While the financial rewards can be substantial, it’s important to consider the compensation of similar roles in other industries. For instance, Michaels managers earn an average of $20-$25 per hour.

Understanding the broader compensation landscape can provide context when negotiating your salary as a Managing Director.

Building strong relationships allows them to stay informed about market trends, identify potential business opportunities, and access exclusive deals. Effective networking strategies include attending industry events, joining professional associations, and leveraging social media.

Aspiring managing directors at investment banks can benefit from understanding the principles that guide effective leaders in education. The five principles of an educational manager – vision, collaboration, empowerment, reflection, and continuous improvement – are equally applicable in the fast-paced world of investment banking.

By fostering a shared vision, encouraging teamwork, empowering team members, embracing feedback, and striving for excellence, individuals can accelerate their path towards becoming managing directors.

Personal Attributes

Certain personal attributes contribute to success as a Managing Director. Ambition, drive, and resilience are essential qualities. They must be highly motivated, willing to work long hours, and able to handle the pressure and challenges of the industry.

Other key personality traits include integrity, discretion, and a strong work ethic. Managing Directors are expected to maintain the highest ethical standards, manage sensitive information, and be dedicated to their work.

One of the key skills required to become a managing director at an investment bank is the ability to design and implement efficient systems. This includes developing strategies for designing an inventory management system , optimizing processes, and managing resources effectively.

By demonstrating strong analytical and problem-solving skills, aspiring managing directors can prove their ability to lead and manage complex operations.

Career Progression

The career path to becoming a Managing Director is typically structured and competitive. Individuals start in analyst roles, responsible for financial analysis, modeling, and research.

As they progress through associate and vice president positions, they take on more responsibilities, lead teams, and manage client relationships. Exceptional performance, a strong track record, and a commitment to the firm are key factors in career advancement.

End of Discussion

The journey to Managing Director is an arduous one, but with unwavering determination, strategic networking, and a commitment to excellence, it is an achievable aspiration. Those who possess the requisite skills, experience, and personal qualities will find themselves well-positioned to lead and excel in this dynamic and rewarding field.

Detailed FAQs

What is the typical career path to becoming a Managing Director?

To become a managing director at an investment bank, you must possess exceptional financial acumen and leadership skills. Furthermore, a deep understanding of data governance is essential, as data governance is an approach to managing information assets and ensuring their quality, accuracy, and availability.

By mastering these elements, you will position yourself for success in the competitive world of investment banking.

The path to Managing Director typically involves starting as an Analyst, progressing through Associate and Vice President roles, and eventually assuming the responsibilities of a Managing Director.

What are the key skills required for success as a Managing Director?

Technical expertise in financial analysis, modeling, and valuation, coupled with strong leadership, communication, and interpersonal skills, are essential for success in this role.

How important is networking in the investment banking industry?

Networking is crucial in investment banking, as it allows professionals to build strong relationships with clients, colleagues, and industry professionals, which can open doors to opportunities and career advancement.